The author is the principal of Bozic LLC, a company that owns intellectual property rights to DRP, LRP, and LGM and manages these programs in a partnership with USDA.

Over the past five years, considerable efforts have been made to improve dairy producers’ financial stability through enhancements in Dairy Margin Coverage and the introduction of Dairy Revenue Protection (DRP). Beef sales constitute a substantial portion of revenue for some dairy producers, accounting for approximately 10% of their overall revenue. The decline in cattle and beef prices since September has highlighted the need to offer better tools to protect revenue from sales of cull cows and dairy calves. Here we present options and challenges in enhancing the dairy safety net to offer effective coverage for dairy producer revenue from cattle and beef sales.

Many producers are familiar with DRP, but fewer may be aware of a similar program for cattle and swine called Livestock Risk Protection (LRP). Like DRP, LRP is a private-public partnership program that is sold by licensed livestock insurance agents and offered through private insurance companies, with subsidies and reinsurance provided by the federal government. While LRP has existed for 20 years, its adoption expanded considerably since 2020 when program rules were modified to make it more affordable and effective for cattle and swine producers.

To further facilitate coverage of dairy calves, USDA should modify the rules to no longer require sales receipts to show dairy calf weight, as day-old calves are typically not weighed at sale time. Additionally, minimum insurable weight should be reduced from 100 to 85 pounds.

Protecting cull cow value

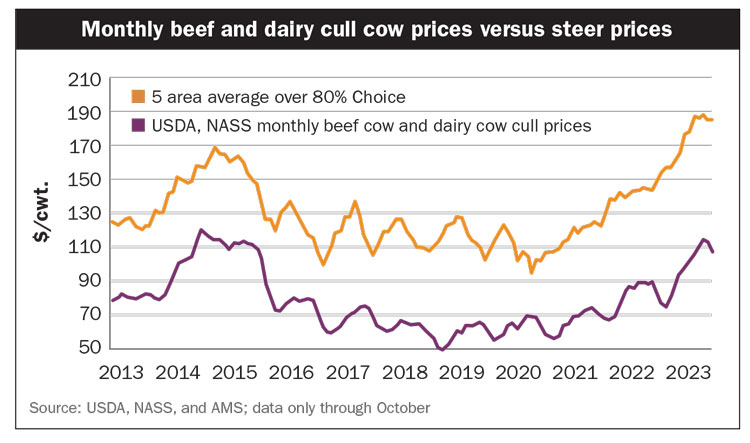

The most recent drop in cattle prices also emphasizes the need to protect the revenue from sales of cull cows. Cull cow prices are closely tied to the dynamics of the ground beef market and cattle byproduct prices. However, a substantial connection persists between cull cow markets and broader cattle markets.

For fed cattle (beef), LRP insurance is settled against five area average cattle prices for over 80% Choice steers. Over the last 10 years, monthly cull cow prices, as reported by the USDA National Agricultural Statistics Service, were on average 40% cheaper per hundredweight (cwt.) than the Agricultural Marketing Service (AMS) prices used for LRP fed cattle. However, the correlation between these price series is very high, and a $10 per cwt. drop in fed cattle prices is typically accompanied with a $7.20 per cwt. drop in cull cow prices.

Unfortunately, LRP does not currently allow for coverage of cull cows. A rule change to allow for such coverage would, in our opinion, substantially benefit dairy producers. Our team is currently working on a proposal to request the modification of LRP rules.

More affordable DRP

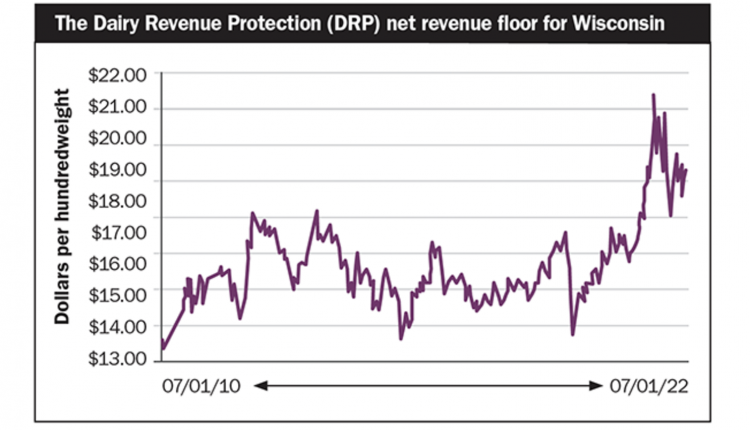

Perhaps the biggest difference USDA can make to improve the dairy safety net in 2024 will be to adjust the subsidies for Dairy Revenue Protection to encourage producers to buy DRP coverage earlier (for example, for more distant quarters).

DRP was designed to offer dairy producers a risk management instrument that would be easy to understand, affordable, cash-flow friendly, and effective in offsetting low milk prices. Based on historical experience, bouts of extremely low milk prices tend to last nine to 15 months. DRP is most effective if producers use it consistently and purchase endorsements for quarters that start at least nine months after the sales effective date.

Such use of the DRP program protects producers for the entire duration of a typical milk price down cycle. However, because greater market volatility since 2020 has led to prohibitively expensive long-horizon DRP endorsements, many dairy producers have resorted to using DRP to cover near-term quarters with comparatively lower premium rates. Such use of the program diminishes its effectiveness, as expected prices typically collapse with the onset of the crises, and dairy producers are likely to seek ad hoc assistance from USDA to cover quarters for which they do not have DRP coverage.

In October 2023, with the support of National Milk Producers Federation (NMPF), Edge Dairy Farmer Cooperative, the Milk Producers Council, and National All-Jersey Inc., we submitted the request to USDA’s Risk Management Agency to consider an increase in subsidies for coverage of quarters which start more than seven months after the sales effective date from 44% to 55%, and that subsidies for coverage of quarters that start more than 10 months after the sales effective date be increased from 44% to 65%. In the focus group organized by the NMPF, we met with dairy farm leaders across the country and presented more than a dozen potential modifications to DRP.

The change we requested in our latest submission was the most requested change by producers and the most important modification on the list, which also has the strongest potential to induce wider adoption and change producer behavior. This request is currently being analyzed by USDA attorneys and underwriters, and we expect the Federal Crop Insurance Corporation board of directors will vote on it in February 2024.