As dairies face low milk prices, their ability to endure and recover from volatile conditions is more important than ever. This has certainly been true for the dairy industry from 2015 through mid-2019, and most recently, in the second quarter of 2020. Dairy farmers overwhelmingly want to stay in business, but tight profit margins make this challenging.

Over the past 18 months, a unique dataset at the University of Minnesota was created. It combines animal health, production, and farm financial data to assist dairy farms in creating more financially sustainable operations. In all, 87 Minnesota dairy farms across 29 counties agreed to share their Dairy Herd Information Association (DHIA) and farm business management records from 2012 to 2018.

This was possible through a multi-entity collaboration between Minnesota dairy farms, DHIA, Minnesota State Colleges and Universities Farm Business Management Program, and University of Minnesota Extension. This study focuses on effective management strategies employed by resilient dairies that managed tight profit margins while mitigating volatility and withstanding economic hardship.

More income per cow

Financial resiliency was defined using the adjusted net farm income ratio. Specifically, we calculated the proportion of profits the farm was able to retain from revenue generated by farm production after farm expenses were paid.

Using this measure, we annually ranked the 87 farms against each other from 2012 to 2018. Then we identified resilient farms as those that ranked in the top 25% for the majority of the years of the study. Using this criterion, 24 of the participating farms (28%) were categorized resilient. We then compared the characteristics of the 24 resilient dairy farms to the remaining 63 farms, which we term “non-resilient.”

The farms participating in this study had herd sizes ranging from 22 to 1,115 cows. Resilient dairy farms were smaller operations with an average herd size of 106 cows. Their median milk production was 18,161 pounds per cow. In our sample, non-resilient dairy farms had 220 cows with a median milk production of 22,676 pounds per cow.

Resilient dairy farms received $0.52 more per hundredweight (cwt.) of milk than the non-resilient farms and reported an average operating expense of $2,651 per cow and $455 per cow for direct expenses. Operating expenses were 20% higher ($3,180 per cow), while ownership costs were 60% higher ($753 per cow) for non-resilient farms.

Hired labor expenses differed for each group. Resilient farms reported a median $6,475 for the year compared to $58,464 for non-resilient farms. Both groups reported hired labor, but non-resilient farms had larger reported costs. When comparing resilient and non-resilient farms of similar size, resilient farms spent four times less on hired labor.The milk price used in this study is calculated by dividing total milk income by total milk sold. It does not include government payments, cull sales, or other revenue adjustments. While we do not have detailed information on milk premiums received, they are included in the milk sales total.

Resilient dairies appeared to be proactive in receiving milk premiums and/or using marketing strategies to improve their milk price to counterbalance lower milk production. An important caveat to this point is the farm having a viable market to sell their milk.

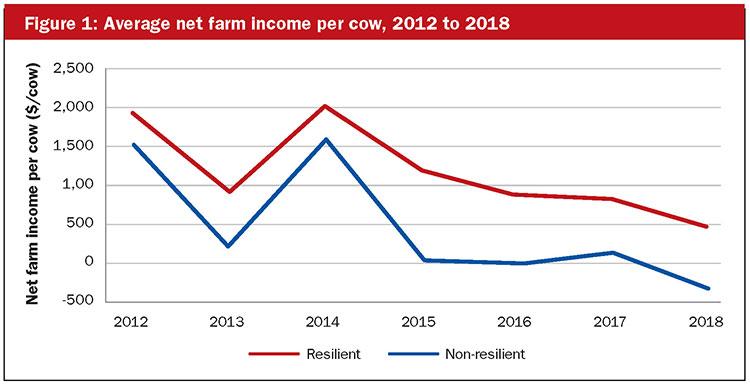

A higher milk price coupled with lower input costs allowed the resilient farms to consistently receive a higher average net farm income per cow, even with smaller herd sizes (Figure 1). Over 73% of the non-resilient farms suffered from negative net farm income in 2018, while only 9% of the resilient dairy farms reported negative net farm income.

The difference between the two groups widened from 2015 to 2018 with sustained low milk prices. Resilient dairy farms did lose profit potential each year since 2014, but those decreases were incremental over time. Meanwhile, non-resilient dairy farms were operating slightly above or at breakeven from 2015 to 2017, with a consistent negative profit per cow in 2018.

Reactive to change

We looked more closely at the cow level data to identify strategies used by these farms to retain profit. First, we observed resilient farms were able to be more responsive to milk price changes with their input purchases while the non-resilient herds were not.

Non-resilient farms responded to falling milk prices with more culling, while resilient dairy farms did not change their culling strategy. Instead, they consistently culled unprofitable cows 75 days earlier than non-resilient farms and kept their profitable cows in their herd for multiple lactations.

The average age of the principal operator on resilient dairy farms was 43 years old, which was 10 years younger than non-resilient farms. These farms also placed a greater emphasis on educational opportunities. Participation in the Minnesota Dairy Initiatives (MDI) program was used as a proxy for additional education. MDI brings dairy producers, veterinarians, nutritionists, lenders, and other agricultural professionals that support the dairy together as a professional team to identify goals for the dairy farm and find ways to achieve them within their current budget.

Eighty-three percent of the resilient farms participated in the MDI program, while only 12% of the non-resilient farms participated. This team-based approach to management potentially allowed these farms to be more responsive to volatile milk prices and adjust more quickly with input purchases as well as potential revenue marketing opportunities.

Indicators of success

The main lesson we learned from this project was that even though resilient dairy farms may not have the highest milk production per cow or net farm income on a pure dollar basis, they were able to retain a larger portion of the milk sales they received as profit. This is more than likely due to the combination of financial and cow management strategies they used to mitigate downside risk.

As farms continue to work through exceedingly tight margins, farm managers must identify what they want to measure as success for their farm. Then, they can continue to build and fine-tune their skill set to achieve their goal.