The author is with Atten Babler Insurance Services LLC.

When it comes to tariffs, “This is all too familiar” or “It’s kind of déjà vu,” has been the common refrain during discussions with dairy producers in the early months of 2025. The new administration is engaged in another round of sweeping tariff negotiations, and the dairy industry is caught in the cross fire.

There is a great deal of uncertainty right now, and some of the patterns of the past trade war are likely to repeat in terms of concessions, government payments, and volatility. However, one key variable is different: The U.S. dairy industry has become even more deeply dependent on export markets.

The remainder of this article won’t focus on specific expectations about the outcome of trade negotiations. Instead, we will review where the trade risk lies and what specific tool is well suited for protecting producers from price volatility in this environment.

Dairy trade exposure

Over the last two decades, the U.S. dairy sector has transformed into a major net exporter, especially in dry products like nonfat dry milk (NFDM), skim milk powder (SMP), dry whey, and whey protein concentrate (WPC). More than 70% of new skim product production since 2005 has left the country (see figure). These exports aren’t a luxury — they’re a pressure release valve for milk production growth, and in many cases, the export market has become the marginal price setter.

It’s not just the volume of exports that is important — it’s what product goes where. Mexico, China, and Canada matter more than ever, and these are the top three countries embroiled in tariffs.

Mexico takes the lion’s share of U.S. cheese and NFDM, China dominates whey, and Canada plays a key role in butter flows. Exposure varies by product, but across the board, global buyers are essential to maintaining balance in all dairy product markets.

Tariff pressure is back

Unfortunately, the additional exposure now comes with returning risks. We’ve been here before — the prior trade war with China and USMCA negotiations with Canada and Mexico all were negative for dairy markets. Now, it’s happening again.

In the last month, a new round of tariffs has taken shape. Mexico, China, and Canada are either implementing or threatening retaliatory actions. The U.S. has committed to further action with reciprocal tariffs across numerous sectors expected soon.

These disruptions can’t be ignored because even small shifts in export flow can push markets out of balance. Losing demand outright, bearing high costs of tariffs, and rising logistics costs can have an outsized impact on overall product prices, and consequently, farm gate milk prices.

Control what you can control

No one knows how — or if — the trade conflict will be resolved, and producers need to focus on the things they can actually manage. This involves maximizing operational efficiency and minimizing market risk. The latter means knowing your numbers by having accurate break-even data and understanding your exposure to risks. Working from a margin model that incorporates all revenue streams — not just milk but also feed and beef value — allows for decisiveness in applying risk management tools to your operation. And when it comes to tools, we believe Dairy Revenue Protection (DRP) is the most effective way for dairy farmers to manage price risk more easily today.

DRP fits the moment

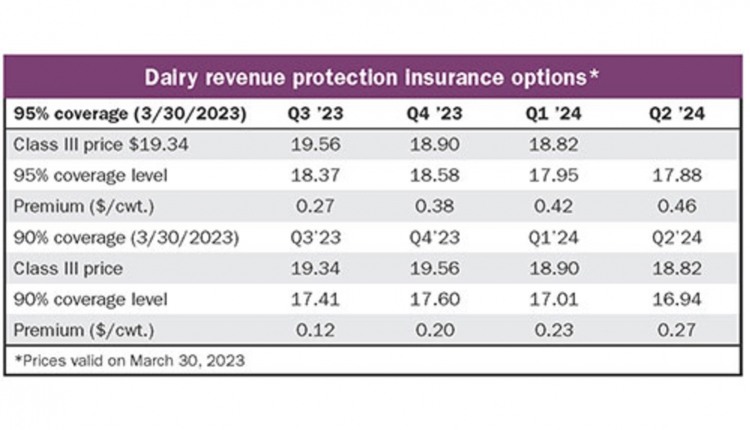

DRP is simple in concept. It provides a price and revenue floor while leaving all the upside open. There are no caps on payouts, and thanks to USDA subsidies and payment schedules, it remains affordable and easy to manage from a cash flow perspective.

The payoff profile of DRP fits this economic environment well. No one in the dairy industry should be surprised by a deep slump in prices if the worst of the tariff scenarios unfold. Likewise, it should be of little surprise if deals are struck and extreme upward price movements occur. The key is to have a consistent approach that maintains coverage now and into the future to protect against this volatility.

When volatility intensifies, consistency pays. Since the inception of the program, it has been shown that DRP rewards those who stick with the program and maintain consistent coverage. Historically, DRP has delivered meaningful payouts during downturns and, on average, has generated a net positive return to consistent users after accounting for claims, subsidies, and premiums paid. Even now, consistent DRP users have buffered against tariff-driven price declines.

The path forward

You don’t need to have an answer on the outcome of tariffs, but you do need a plan. With geopolitical volatility rising and dairy trade in the crosshairs, now is not the time to sit on the sidelines. Focus on what you can control, know your numbers, use tools like DRP consistently, and make sure your operation is positioned to weather the storm.