We’ve seen a sharp increase in prices for dry whey, whey protein concentrate (WPC), and whey protein isolate (WPI) in the past three months, along with a little strength in permeate and lactose prices. The CME spot dry whey price has risen about 12 cents in the past month. Every 1 cent change in the price of dry whey adds about 6 cents to the Class III milk price, so the rally in whey markets is giving milk checks a small boost. The market was led by high protein WPC and WPI prices, which have improved the most on a percentage basis and seem to be pulling the price of all whey products higher.

China is the largest importer of dry whey, permeate, and lactose in the world, with more than half of the imports going into hog feed (primarily for piglets). But pork prices in China have been falling, driven by continued poor demand and growing slaughter concerns about African Swine Fever (ASF) resurfacing that drove some farmers to send extra pigs to slaughter ahead of schedule.

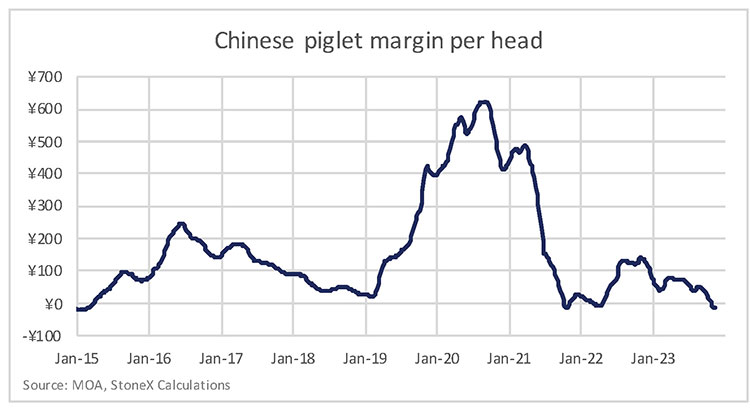

Lower hog and pork prices have pushed margins below breakeven for the hog farms, and that is feeding through to weaker piglet prices and negative margins for weaning operations as well. At least that is my understanding of the situation in the Chinese hog/pork market. Could this weak Chinese hog market hold back demand for whey products and limit the price rally?

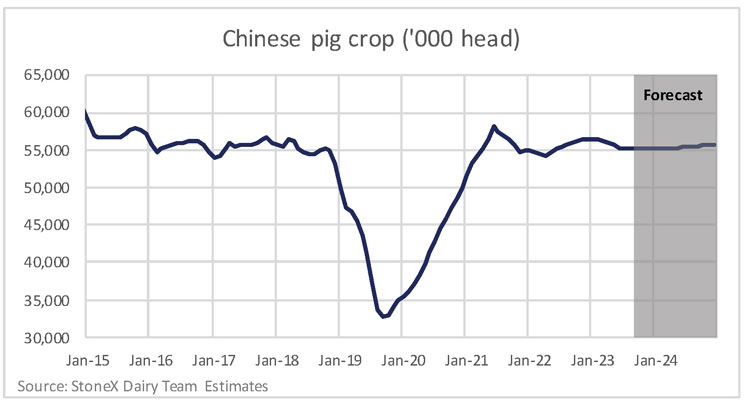

The first place to start is looking at the size of the hog herd and assessing whether it is going to be expanding or contracting. The herd was roughly steady from 2016 to 2018 before ASF caused a massive contraction. The industry quickly rebounded in 2020 and 2021, but the herd has effectively been steady since then. As far as I can tell, the recent rumors around ASF are probably overblown, so I don’t think we’re looking at a big drop for the herd. With demand weak and margins negative, the herd will likely be flat through most of 2024.

One positive for whey demand is that the industry continues to shift toward large farms that are more likely to feed whey products (primarily carbohydrates) that help piglets gain weight faster. So, even with a steady hog herd, feed usage of whey will probably rise a little.

