DRP adoption rate grew fast over the 2019 to 2020 period and has stabilized at 30% to 35% of U.S. milk production. Overall, DRP usage has been particularly strong in states with expanding dairy herds and growing plant processing capacity. This includes Kansas, South Dakota, and Texas, with DRP adoption rates near or above 50% of each state’s annual milk production. The Midwest, Plains, and Western states have seen higher adoption rates than the Northeast and the Southeast.

A stabilizing impact

My academic research that led to the DRP design indicated that hedging at longer horizons is more effective at stabilizing dairy revenue. The results so far are in line with this hypothesis, especially with Class IV DRP endorsements. Net indemnities based on the U.S. national DRP book of business for Class IV are estimated as follows:

- First nearby quarter, 20 cents per hundredweight (cwt.)

- Second nearby quarter, 81 cents per cwt.

- Third quarter out, $1.30 per cwt.

- Fourth quarter out, $1.55 per cwt.

- Fifth quarter out, net average indemnity of $1.18 per cwt.

Throughout much of 2020 and 2021, very low nonfat dry milk (NDM) prices bolstered payments for Class IV endorsements. Those who booked coverage prior to the COVID-19 crisis did the best to insulate their revenue from COVID-19 impacts. On the Class III side, gross indemnity did not rise above premium paid, but the true benefit of DRP should be seen through the peace of mind that DRP endorsements provided, allowing producers to fully benefit from the upside of the cheese market rallies of 2020 and 2022.

Lock in a revenue floor

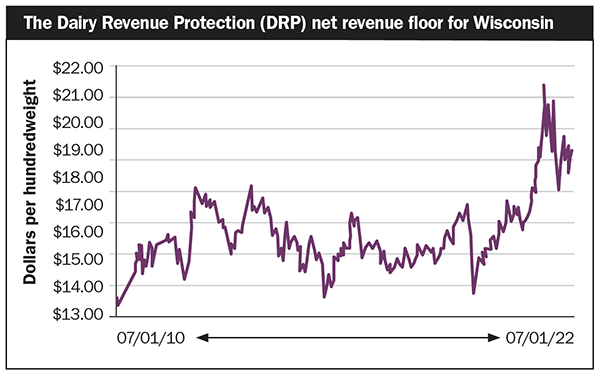

The current DRP third quarter out contract offers a Class III net revenue floor of $18.65 per cwt. for Wisconsin compared to the average of $15.92 per cwt. since 2010 (see chart below). Producers have the opportunity to lock in revenue floors at higher levels compared to the last 10 years, although feed costs, in many instances, have climbed, making floors in the $18 range not as attractive.

Producers interested in protecting margins may consider the Livestock Gross Margin (LGM-Dairy) program instead. Milk covered under LGM-Dairy has been steadily rising in recent years, from 1.6 billion pounds in reinsurance year 2020 to 2.9 billion pounds in reinsurance year 2022. However, dairy producers indicated a strong preference for DRP over the Livestock Gross Margin program, with DRP enrollment dwarfing LGM-Dairy utilization.

Perhaps the way forward is to either reform LGM-Dairy or improve DRP to provide better coverage when feed costs spike, like they did in 2022. One method to do that would be to add a feed mover option to DRP, where the DRP coverage price rises if the feed costs increase but does not fall if the feed costs decline versus the expected level.

The Dairy Margin Coverage (DMC) Tier 1 level (up to 5 million pounds of milk production) estimated average net indemnity per year for the $9.50 per cwt. coverage level averaged 74 cents per cwt. over the 2019 to 2022 period. Approximately 20% of U.S. milk production was insured at this level of protection through DMC.

DMC indemnities averaged:

- 48 cents per cwt. in 2019

- 63 cents per cwt. in 2020

- $2.41 per cwt in 2021

The margin has fallen below the threshold of $9.50 per cwt. in 56% of the months since 2019, with the average DMC margin at $9.09 since 2019. In 2022, margins have been higher than normal, near $10.82 per cwt. through September. While the top level Tier 1 coverage is easy to recommend, such a strategy would be net negative for coverage above the 5 million pounds of milk production. At the Tier 2 premium, $5 coverage level appears to be optimal. With 25 million pounds annually declared, the average net indemnity was 23 cents per cwt. annually since 2019.

The trend of rising nonfeed costs for dairy farms is creating challenges with risk management tools. The traditional $9.50 per cwt. margin level for DMC might be underestimating true costs for dairy producers. Recent cost studies from USDA’s Economic Research Service (ERS) and other dairy producer accounting firms are showing that 2021 to 2022 “other nonfeed costs” climbed up to 15% from the 2019 to 2020 levels, adding some 50 cents to $1.25 per cwt. to costs. That might be pushing some dairy producer nonfeed costs into the $10 to $11 range per cwt. With that in mind, policymakers may wish to evaluate the effectiveness of adding a $10 per cwt. margin level to DMC.

Chart your plan

In late November, a major new artificial intelligence chat-based model was released. I asked the chatbot: “Write me a joke about risk management in dairy business.” This was its reply: “Why was the dairy farmer terrible at risk management? Because he was always milking it!”

Indeed, the best results will be achieved by those who exert discipline and follow sound principles rather than the most recent rally.