The best times for many agricultural sectors occur during periods of strong demand. The ethanol industry boomed when ethanol use grew during a period of record crude oil prices. The cattle industry saw stronger beef prices when consumer demand for beef recovered as the industry better matched output to consumer beef preferences.

As the dairy industry looks forward, there are reasons to be excited regarding demand growth areas but also challenge areas that must be overcome to keep dairy industry growth on track. It is a good exercise to look at the long run demand trends in dairy categories.

The bright spots

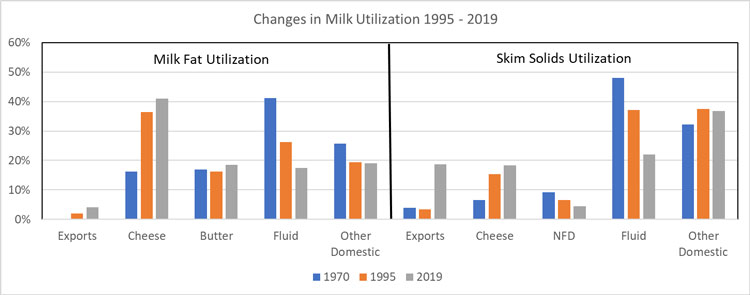

Cheese is often the demand category that is highlighted as the best news on the dairy front, and the role cheese demand has played is evident in the chart below. In 1970, cheese absorbed 16% of milk fat production and 7% of skim solids production. By 1995, cheese had grown to the point that it used 36% of the milkfat produced and 15% of skim solids.

The percentage growth of milkfat and skim solids used in cheese production continued to grow from 1995 to 2019, though at a slower rate, reaching 41% of milkfat utilization and 18% of skim solids last year. Although the growth rate in the percentage of milkfat and skim solids has slowed, cheese remains a critical category. Anything that stops or reverses the growth in cheese consumption would have large impacts on the size of the U.S. dairy industry.

The dim spots

Fluid milk use is often described as the other side of the story. In 1970, fluid milk used 41% of total milkfat production and 48% of skim solids production. By 2019, fluid milk reduced its share of total milkfat utilization by 24% and skim solids by 26%. The dairy industry would be substantially larger today if the decline in fluid milk usage could have been stopped or reversed at some point along the way.

The chart also highlights another important trend regarding fluid milk demand. From 1970 to 1995, the percentage of milkfat consumed as fluid milk fell faster than the percentage of skim solids as consumers looked to products with lower-fat content. That trend reversed from 1995 to 2019. Butter experienced similar trends over the two periods.

A new star

Exports have been increasingly important to skim solids utilization over the 1995 to 2019 period, growing by 15%. Exports still use only a small percentage of milkfat supplies. Exports remain important to skim solids use moving forward and should enjoy continued growth as economies recover from COVID-19 slowdowns.

Growing the demand for dairy products is the winning long-term strategy for a vibrant and strong U.S. dairy industry.