Futures prices indicate that 2024 could be the third-highest milk price year on record. However, sluggish international dairy trade and tepid domestic consumer demand due to four years of inflationary forces across the globe have been slowing growth in dairy product sales.

Global dairy trade peaked at 11.5 million metric tons in 2021 and has since fallen off that record to settle at 10.9 million metric tons in 2023, according to Trade Monitor Data. On the domestic front, cheese has long been the sales growth leader. But domestic cheese sales posted a rare 3.5% downturn as measured by USDA’s commercial disappearance data this February.

When it comes to the processing side of the equation, conversations at dairy meetings across the U.S. have been dominated by new cheese production capacity coming online later this year. Acting as a counterweight, shrinking dairy replacement inventories could limit the upside for growth in milk production. We’ve already seen some of that impact as milk production has been down for nine straight months from July 2023 to March 2024.

All these situations could pull dairy demand and milk prices in either direction as the year unfolds.

The widening Class-III-to-Class-IV spread

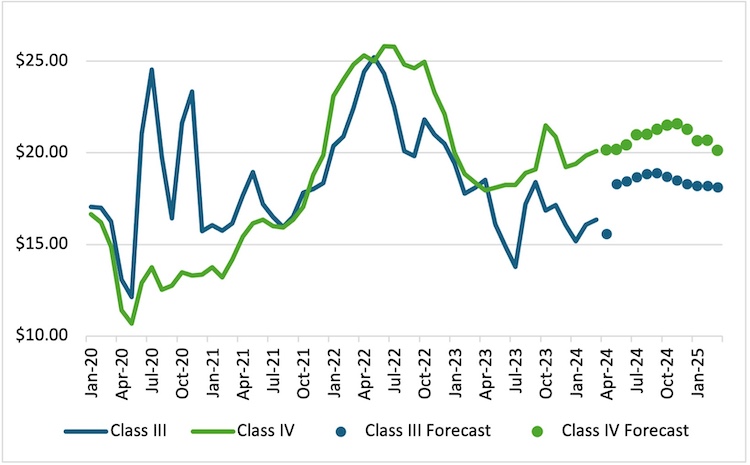

The prospect of new plant capacity coming online, and with it more cheese trying to find a consumer home later this year, also has been putting downward pressure on Class III milk prices. Meanwhile, butter selling near-record retail prices has lifted Class IV milk prospects higher.

Together, cheese and butter prospects have inverted the Class III to Class IV price relationship (see graph). This atypical situation began in May 2023 and has continued since that moment in time.

The futures market indicates this unusual market situation could persist throughout 2024 and well into 2025, delivering lower milk prices to farmers in high cheese production regions such as the Upper Midwest. Meanwhile, strong Class IV markets, like those found on the West Coast, will receive higher milk prices as tracked by USDA’s Mailbox Price series. The Class III-to-Class-IV spread also dampens Class I prices due to average pricing formulas.

Even as Class III price forecasts remain off pace from Class IV, there’s not a lot of extra milk in the marketplace. Midwest Class III spot milk prices near $2 under Class III federal order minimums indicate that milk is fetching closer to Class III Federal Milk Marketing Order minimum prices this year compared to milk selling for $7 to $8 per hundredweight (cwt.) under value last year to proprietary plants. Milk supply caps, known as base excess plans, also continue to keep markets in balance given sluggish growth in demand, as does the fact there are 709,100 fewer dairy heifers 500 pounds and over compared to just six years ago. With fewer replacements available, dairy farmers have sent 127,300 fewer cows to slaughter this year compared to the first 14 weeks in 2023.