The author, Will Babler, is with Atten Babler Insurance Services LLC.

A few decades ago, dairy producers primarily focused on milk price when it came to managing their risk. Since then, the biofuel craze, a global financial meltdown, and harsh drought conditions taught producers they also needed to address feed prices when managing their margins. Then COVID-19 came along, and the government’s food program showed another side of the milk business through the impact of producer price differentials (PPD) and depooling.

Now, the value of cull cows and beef have moved from a rounding error to a critical component in dairy profitability. This “beef value” can no longer be ignored, and producers that don’t make it part of their margin calculus may be leaving dollars on the table.

A growing opportunity

In 2024, cattle prices hit all-time highs as cow and calf supplies approached 60-year lows. This has been good for dairy producers, especially when selling dairy-beef cross calves. Until recently, a bull calf from a dairy cow wasn’t worth much more than $25 to $50. Now, when using A.I. with a beef sire, these calves can bring $700 to $800 each. Even though the price of regular dairy calves has gone up, the value of these crossbred calves is often two to three times that of pure Holstein bull calves.

For dairy producers, the money made from selling beef cross calves has become a big part of their total revenue. Since 2021, beef value from calves has gone from 33 cents per hundredweight (cwt.) to $1.27 in the first quarter of 2024 (see the purple bar in Figure 1). Beef used to be only a small part of total revenue, but now it’s more than 15% for many operations. This is a big opportunity, but it also means tracking and managing risk from the beef market.

The dairy business has its ups and downs, and as a case in point, an excellent 2022 turned into a very difficult 2023. In fact, using USDA data, 2023 was one of the worst years on record for dairy losses. Still, there were opportunities to minimize losses or even lock in profitable levels.

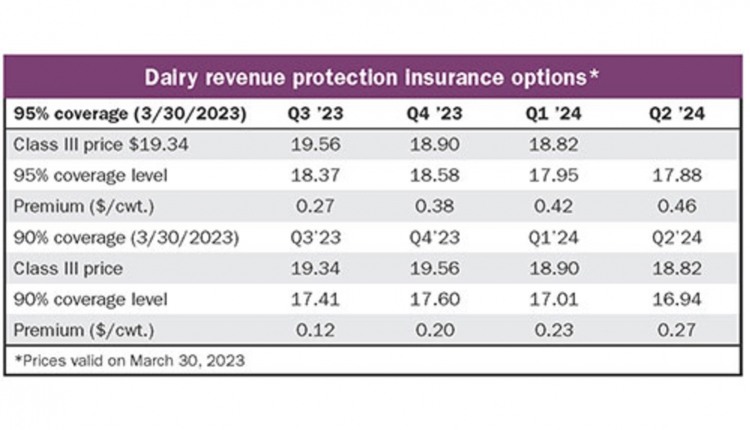

Today, the futures markets continue to provide profitable opportunities when considering lower feed costs and high beef prices. These opportunities aren’t in the spot market, but they are available to those managing risk further along the curve as shown in Figure 2.

Think about the future

To deal with all the changes in the market, dairy producers need to be deliberate and thorough when it comes to modeling their forward margins. They need a financial model that incorporates all forward opportunities, and they need to pay attention to major changes in the industry, like the rising use of beef sires on dairy animals.

They also need to have a plan for execution that fits their farm goals and their personality. Without a solid plan, it is hard to take advantage of opportunities and make it through tough times.

Lastly, they need a team that drives consistency in their risk management approach. Understanding how all these factors work together is key to being successful in the dairy business in the long run.