DRAMATIC DECLINE

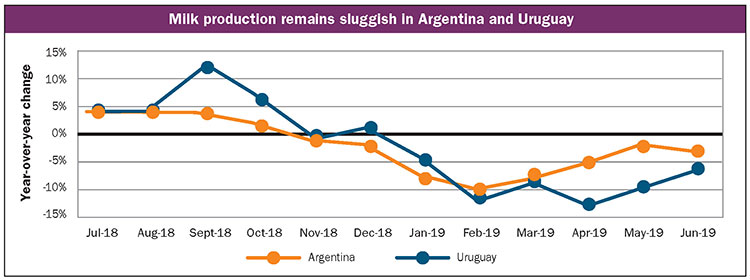

In reality, the year-over-year decline in milk production began during late 2018. However, relative volume growth was high enough in earlier months to keep the change positive for the year. In fact, Uruguay reached the highest output on record last year, while Argentina saw the strongest production since 2015.

Yet, the tone so far in 2019 has been decidedly negative, with year-to-date production running behind the prior year by 5.8 percent in Argentina and 6.2 percent in Uruguay. This represents a significant development for the continents two largest dairy exporters.

Most of the production decline is being blamed on poor weather, but not in the way that was anticipated earlier in the year. An El Niño weather effect loomed over the region in the first half of 2019, and while this phenomenon typically means excessive rain and flooding in this part of South America, this year was quite dry. As a result, pasture growth was limited, and farmers pointed to low-quality forage as one of the major drivers behind the milk production losses.

MORE THAN WEATHER

In addition to climatic challenges, economic issues contributed to the milk volume contraction. Crunched farmer margins during late 2018 forced farmers to reconsider their operational continuity, and many farmers elected to exit the business.

The economic situation was particularly severe in Argentina, where a major currency devaluation in September 2018 eviscerated the milk price. The situation has improved markedly, but farmers in both Argentina and Uruguay are coping with the economic hangover and a hesitancy to expand.

A reduction of the dairy herd has also placed downward pressure on milk volumes. Greater beef demand from Asian buyers supported strong meat prices and led to higher slaughter rates. This structural shift helps to explain why even though farmer profits have improved, the reaction in terms of milk production has been slow to materialize.

The most obvious impact of the limited milk production from the perspective of global markets will be reduced exports from Argentina and Uruguay this year. Without sufficient raw milk to fill orders in the early months of 2019, processors and traders in the region have been forced to draw down inventories to fill previously agreed upon orders.

In Argentina, many processors have also been forced to put exports on the back burner as they struggle to meet demand from the domestic market. Market participants indicate that dairy product prices have risen with the reduced supply.

The situation will surely ease as more milk comes online seasonally in the spring. However, the dairy chain will first have to dig itself out of a hole by shoring up stocks and having prices come down to a level more aligned with the international situation. As a result, it is likely that Argentina and Uruguay will continue to have reduced exports this year.

LOOKING AHEAD

Despite the challenges faced so far this year, there are indications that milk production will begin to grow once again in the coming months. First, margins are quite strong in the region as dairy farmers are benefitting from moderated operating costs thanks to a bumper grain harvest. Though the crop struggles in the U.S. have somewhat counteracted the South American season, concentrates remain plentiful and dairy rations are less expensive as a result.

Milk prices have also risen as processors are forced to compete with one another to attract additional milk volumes. The gains have been most dramatic in Argentina, where milk prices rose by 34.2 percent over the first six months of the year. Milk prices have climbed more modestly in Uruguay, but they are at comfortable enough levels to leave the average farm with some profit.

POISED FOR RECEOVERY

Under the bold assumption that the weather cooperates and political forces don’t interfere, milk production in South America’s most important dairy exporting countries is poised to recover in the final months of 2019. This growth should position both Argentina and Uruguay to return to global markets in a more substantial manner by early next year.