With trade specialists from the U.S., New Zealand, Mexico, Ireland, Germany and Australia on hand, exports garnered a great deal of attention at this year's Dairy Forum in late January sponsored by the International Dairy Foods Association (IDFA).

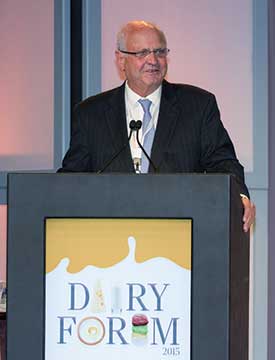

With trade specialists from the U.S., New Zealand, Mexico, Ireland, Germany and Australia on hand, exports garnered a great deal of attention at this year's Dairy Forum in late January sponsored by the International Dairy Foods Association (IDFA). At right: Mike Moore extolled the positive attributes of the Trans-Pacific Partnership (TPP) for both New Zealand and the United States. With the U.S. producing five times the milk compared to the Kiwis, Moore believes both countries could gain dairy exports from the (TPP) trade pact.

"I don't think you (the U.S.) know how good you are (in dairy)," said the Right Honourable Mike Moore, New Zealand trade ambassador to the U.S. "The U.S. sells four times more dairy to emerging markets than my country. American dairy exports are now larger than U.S. beef exports," he went on to say. In these statements, Moore was making the case that the U.S. should not fear New Zealand's dairy export position in the Trans-Pacific Partnership (TPP) trade negotiations, which involve the U.S., New Zealand and 10 other Pacific-region nations.

"We (New Zealand) represent just 3 percent of the world's dairy production, you (the U.S.) represent 15 percent," Moore explained in his folksy and disarming style. "One in three U.S. farm acres are planted for international customers," he said, further documenting the United States' already existing agricultural exporting prowess.

"The TPP negotiations are not an economic problem, they're a political problem," the ambassador for the world's leading dairy export nation went on to say. "With all the 21st century issues, TPP comes down to dairy, sugar, rice and a few other agricultural crops," noting that Japan has some extremely protectionist agricultural policies in five ag sectors, while Canada has an entrenched supply control system in dairy. Both these nations are also involved in TPP trade talks.

"What we (New Zealand) are seeking is the opportunity to compete," Moore explained to the 1,050 attendees at this year's Dairy Forum from 13 countries around the globe.

Earlier in the meeting, IDFA President Connie Tipton noted New Zealand's dramatic growth in dairy circles. "Since going free market in 1994, New Zealand has seen its number of dairy cows grow by over 70 percent to about 6.5 million," she said.

Pacific holds more promise

After Moore's presentation, a standing-room-only breakout panel discussed the state of international dairy trade. Most people at the discussion, and at the overall meeting for that matter, believed that TPP could receive "fast track" status this year or in early 2016. That status means that Congressional approval would be a thumbs up or thumbs down vote with no ability to amend the trade pact. And all agreed that the TPP represents big stakes.

"The Trans-Pacific Partnership involves 40 percent of the global GDP (gross domestic product)," said Darci Vetter, chief agricultural negotiator from the Office of the United States Trade Representative. "TPP countries also account for 41 percent of all U.S. agricultural exports," explained Vetter, who reminded dairy industry personnel that 2014 was the best year in history for U.S. dairy trade and for all of agricultural exports.

"TPP is the most important trade negotiation in the world. The Asia-Pacific region will be the engine of economic growth in the next 25 years," said Kenneth Ramos who is head of the Trade and NAFTA Office in the Ministry of the Economy for the Embassy of Mexico. "It will be the blueprint for other trade agreements.

"A good TPP could help improve the 20-year-old NAFTA (North American Free Trade Agreement)," said the Mexican ministry official. "That's important for U.S. dairy as 26 percent of American dairy exports go to Mexico," explained Ramos.

While trade representatives thought there could be action on TPP in the next 15 months, a trade pact between the U.S. and the European Union - known as TTIP or Transatlantic Trade and Investment Partnership - faces many more hurdles.

"TTIP is having more issues in the EU than in the U.S.," said William Reinsch, president of the National Foreign Trade Council. "That is in part because the U.S. is spending more time on TPP."

"We have a great deal of work on TTIP," said Vetter, who negotiates on the behalf of the American government. "U.S. ag exports to the rest of the world have grown by 181 percent and only 82 percent during that same time frame in the EU."

Tariffs or taxes on imported goods play a role in that trade disparity. "The EU has a 30 percent tariff on average on U.S. ag products, while the U.S. only has a 12 percent tariff on EU products," said Vetter.

While the EU may be moving away from dairy production quotas in April 2015, it has employed a strategy of protecting product names under a concept called geographical indications or GIs. Recognized by the World Trade Organization (WTO) as a way to protect unique products made in a specific region of the world, most outside of Europe have believed that the 28 nations on that continent have taken the strategy too far.

Views on federal orders mixed

In a panel discussion with two dairy processors and one processor-cooperative, views were mixed on the potential for federal milk marketing order (FMMO) reform, with the processor-only group favoring an overhaul. Of course, any discussion of FMMO reform always comes down to money - 2008 to 2009 wasn't a profitable year for dairy producers, while 2014 left a sting in processor's bottom lines.

"Volatility and risk are not going away, even if we did away with orders, but the system exacerbates the symptoms," said David Ahlem, chief operating officer of Hilmar Cheese.

"We need to force everyone (farmers) to compete. As long as we have this safety net system (FMMO), that doesn't happen," Ahlem went on to say.

"The world is a different place, and the reasons why we have federal orders are no longer important," Ahlem said. "The system defines value, and while we are fighting over where to slice the pepperoni pizza pie, the rest of the world is eating a different pie."

"The system should include more price discovery and reporting than what it does today, but pricing itself needs to be completely overhauled," said Jeff Kaneb, executive vice president of HP Hood. "We all have a vision of something different and better without the artificial barriers, opening the doors to innovation for both processing and product, but we don't really know what it is or could be because the doors are closed."

"I have a hard time seeing where eliminating market pooling increases value for dairy producers," stated Jay Bryant, CEO of the Maryland and Virginia Milk Producers Cooperative Association. "If processors want federal order reform, they must convince dairy farmers that they will not assume all the risk," said Bryant.

"To move forward, we need leadership and vision," said Bryant. "Producers and processors can continue to be at polar opposites as generations in the past have been. But the leaders in our industry need to ask themselves if they are happy with what we got, and I think the answer to that is no. The right starting step is exactly what is happening with IDFA and NMPF leaders working together and starting the conversation."