According to The New York Times, there are 21 states, 37 counties, and 16 cities in the U.S. that have “locked down,” telling their residents to stay home except for necessities. An even greater number than that have shut down in-person dining at restaurants. Last week I built some statistical models that tried to connect food expenditures at both foodservice and retail back to total dairy demand, but I wasn’t really confident in them.

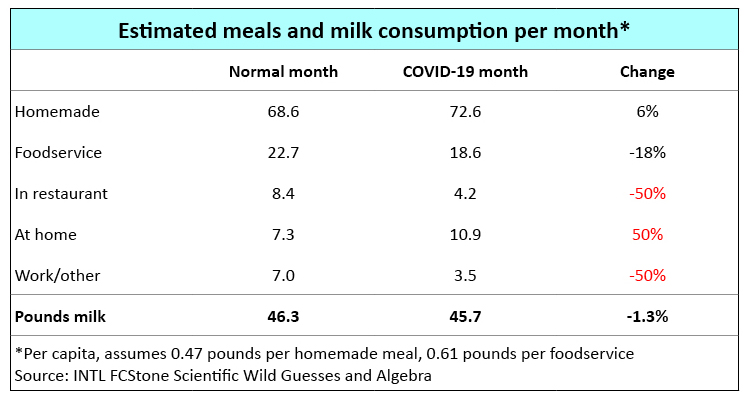

How much dairy does the average foodservice meal versus homemade meal contain? What is the breakdown between foodservice and homemade meals for the average person before the COVID-19 outbreak, and how might that be different during the lockdown that forced restaurant closures?

If we know all those numbers, we can make a reasonable estimate about how demand will change as consumers shift toward homemade meals.

Foodservice uses more dairy

From what I can figure, about 30% of milk solids are consumed through foodservice every year. Piecing together data across various sources, it looks like 25% of U.S. meals per year are from foodservice. If we take those assumptions, it looks like the average foodservice meal has 0.14 pounds (+29.8%) more milk in it than a homemade meal. So, the shift from foodservice to homemade would be a net negative for overall dairy demand.

Best Guesses

- 30% of milk solids are sold through foodservice

- 25% of meals per year come from foodservice

- 37% eaten in restaurants

- 32% eaten at home (delivery or takeout)

- 31% eaten at work, in a car, or in other places

- Pounds of milk equivalents per meal:

- Foodservice: 0.61 pounds of milk/meal

- Homemade: 0.47 pound of milk/meal

Every meal shifted from foodservice to homemade reduces dairy consumption by 0.025% on an annual basis (0.3% on a monthly basis).

The last step is to take a guess at how much foodservice sales at a national level will decline with the lockdowns. The data I found suggested that roughly one-third of foodservice meals are consumed in the restaurant; another third at home via delivery and takeout; and another third are consumed at work, in our cars, or other places.

Black Box Intelligence says they are already seeing delivery and takeout sales up 30% to 60% in late March, so I think a 50% increase in at-home consumption of foodservice meals is reasonable.

Not all states are locked down, and many people are still going to their workplaces for jobs that have been deemed essential, so I’m reluctant to take in-person dining and work-related foodservice meals all the way down to zero. Let’s assume they are both down 50% at the national level.

Dairy demand down some

If in-person and workplace foodservice meals are down 50% and delivery and takeout is up 50%, total foodservice meals would be down 18%. On the flip side, homemade meals would be up 6%. Under this scenario, the hit to milk-equivalent demand is about 1.3% per month (0.11% on an annual basis for every month the lockdowns persist).

If we see foodservice sales down 18% for three months, it would reduce total dairy demand by about 0.32% for the year, which would push inventories about 5% higher than they otherwise would have been by December.

Looking at a simple stocks use model, that would reduce the average Class III and Class IV milk price by a little over $1 per cwt. for the remainder of the year. That would be a 6.6% reduction in prices due to the shift away from foodservice as a point of reference. The models that I had worked up last week suggest a more dramatic 11.5% drop in prices for that same scenario. I think the 6.6% price drop is more reasonable if we are just looking at the consumption shift.

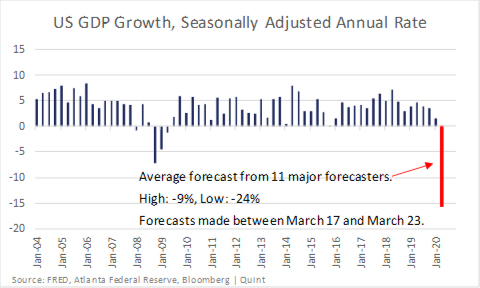

A depressed economy

However, the shift from foodservice to homemade meals probably isn’t the biggest headwind dairy demand is facing right now. We are looking at the largest quarterly drop in gross domestic product (GDP) since at least 1945, with major banks and macroeconomic forecasters pointing toward a drop of 15% or possibly more in the second quarter.

When we were coming out of the last recession, Domino’s CEO would often say, “Employed people eat more pizza” on earnings calls. That message has a ring of truth to it. This time, employed people might eat enough extra pizza delivered to their doors to offset the decline in sales to unemployed or under-employed people.

The point is that people change their consumption behavior significantly in times of personal economic stress. And this isn’t just an issue for the U.S.; we are looking at a very large global drop in economic growth for at least the second quarter.

Maybe we’ll somehow get a grip on this pandemic in the next 90 days and the economy, along with the jobs, will come roaring back in the third quarter. I certainly hope that is the case, but it might not be.

An economic plunge

We can try to estimate how much milk is in a homemade meal versus a foodservice meal. Or how schools closing down will impact total fluid milk sales. Or how much of the dairy products consumers stocked up on will spoil and be thrown out and thus represent “extra” demand for the year.

At the end of the day, we’re going into one of the largest drops in economic activity we’ve ever seen in the U.S. with a nearly instant surge in unemployed people. That is terrible news for dairy demand. With milk production growth looking pretty good across the major exporters through July or August, the weaker demand outlook and adequate supply suggest prices are going to face some continued downward pressure for a while.