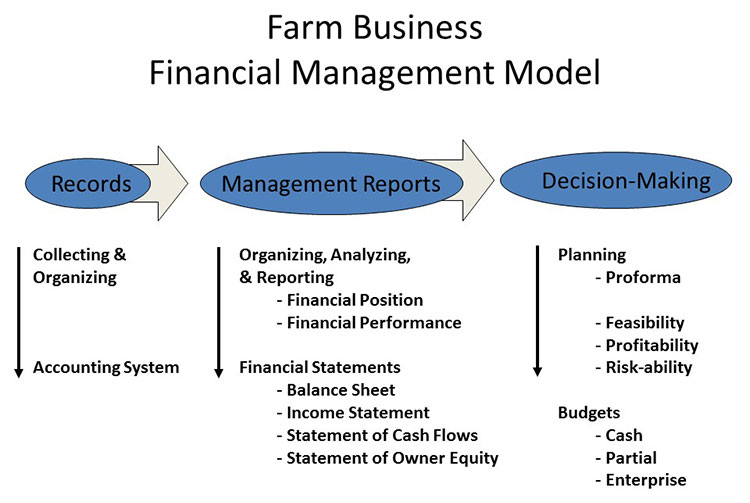

The farm financial model is a concept for understanding the financial flow of the farm business. Collecting and organizing financial information (records) through an accounting system is the first step. This financial information is then transformed into financial statements for analysis and interpretation of the farm’s historical and current financial position and performance. Budgeting, feasibility, profitability, and risk-ability analyses allows the farmer to make the best decisions possible for the farm business’ future.

Let’s dig a bit deeper into the concept.

By its very definition, the farm financial model offers a linear and circular process for informed decision-making. Records feed into reports, and reports help farmers integrate financial sense into farm production decisions.

Records: The farmer must collect and organize income and expense receipts in an accounting system before generating financial statements. Receipt accounting is also referred to as record keeping.

Management reports: Organizing records provides the farmer with the financial information necessary to complete management reports, which are also known as financial statements. The Farm Financial Standards Council (FFSC) recommends farmers create four financial statements from which the financial position and performance may be analyzed. Overall, the strength of the business at a point in time (position) and how well the farm business has performed over time (performance) are two historical insights reported as financial statements. Statements include:

- balance sheet

- income statement

- statement of cash flows

- statement of owner equity

Financial position describes the farm’s assets. Assets include the tangibles needed by the farm business to function, such as cash, farm machinery, livestock, and other inventories.

Financial performance describes how money flows through the farm business and how well the business can pay its bills, meet payroll costs, and how much money is reserved for unanticipated farm expenses.

Financial analysis provides an opportunity for the farmer to determine the farm business’ profitability and financial efficiency. Using information generated from the reports, the farmer can benchmark the business against other farms in the industry, determine strengths and weaknesses, measure financial progress, and set financial goals. Financial analysis also allows for future management and decision-making.

Decision-making: Understanding the farm business’ history of financial position and performance provides a basis for the farmer to make decisions and plan into the future. Pro forma refers to the future view of the farm’s financial position and performance. For example, what would the balance sheet look like after a future expansion? The future financial position can be analyzed for feasibility, profitability, and risk-ability. Pro forma financial statements complement the farm’s budgets. Cash, partial, and enterprise budgets are commonly used to assist the farmer in decision-making.

In close, the farm financial model helps the farmer make the best decisions for the farm business. From record keeping to financial analysis, this model illustrates how to make sound financial decisions and identifies tools to help in the process.