The lack of price-supportive grain news means that feed prices have settled into a weaker pattern in recent months and are set to continue their declines. Without a significant demand boost, pressures such as continued growth in yields will likely win over the market and keep feed prices in check for dairies.

There’s an old saying that bull markets need fed. In other words, for prices to stay elevated, there needs to be a steady stream of news into the markets justifying those higher prices.

The grain market bull has gone very hungry, indeed. Although summer dryness led to lower yields and higher prices, harvest brought the realization that large plantings offset the low yields, and prices have been alternating between sideways and down ever since.

In 2024, I expect to see sideways or downward trends continue at least through March. Once planting begins in earnest, weather will matter more, but ample 2023 production will keep a lid on any feed rallies.

Sources of demand

Since the fall, corn futures prices have continued to weaken on large supplies and modest demand. Demand changes would drive any changes to old crop corn prices in 2024.

We are still not seeing increases in cattle or hog numbers, so feed demand won’t be a factor.

Ethanol production has been solid and should continue to be through 2024. But strong growth is not expected, and any boosts from sustainable aviation fuel demand won’t happen for a few more years.

That leaves exports as the remaining source of any additional corn demand. To date, exports have been in line with the USDA forecast of 2.2 billion bushels. This level of exports is higher than last year but has already been priced into the market.

South American harvest outlook

South American corn production will matter increasingly more as we move through 2024. Argentina’s production is set to rebound from last year’s abysmal crop, with availability starting in April. It is still too early to say much about Brazil’s second crop, which will start being harvested in June, but there is widespread belief that plantings will decline on lower prices compared with last year.

Between now and April, I expect corn prices to languish and basis also to struggle. Dairies should stay hand to mouth on feed purchases through planting. If the second crop Brazilian harvest starts to struggle or U.S. planting is delayed, be proactive in pricing summer needs.

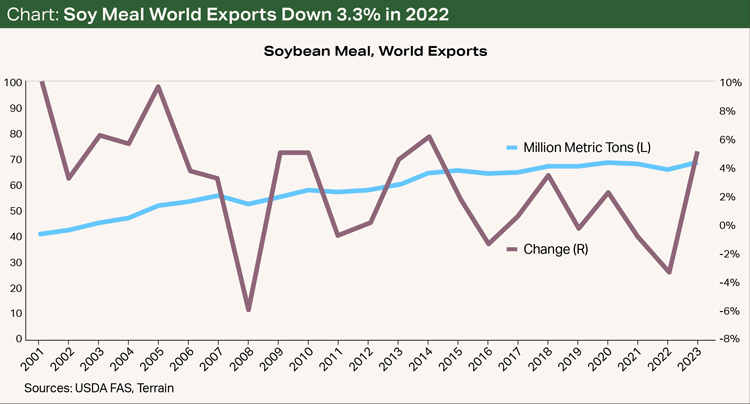

Soy meal prices have remained high over the past two years, primarily because of restricted supplies from Argentina. World exports in the 2022/2023 marketing year were down 3.3%, the largest decline since 2007 (see below). U.S. exports were significantly higher last year and this year to fill the gap left by lower Argentine exports.

I expect South American soybean production to return to a much more normal level this year after last year’s severe drought in Argentina. After South American harvest, this should cause a weakening in domestic meal and feed prices unless there are problems with U.S. planting or growing weather.