This quote paraphrases conversations I had with a number of producers from all across the country in recent weeks. If you are a dairy producer reading this article, you might be thinking the same thing.

Old crop feed prices are indeed very high and milk prices have dropped considerably from their record highs. This situation presents a significant risk management hurdle. However, opportunities still exist.

A three-prong focus

We recommend producers focus on three key ideas as they move forward with their 2023 risk management:

- Don’t ignore the market reality that commodity prices have a long history of overshooting and undershooting cost of production.

- Don’t be distracted by nearby prices and margins.

- Do stay consistent with your risk management plan and take advantage of forward opportunities.

In the short-run, the market isn’t sensitive to margins and cost of production. Commodity price movements are a function of supply and demand imbalances. These imbalances can supersede any of the underlying economics of producing the commodity.

This is especially the case in a highly perishable and less storable commodity market like dairy. If a product becomes oversupplied, then prices can easily drop well below the cost of production as the market seeks buyers and a new price equilibrium. One of the main purposes of risk management tools is to mitigate this short-run risk while waiting out the long-term rebalancing of prices and cost of production.

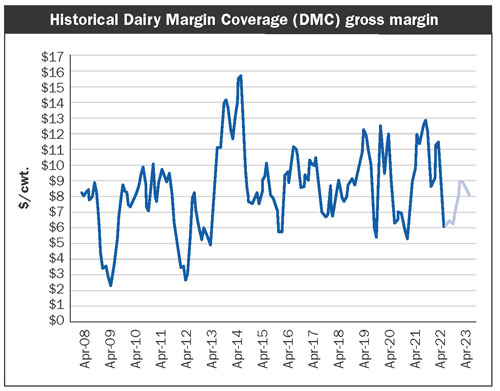

We can learn a great deal by evaluating the historical volatility of dairy gross margins. In this evaluation, Dairy Margin Coverage (DMC) calculations shown above can serve as a proxy. Industry margins are presently at a challenging level. These margins could be much worse, depending on region and other vertical integration characteristics.

There is opportunity

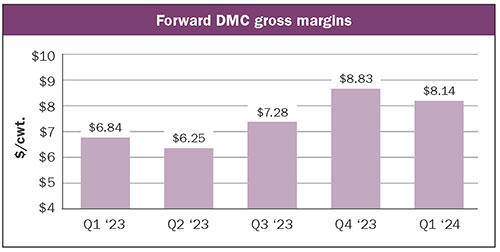

Despite recent challenges, it is important not to let short-term prices, margins, or volatility distract from long-term opportunity. Looking forward to 2023’s fourth quarter (Q4) and beyond shows margins at historically average or better levels. The figure also demonstrates that there is a dramatic improvement in gross margins six to 12 months forward as compared to today.

Higher milk prices and improved new crop feed prices are driving a significant gross margin improvement in the latter part of the year. Don’t let sunk costs and recency biases distract from this opportunity.

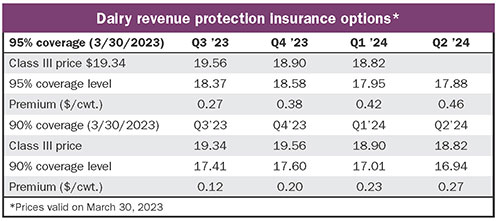

A simple and effective tool that can be used to capture this opportunity is Dairy Revenue Protection (DRP) insurance. The table highlights the example of setting a $18.58 minimum Class III price for a $0.38 per hundredweight (cwt.) premium. This tool provides a minimum price and revenue guarantee while leaving all the upside open, less the premium cost.

While the DRP example is a great starting point to capture opportunity and minimize risk, there are many other caveats and considerations beyond the scope of this article. Each producer has to determine their risk tolerance and goals to tailor a risk mitigation plan around the particulars of their operation.

There are many individualized risk management approaches that can work, but there aren’t any that will prove effective unless they are implemented consistently. At this time in the market, consistency is critical. It is much more common for risk managers to deviate from their plan when short-term difficulties distract from long-term opportunities. Make sure that you are staying consistent and continuing to reach forward with protection to avoid this pitfall.