During the past two years, the commodity world was rocked by both the biggest demand shock and the biggest supply shock seen in generations. COVID-19 lockdowns crushed demand and led to widespread milk dumping and even negative crude oil prices.

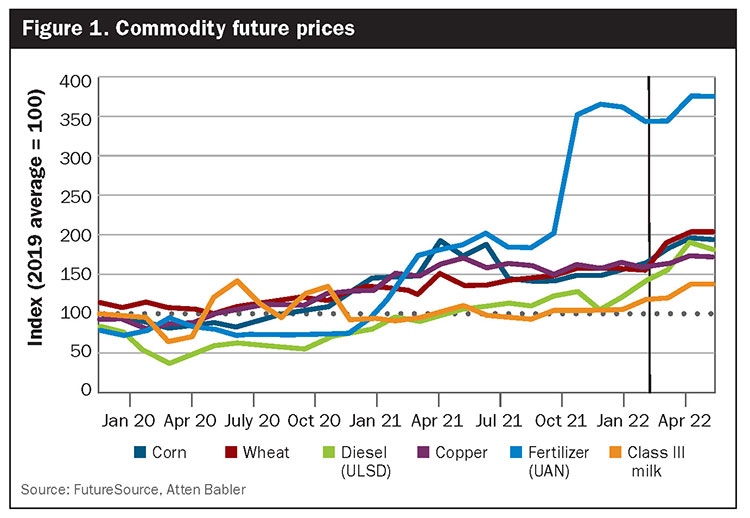

Then came the supply chain and transportation issues. Just as markets began some recovery, the Russians invaded Ukraine. That set into motion explicit sanctions and de facto sanctions through logistics, insurance, and financing limitations. These actions are taking a significant share of the world’s exported commodity supply off the market. For example, Russia and Ukraine combine to supply nearly one quarter of all the worlds’ coarse grain and wheat exports and are also major exporters of natural gas, fertilizer, crude oil, and metals.

Russia and Ukraine are both critical sources of commodities that affect global dairy producers. Feed, energy, transportation, and fertilizer costs all hit the bottom line for every dairy. Even the surge in metal prices is causing equipment cost pressures on the farm and at the milk processing plant. As a result, grain, energy, fertilizer, and metal prices have moved considerably higher, and in many cases to record levels, following the Russian invasion of Ukraine (Figure 1).

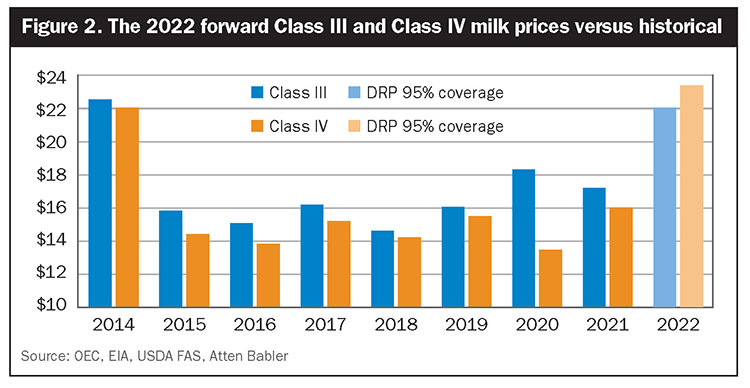

Dairy producers are fortunate that milk prices also have gone along for the ride with input costs even though Russia and Ukraine do not directly affect global milk supplies in a meaningful way. Global dairy producers have been cutting back on production due to high feed and operating costs. The war pushed those prices higher. In turn, it also helped push milk prices to record highs.

Keep it simple

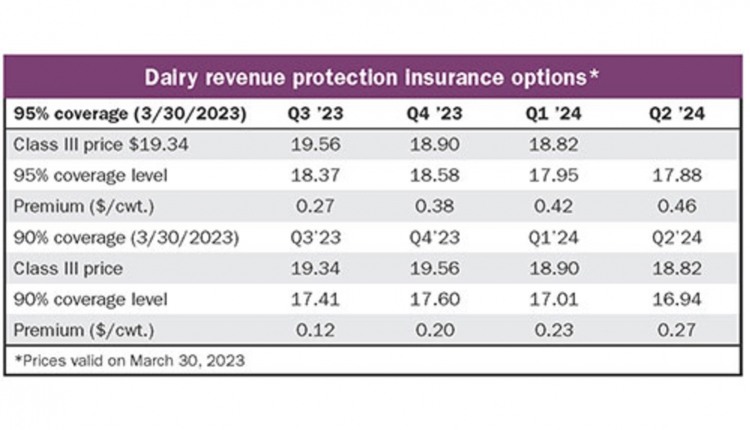

In an environment of extremes, often the best risk management approach is to keep it simple. In today’s challenging environment, no one can predict the length, severity, or ultimate impact of the war. What we do know is that milk prices are at record highs, and those historic high prices will not last forever. This situation calls for a minimum price approach that protects the downside, leaves the upside open, and doesn’t materially influence cash flows due to financing requirements. Dairy Revenue Protection (Dairy-RP) is an excellent tool that fulfills all of these needs. Consider this:

- Minimum price protection — locks in a guaranteed revenue while leaving the upside open.

- No margin calls — no ongoing financing requirements for margin calls in a high volatility environment.

- Subsidized — USDA covers nearly half of the premium cost through subsidies.

Payment at the end of the period — cash flows aren’t impacted at initiation of coverage, and premium payment is made at the end of the covered period.

Current Dairy-RP coverage levels through the balance of 2022 would allow producers to effectively lock in minimum prices not realized since 2014 (Figure 2). This is a rare opportunity, and dairy producers should work to fully understand the mechanics of Dairy-RP so they can take advantage of these prices.

The next steps

The approach we are recommending today is simple, but it still requires both focus and taking action. The current frustration with high input costs is a source of distraction from the record high milk prices. As risk managers, we are inundated with discussions about today’s high feed prices, just as we are usually flooded with inquiries about hedging milk after it crashes.

These are among the many reasons we are imploring producers to consider taking action on milk now. For any dairy producer who has been on the sidelines, now is a fantastic time to start engaging with a minimum price tool that leaves all of the upside opportunity open.