The author is an economist with the American Farm Bureau Federation.

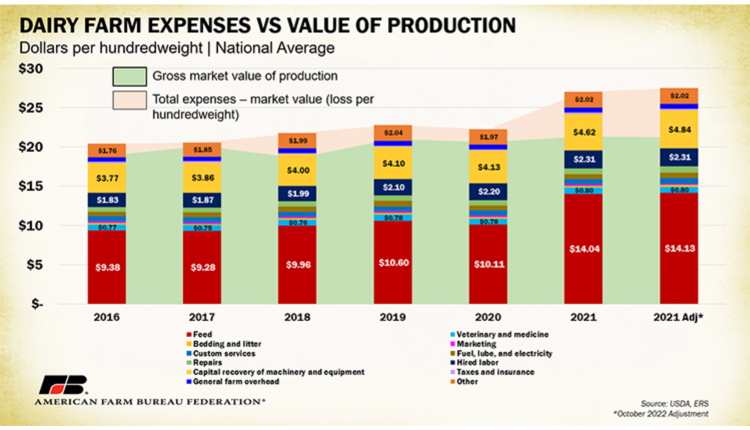

With the uncertainty of a new administration and related shifting trade policies, not to mention the untested long-term impacts of the upcoming Federal Milk Marketing Order (FMMO) changes set to take effect in June, dairy markets are anything but predictable. In addition, milk prices remain volatile, and while some relief has come in the form of declining feed and feed input costs, break-even question marks remain.

One area, however, may provide a measure of stability — beef-on-dairy crossbreeding. With the U.S. beef herd at its lowest level in more than 70 years, the supply of beef cattle remains historically tight, driving up cattle prices and making dairy-beef calves increasingly valuable. As a result, beef-on-dairy crossbreeding has evolved into a strategic revenue stream, helping dairies navigate milk market swings and adding a relatively stable component to the beef supply.

A key strategy

In the 20th century, dairy farmers bred primarily for milk production, with little economic incentive to focus on beef traits. However, advancements in artificial insemination and sexed semen have changed the equation. With enhanced control over breeding decisions, farmers can selectively breed their highest-quality cows for dairy replacements while dedicating a larger share of their herd to producing crossbred calves with beef traits — calves that command premiums over purebred dairy steers.

The shift has been rapid and widespread. According to a 2024 survey, 72% of dairy farmers now utilize beef-on-dairy crossbreeding, with some reporting additional revenue of up to $700 per head compared to purebred dairy steers. These premiums have helped dairy farmers offset balance sheet shortfalls, providing much-needed financial flexibility.

The beef market's role

The success of beef-on-dairy crossbreeding isn’t happening in a vacuum — it is directly tied to broader cattle market trends. The U.S. beef herd has shrunk significantly due to years of drought-driven liquidations and the irresistible temptation to send beef females to feedlots for a sure return rather than retaining them for breeding. This tightened supply has left beef processors scrambling to secure cattle. With fewer traditional beef cattle available, crossbred dairy-beef calves have become an essential part of the beef pipeline, helping to fill critical gaps in feedlots and at packing plants.

Data from the National Association of Animal Breeders highlights the scale of this shift. Domestic sales of beef semen have surged from just 1.2 million units in 2010 to 9.4 million in 2023, with 7.9 million units used in dairy cattle. CattleFax has estimated the dairy-beef calf crop rose from just 50,000 head in 2014 to 3.22 million in 2024 (Figure 1).

Carcass quality impact

One reason dairy-beef calves are fetching premiums is improved carcass quality. While traditional dairy steers are often discounted due to lower muscling and dressing percentages, crossbreds are more marketable because they combine the feed efficiency, muscling and yield of beef breeds with the marbling advantages of dairy genetics. These calves perform better in feedlots, grow more efficiently, and produce carcasses that meet consumer demand for high-quality beef.

Additionally, with lower feed costs and historically high beef prices, feedlots are pushing cattle to higher weights, amplifying the impact of these improved genetics. While crossbreeding alone isn’t responsible for rising carcass weights, it has contributed to a trend that benefits both beef and dairy sectors. Between 1990 and 2023, all steer dressed weights jumped from 741 pounds in 1990 to 908 pounds in 2023 (+22.5%), while heifers climbed from 672 to 829 pounds (+23.3%).

Effects on milk markets

Beyond providing an alternative revenue stream, beef-on-dairy crossbreeding may have long-term implications for milk markets. Traditionally, when milk prices rose, dairy farms expanded by retaining more replacement heifers, often leading to milk oversupply and subsequent price declines. However, with more dairy cows now bred to beef, fewer dairy heifers are being raised, which could slow the industry’s ability to rapidly expand production in response to short-term price signals.

This shift represents a fundamental change in risk management for dairy farms. Instead of relying solely on volatile milk markets, producers leveraging beef-on-dairy crossbreeding have a built-in hedge against milk price swings — a revenue stream that can remain reliable even when dairy margins tighten.

While uncertainty continues to define the dairy sector in 2025, the role of beef-on-dairy crossbreeding as a financial buffer is clear. With the beef supply still tight and cattle prices expected to remain strong for at least the next couple of years, crossbreeding presents a strategic opportunity for dairy farmers to diversify income and mitigate milk price volatility.

As the industry adjusts to upcoming FMMO changes and shifting trade policies, dairy producers who incorporate beef-on-dairy breeding into their operations will likely find themselves better positioned to navigate the unknowns ahead.