The USDA launched the Dairy Revenue Protection (DRP) program in the fourth quarter of 2018. There are a lot of nuances, but the program is marketed as insurance for a farmer’s milk price. By paying a premium, a dairyman or dairywoman locks in a floor price for a quarter. It is very similar to buying a put option.

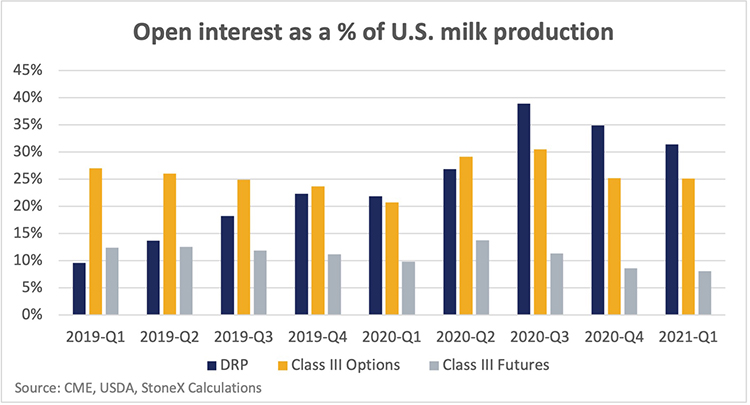

From a dairy farmer’s perspective, one of the more appealing parts of DRP is that the government subsidizes some of the cost, ranging from 44% to 55%. The program has become very popular with about 35% of milk production enrolled in the program during the second half of 2020. In fact, the volume of milk protected with DRP now exceeds the open interest in Class III futures and options.

Limiting liquidity

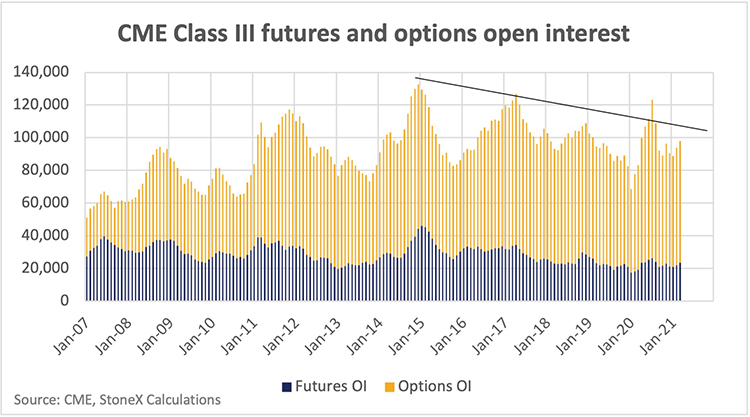

There has been some debate about whether DRP is taking volume and liquidity away from the CME futures and options markets. Combined futures and options volume for Class III peaked in December 2014 and has been on a long-run downtrend since.

Looking at the long-run graph of futures and option open interest, it seems like periods of high prices, volatility, and some seasonal factors drive a lot of the fluctuations in open interest. To determine whether DRP is reducing the use of CME products, I wanted to develop a good statistical model that could predict futures and options open interest based on price levels, volatility, seasonality, and so forth. While you can eyeball the graph and see how those things likely played into the open interest, statistically it is hard to capture.

Another problem for an analysis of this nature is that DRP has only been around for 30 months. That may seem like a lot of time, but if you are trying to estimate how open interest and DRP endorsements fluctuate throughout the year, 30 months of data mean the model has only seen a pair of Aprils or a pair of Julys. That leaves limited data to try to figure out how they differ from each other with only two observations . . . plus, we’ve wrapped the pandemic clouds in this analysis.

Overall, it just isn’t enough data, and I haven’t nailed down a good enough model to say anything conclusive. But I’ll stop complaining about how hard my job is and give you the best results I could come up with.

An 8% to 10.5% reduction on the CME

Again, these are only preliminary results based on limited data, but my best estimate is that every million pounds of milk hedged through DRP reduces the amount of milk hedged on the CME by 30,000 to 40,000 pounds. Without DRP, current Class III futures and options open interest would be 7,700 to 10,300 contracts higher. That’s 8% to 10.5% more activity than currently experienced on the CME.

There are at least a dozen caveats and complicating factors. I’m doing all these calculations based just on the Class III market, while DRP allows farmers to split their protection between Class III and Class IV . . . so maybe I should be including Class IV futures and options open interest in this for a fair comparison.

There are also some complementary hedging strategies that combine DRP with CME options. If more farmers employ those in the future, it could bring some liquidity back to the CME. As DRP grows, the financial risk for the insurance companies also grows and they may use the CME market to offset some of that risk. So, there are also some pathways that DRP could push some volume back on to the exchange as well.

Well-received on the farm

The numbers make it clear, farmers like the DRP program and seem to be increasingly willing to use it. It is not taking volume away from the CME on a one-to-one basis, but given the volume of DRP endorsements being written, they are almost surely taking some volume away from the CME markets. Again, my best estimate is that CME open interest would currently be 8% to 10.5% larger if DRP did not exist, but that estimate could change significantly a few years from now when we have more data.