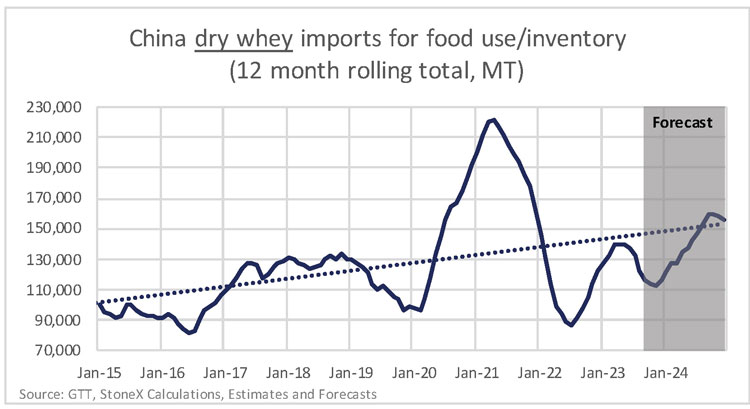

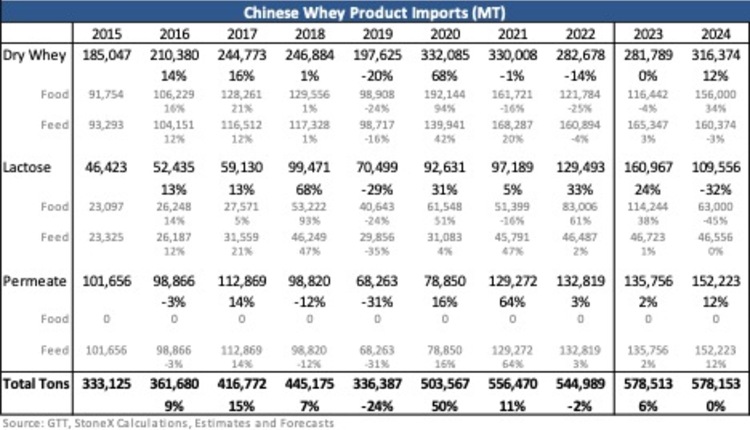

The second step is figuring out how much product is already sitting in inventory in China and what the non-hog feed demand looks like. What I do is take the total imports for each whey product and subtract out the amount that is likely going into hog feed. The remainder of the imports are either going into human food uses or into inventory. A little probably goes into milk replacer for the dairy herd, but I’m ignoring that for simplicity.

Looking at these “residual” imports of dry whey, there used to be a relatively steady uptrend, but then imports exploded higher in 2020 as the hog herd started to rebound and inventories must have ballooned during that period. Imports fell hard during 2021 and early 2022 as those inventories were worked down. Dry whey imports started to recover in the second half of 2022, but they have remained below trend into 2023, and I think inventories built up in 2020 and 2021 have probably been drawn down to balanced or slightly tight levels.

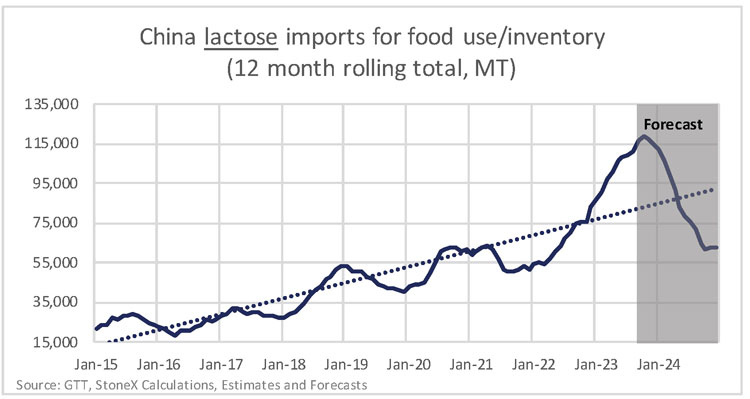

The story is different for lactose. “Residual” imports of lactose (above and beyond what is likely being fed to the hogs) were massive in the first half of 2023. Lactose is often blended into skim milk powder (SMP) or whole milk powder (WMP) to standardize the protein content, and with very strong WMP production in China over the past two years, I thought that some of this big surge in lactose imports might be going into WMP. However, the processors we’ve talked to in China say that standardizing WMP is rare in the country. That suggests the big growth in lactose imports has probably led to some inventory buildup.

I assume all the permeate imports are going into hog feed, so there is no residual to try to forecast.

What we end up with is a mixed outlook for Chinese whey product demand in 2024. Feed usage of whey products looks slightly higher with a little more permeate offsetting a little lower dry whey usage in the rations. But inventories of dry whey look balanced to light, and I think we’ll see stronger dry whey imports in 2024 for non-hog feed uses, which would put total dry whey imports up about 10% from 2023. That is partially offset by lactose where current inventories look heavy, and we could see lactose imports fall in 2024. When I add it all up, total imports of dry whey plus lactose plus permeate in 2024 are forecast basically flat from 2023.

I think the outlook is mildly supportive for prices across the whey complex, but the rebound in lactose prices might lag the growth for the rest of the whey complex. I think the bearish risk is that human food use of dry whey could turn out weaker than expected given the general weakness in consumer demand in the country, or there is always the chance that ASF spreads and sharply reduces feed demand. It is harder to come up with a strongly bullish scenario. One possibility is that the big lactose imports this year haven’t gone into inventory but were used somewhere in the feed or food chains. If those imports represent real consumptive demand, I’m not sure there is enough lactose and permeate available to meet that continued demand in the first half of 2024.