Larger U.S. milk supplies require growing consumer demand — both in America and abroad. Fortunately, dairy exports have been up to the task thus far in 2018.

On a volume basis, this April’s dairy exports set an all-time monthly record at 18.8 percent on a total milk solids basis. That was on top of the March 2018 totals — a record that stood for one month, following the all-time daily average high that was set in February. For the first quarter of 2018, export volumes of both milk fat and skim solids were 18 percent above year ago levels.

All sales are up

All of the major dairy product categories recorded double-digit percentage gains in volume for the first quarter of the year. This is the first time that has happened since the third quarter of 2010. Shipment totals were:

• Butter, up 54.5 percent

• Dry whey, up 28.1 percent

• Nonfat dry milk and skim milk powders, up 23.1 percent

• Whey protein concentrate, up 20.8 percent

• Lactose, up 17.5 percent

• Cheese, up 11 percent

The total value of dairy exports amounted to $1.39 billion for the first three months of the year, 4.2 percent above last year.

Tribulations on trade

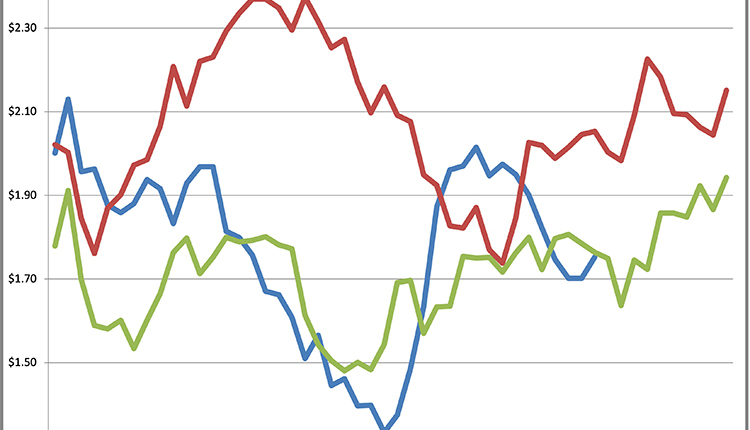

It is against this backdrop that dairy industry participants keep a wary eye toward U.S. trade negotiations with North American Free Trade Agreement (NAFTA) partners and China. Mexico (22.7 percent), Canada (11.7 percent), and China (10.3 percent) have accounted for almost 45 percent of U.S. dairy export volume during the first three months of the year. These sales totals are similar to their combined purchasing power since 2015. With U.S. milk production projected to grow by another 1.5 billion pounds during the second half of the year (1.4 percent), the extent to which international consumers purchase U.S. dairy products will be a large factor in determining milk prices for the remainder of the year.

America isn’t the only country growing milk production; Australia (2.2 percent) and the European Union (1.1 percent) are also projected to grow this year. In addition, with large stocks of nonfat dry milk continuing to hang over world markets, competition from other major dairy exporters is unlikely to ease.

Dairy exports from Canada have also increased markedly for the first quarter of 2018, rising by 24.5 percent in terms of volume and 7.4 percent in value. It is clear that the challenge to keep consumer demand growing at or above the rate of milk production increases will continue to be difficult. But failure to do so will likely translate into lower milk prices and an even more difficult financial environment in the months to come.