U.S. dairy cow numbers are on the rise again, with the U.S. herd up 40,000 head in October 2020 relative to June. That’s an expanse of just five months. By comparison, this recent expansion in the dairy herd has more than offset the 35,000 head that were cut between March and June. Producers have quickly responded to higher milk prices that have occurred in recent months following the lowest monthly prices in more than a decade that occurred in April and May.

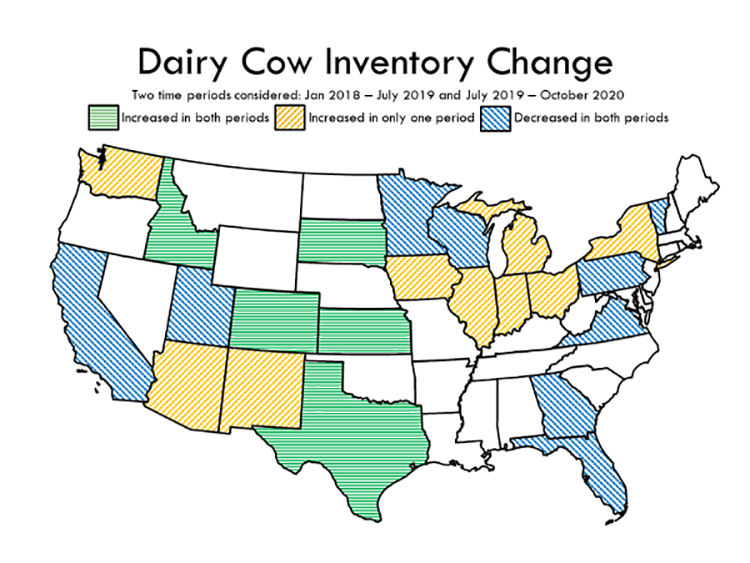

Stepping away from recent monthly changes, which are often revised with each monthly data release, July 2019 appears to have marked a turning point for cow numbers, at least in most dairy states. The national herd shrunk by 121,000 head from January 2018 through July 2019 but has since risen by 75,000 head. Examining the behavior of individual states reveals some interesting dynamics.

Of the 24 individual states identified in monthly USDA milk production reports . . . plus the “all other states” group, . . . 10 states reduced cow numbers in both the January 2018 to July 2019 and July 2019 to October 2020 time periods. Meanwhile, five states grew herd sizes during both periods and nine switched direction. Only Oregon posted no change.

The “Big five” growing states

Texas, Idaho, Colorado, South Dakota, and Kansas not only grew during both periods, they grew by similar amounts, adding 83,000 (January 2018 to July 2019) and 97,000 head (July 2019 to October 2020), respectively. But the 10 states who decreased in both periods have reduced cow numbers by just 56,000 since July 2019, relative to a 150,000-head decline in the earlier period. And of the nine “switchers,” seven shifted from reductions to growth as of July 2019, led by Indiana, Ohio, and Arizona. In total, the switchers have added 34,000 cows recently after reducing the herd by 54,000 from January 2018 to July 2019.

With cheese prices down about $1 per pound in the past month, future milk price expectations have diminished. Recent history suggests that cow numbers will not decline as quickly as they have expanded, again placing the industry in a situation of potential milk surpluses heading into 2021. Unless demand is stronger in 2021 as COVID-19 effects diminish, it will take a leveling off or perhaps even a decline in the U.S. herd for milk prices to rise in 2021.