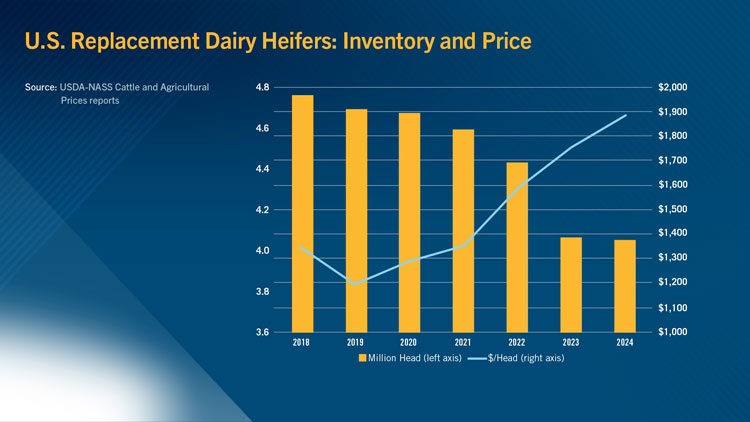

Dairy heifers weighing over 500 pounds — a proxy for the number of dairy replacements expected to enter the U.S. milking herd over the next year — have fallen almost 15% during the past six years to settle at 4.06 million head.

That downward shift has taken place so fast that USDA revised its January 2023 dairy heifer inventory figure from 4.34 to 4.07 million. That’s a remarkable 263,000-head reduction in dairy heifers for the same snapshot in time between the January 2023 and January 2024 USDA Cattle reports.

As it stands now, the 4.06 million dairy heifers 500 pounds and over is the lowest total since January 2004, when there were 4.02 million head of dairy heifers in the 500 pound-plus category.

It’s a different dairy world

Inflation has driven up the costs in many areas of our lives. The same holds true on America’s dairy farms. In the past 20 years, the cost to raise a dairy calf from birth to adult cow has climbed substantially. University of Wisconsin Extension survey data from 1999 to 2015 found the total cost to raise a dairy heifer from birth to first calving climbed from $1,360 to $2,510 per head. That’s an 85% increase. In a similar analysis from 2016 to 2021, Penn State Extension specialists calculated heifer rearing costs averaged $2,034 with a range of $1,411 to $2,301 between the lowest and highest of the five quantiles.

Whether $2,000 or $2,500 per head, the trouble is, these expenses haven’t borne out in higher values. Sale prices for dairy replacements have hovered between $1,300 to $1,600 for nearly a decade. That led to a transformative change.

Beef semen sales have more than tripled, with dairy farmers purchasing the vast majority of those units. The shift from dairy semen to beef semen has created an estimated 3 to 3.25 million beef-on-dairy animals, estimated Dale Woerner of Texas Tech University. Prior to the boom in beef semen sales, nearly all those animals were sired by dairy bulls.

Part two of this transformative shift to beef-on-dairy is the shrinking number of replacements expected to enter the milking herd. That 15% drop in the heifer supply largely went unnoticed until dairy farmers went looking to buy now-scare replacements this fall and into the new year. As a result, prices have jumped to a seven-year high of $1,890 per head based on January 2024 USDA data published in Agricultural Prices. Auction market reports have been even higher in some regions, with prices topping out in the $2,800 range.

The situation may be the new norm for the next two to three years. The use of more gender-selected dairy semen, less beef semen on dairy cows, and reduced dairy cow culling could eventually rebuild dairy replacement inventories. In the near term, however, dairy replacement numbers could limit the upside on growing U.S. milk production.

To learn more about this important topic, read “Dwindling Dairy Heifer Numbers May Inhibit New Milk Production.”