The author is chief marketplace officer for Farm Credit East, ACA.

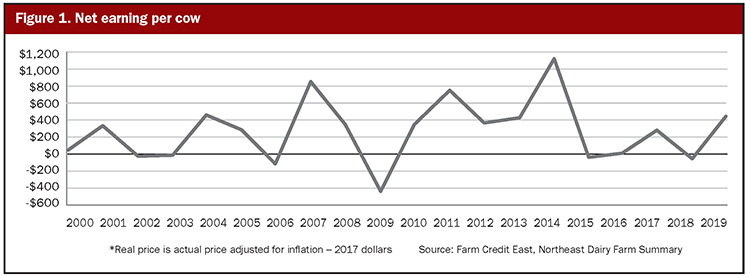

Maintaining adequate financial liquidity has become a greater issue for dairy producers in recent years because of the more intense volatility of both earnings and cash flow. While no one knows what the future holds for sure, it’s certain that we will continue to see significant variation in milk prices and subsequent earnings in future years.

Because of this reality, some of the most successful producers have worked hard to enhance the liquidity position of their operations. Farms are positioning their balance sheets to be as strong as possible going into 2021.

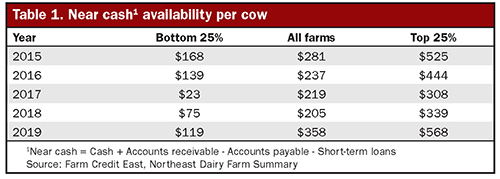

As can be seen in the table below, the top profit quartile farms from the Northeast Dairy Farm Summary have consistently maintained a superior “near cash” position over the average farm throughout the last five years, while those in the lowest profit quartile have struggled to maintain liquidity, with near cash hitting a low of $23 per cow in 2017.

Near cash is a concept that captures the liquidity of a business. It is cash, plus accounts receivable (which are likely to be converted to cash shortly), less accounts payable (expenses incurred that need to be paid for), and short-term loans outstanding, as this money is only temporary and generally must be paid back within the year. Having a cushion of cash and near cash gives a business additional flexibility and the ability to focus more on long-term goals and strategy than short-term cash flow management.

Another important source of liquidity can be available lines of credit. While not counted directly in near cash, that available credit is important for seasonal expenses or those that may come up quickly.

Important this year

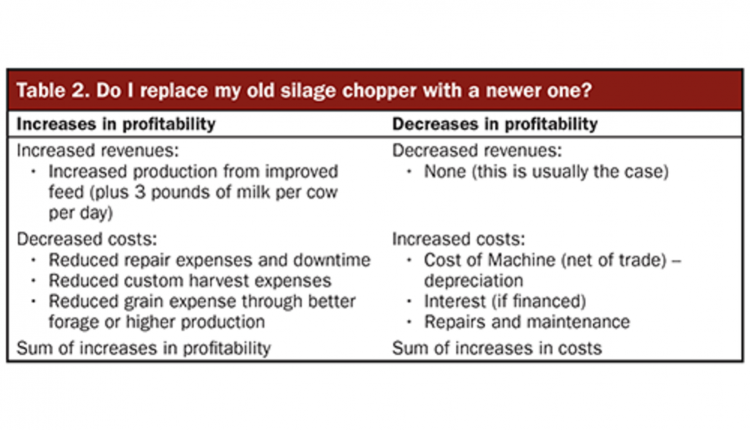

This may be particularly important in a year like 2021. Many producers have benefited from significant government relief programs enacted in response to COVID-19. As we look ahead in 2021, milk price futures suggest that we may see lower prices this year than we did in 2020, and it seems unlikely that we will see government payments as generous as those we had this past year. It may be tempting to spend that cash on new equipment, but while re-investing in the business is important, so is having a reserve for a “rainy day.”

Those producers able to balance equipment purchases and business investment with the need for cash reserves are likely to come through a market correction in better shape than the rest. Additionally, having cash reserves allows for opportunistic investments during downturns.

As this year proceeds, risk management will be paramount. Maintaining sufficient near cash reserves is a key component of managing risk for your business, but it’s only the beginning. Participating in crop insurance programs and/or hedging strategies will help complete the protective shield from market volatility for your business.

Bear in mind that programs such as Dairy Revenue Protection (DRP), Livestock Gross Margin (LGM), or Dairy Margin Coverage (DMC) should really be looked at as “insurance” rather than profit opportunities. While it’s a good thing if prices are high enough that you won’t collect payments or indemnities, it’s also good that they’re in place if you need them.

Many people didn’t think they needed these programs one year ago before the impact of COVID-19 on markets. However, those that bought coverage were glad they did when the bottom dropped out in March, April, and May of last year.