Milk production across the major exporters was up 1.6 percent from last year this August, after adjusting for components, according to the latest data compiled. The U.S., New Zealand, and Australia have all reported production for September, and they were all stronger than forecasted. However, the EU data for September is still trickling in. So far it looks like growth in September will be about as strong as August, with growth up at least 1 percent.

With the recent strength in production and profitable margins across all the major exporters, it’s easy to argue for continued strong growth into the fourth quarter. However, despite being better than expected, New Zealand production was only up 0.7 percent from last September. As for the U.S., dairy producers haven’t yet healed enough.

The future forecast

Even with good weather, we’re lapping over good production and weather from last year for the next couple of months in New Zealand, so we’re probably not going to see much growth until March or April. Production was better than expected in Australia, but still down 3.6 percent from last year in September. Under a best-case scenario, they could show some slight positive growth, but it wouldn’t happen until the first or second quarter of 2020. So, the Southern Hemisphere nets out to flat or down in the fourth quarter.

Production in the U.S. was stronger than expected in September, up 1.7 percent on a component-adjusted basis. But weekly dairy cow slaughter data accelerated in late September and early October. This suggests farmers are still struggling a bit, and we should factor in something closer to 1.2 percent for the fourth quarter.

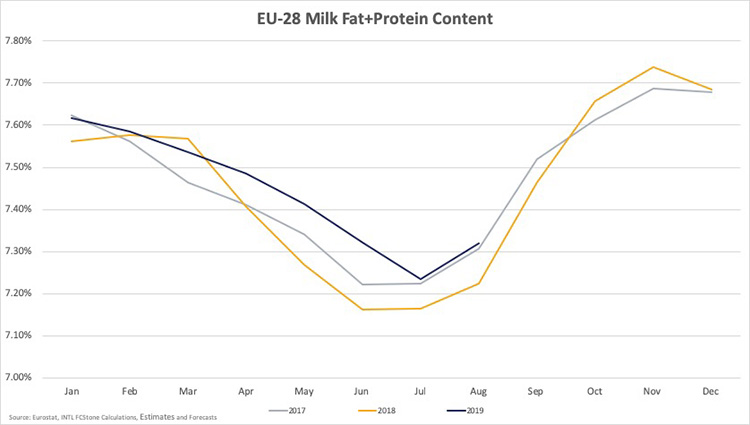

Production in the EU has been a little better than expected. It’s possible that could continue, but the EU is going to be lapping over relatively strong components in their milk during the fourth quarter of last year. They might be able to match those component levels, but probably won’t be adding much growth.

That will limit EU component-adjusted milk production growth. When we add it all up, adjusted production across the major exporters is only forecast up 0.6 percent during the fourth quarter compared to the 1.1 percent growth we saw in the third quarter.

Buy side is stronger

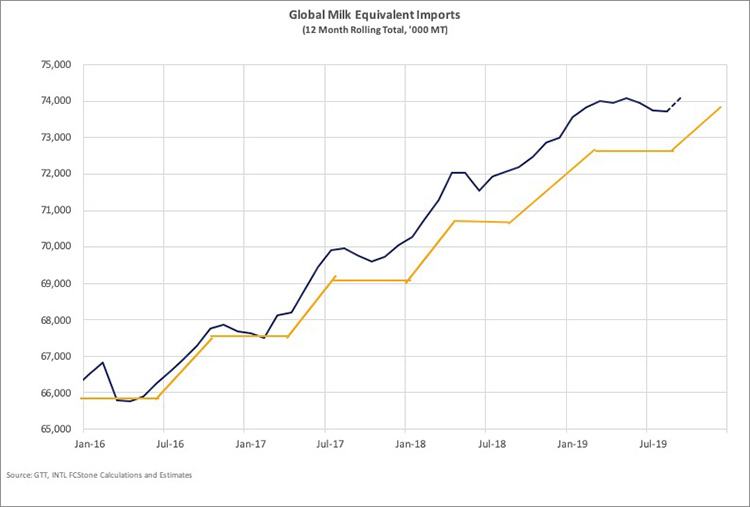

On the demand side of the equation, it looks like global imports bumped higher in September after being flat since April. Global imports have been on a roughly six-month cycle with imports running flat for six months, and then trending higher for six months before flattening out again.

The general trend of higher imports over time is being driven by population growth, income growth, and other factors. But the short-term trend is being driven by product availability, prices, and short-term inventory positions. And it’s still strong.

There are still reasons to be concerned about global economic growth in 2020 and 2021, but we should see a short-term bump higher for imports in the fourth quarter of 2020 and the first quarter of 2021. As that demand bumps up against relatively tame milk production growth, it should be generally supportive for dairy prices globally.