One of the privileges of my job is that I get to talk to people involved in the dairy industry from all around the world. And when we talk about pricing systems, the U.S. system is often admired.

That’s because we have active and transparent spot markets, government-mandated price reporting for certain products, and clear formulas that tie milk prices to dairy product prices. However, there is always room for tweaks and improvements. It has been more than 20 years since the U.S. did a large overhaul of the pricing system, and trade groups for the processors (IDFA) and the farmers (NMPF) are working through various potential changes to the system.

Before I get into the nitty gritty, let’s start at a 30,000-foot view. First, supply and demand find a balance based on price. You can’t make a change to supply, demand, or prices without affecting the other parts of the equation. Second, we use market prices to calculate a fair milk price to pay to farmers. But those formulas can change financial incentives and the supply and demand balance. No matter what we decide to do with the Federal Milk Marketing Order (FMMO) formulas, the market will find an equilibrium price for individual dairy products, so we need to think through how changes in the formulas will change supply, demand, and prices.

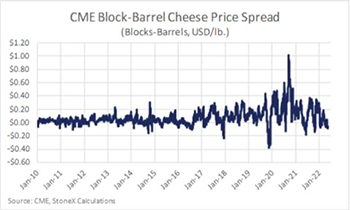

One issue that we’re trying to deal with is how to set a benchmark cheese price. Currently the FMMO cheese price is the volume weighted average of the 40-pound block Cheddar and 500-pound barrel Cheddar, with the weighting determined by reported weekly sales of bulk cheese. While blocks and barrels are packaged differently, colored differently, and typically used differently, their prices stayed within a tight range from 2000 to 2015.

The cheese price calculation in the FMMO formulas assume that barrels average 3 cents less than blocks, which lined up well with the market from 2000 to 2015 at 3.4-cent average. But from 2016 to now, barrels have averaged 11.9 cents less than blocks.

That difference is dragging down the average cheese price used to calculate the Class III milk price, which is what gets paid back to the farmers. By my calculations, the weak barrel price has reduced the average Class III price by 37 cents per hundredweight (cwt.) since 2015. Obviously, farmers aren’t thrilled about this.

In recent years, the spread has also been much more volatile than in previous years with barrels trading up to 40 cents above blocks, and for a day in 2020 they were more than a $1 per pound below blocks. That means the average block price and average barrel price for the month ended up being significantly different than the weighted average of the two different prices. For a cheese buyer trying to hedge their block or barrel purchases using the cheese futures, this volatility is a problem.

So, who benefits from this?

Any plant paying the Class III milk price but selling their cheese based on the block price is benefiting from the relatively cheaper barrels. The cheaper barrels pull the weighted average cheese price down, which pulls the Class III price lower while these plants are able to sell the cheese based on the higher block price.

What can be done to fix it?

The proposed fixes have been to either dilute the weighting on barrels or remove barrels completely from the cheese price in FMMO formula. The weighting could be diluted in a number of ways like adding in other varieties of cheese such as Mozzarella, including 640-pound blocks of Cheddar, or by basing the weighting on production instead of reported sales.

Adding more cheese prices to the equation complicates the system further, and there will be some pushback from industry on sharing prices for Mozzarella and 640-pound blocks. Diluting barrels by using production weighting instead of reported sales weighting will reduce the impact cheap barrels are having on the weighted cheese price and the Class III price a little bit, but it won’t fully solve the problem.

The last idea, removing barrels from the cheese price calculation altogether, has some appeal. No one has to report their confidential prices or production volumes to the USDA. Over the past five years, it would have raised the average cheese price and Class III price, which farmers would have liked, and it would have improved the hedging basis on cheese, at least for anyone who is hedging block cheese against the cheese futures.

So, what is the argument against removing it?

There is a tacit agreement embedded in the pricing formulas. Plants agree to take the milk and pay farmers the announced class price, but the plants will have their processing costs covered through the make allowance. That way, plants are theoretically happy to take milk, and the value of the bulk commodities they produce is mostly paid back to the farmers with limited risk for the processing plant.

If you build a plant that produces bulk Cheddar, butter, nonfat dry milk (NFDM), and dry whey, then you are investing millions (often hundreds of millions) of dollars with the assumption that this agreement will continue. Barrel plants that are pooled on an FMMO are paying the Class III milk price for their milk. If you remove barrels from the cheese price calculation, the milk costs for these plants are going to rise and margins will fall.

Barrel plants would have two options: reduce production or try to raise prices. The hope and assumption are that barrel makers will start pricing their cheese on long-run contracts based on blocks. Instead of pricing off the CME spot barrel market, barrel sellers would agree to sell barrels at a fixed discount to blocks for a period of time. That way their input (Class III, driven by blocks) and output prices would be correlated.

However, the market has to find equilibrium, and for the past five years, equilibrium has been barrels at a 11.9-cent discount to blocks. I’m not sure if barrel sellers will find enough buyers if they switch to a fixed discount against blocks. That would suggest that barrel makers will either end up sitting on a big surplus of barrels, which is unsustainable, or they will cut production.

If barrel makers cut production, where does the milk go? What does it do to prices of those other products?

It depends on the region, but the milk could flow into block cheese and pull the average block cheese price down. Alternatively, it could flow into butter or NFDM and pull those prices down a little.

The maximum potential upside for farmers from dropping barrels from the cheese price and the resulting Class III calculation averages 37 per cwt. over the past five years. That upside would be reduced by milk shifting out of barrels and into other products.

My guess is the amount of milk shifting out of barrels would be relatively small, maybe equivalent to 50 million pounds per year. If that shifted into blocks, butter, or NFDM, it wouldn’t knock more than 5 cents off the Class III and Class IV prices, so removing barrels from the calculation is still likely a net gain of 30 cents per cwt. for farmers. But the impact from changes like this are hard to model and sometimes have large unintended consequences.