I don’t envy USDA statisticians. The U.S. produces billions of pounds of milk a month from over 9 million cows, and we expect the USDA to be able to tell us how much it is changing within a fraction of a percentage. It is a really tough job, but recently it looks like the estimates are getting worse.

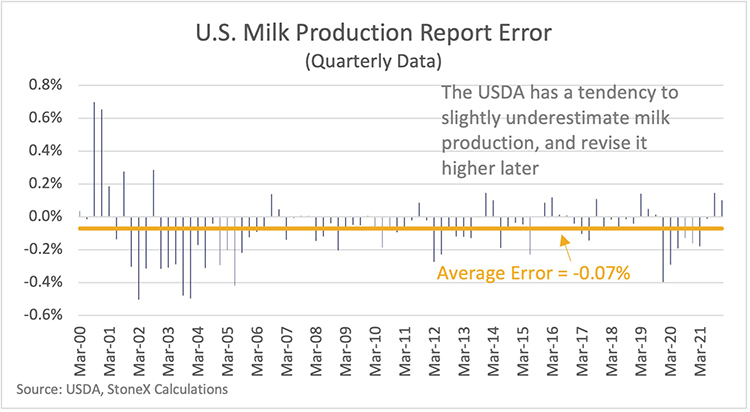

To their credit, USDA includes a table toward the end of the Milk Production report that shows metrics on their estimate errors. Historically, they have used quarterly data for errors but have recently switched over to calculating these metrics on a monthly basis. I wanted to look at their errors from a long-term perspective, so I decided to use quarterly data. To do this analysis, I dug back through the Milk Production reports since 2000 and recorded their initial estimate of milk production and compared it to their current estimates. On average, USDA has a tendency to initially underestimate milk production and revise it higher later.

Understanding the process

It has been a while since I’ve talked to a USDA statistician, so I might not remember the revision process correctly, or they may have changed the process. With that said, here is my recollection. Their monthly estimates are the least reliable because they represent a combination of farmer and processor surveys in the major milk producing states. Then, that information is combined with an estimate that statisticians plug in for the smaller states to arrive at a U.S. total. Each quarter, they do a more rigorous survey and estimate production in all 50 states.

The department also does an estimate of the total number of cattle (dairy and beef) in the country, which is published in January and July. The January Cattle report is particularly rigorous, which gives them another calibration point to revise the quarterly and monthly estimates against. Finally, the Agricultural Census is carried out every five years with the Census Bureau attempting to identify and survey production for every single farm in the country. That being said, there are multiple points in time when USDA revises previous data based on what they find in more rigorous quarterly, annual, and half-decade surveys.

It is very possible estimates for the past few years could be revised again, which might make their recent errors bigger or smaller. So again, I don’t want to be too harsh on USDA before we get the final estimates, but that could still be a few years into the future.

From the data that we have right now, it looks like the estimates started to get worse in the fourth quarter of 2019. While I can’t say for sure, it looks like the error is due to milk production in Texas really ramping up during that quarter. Then, the pandemic hit, and we saw a very quick drop in production. That was followed by a very quick rebound in production, which likely made it harder for USDA to estimate production. When I first looked at the data, I was tempted to just write off the recent errors as pandemic related, but the fact that they started in the fourth quarter of 2019 suggests that they were actually missing some farms in their estimates. If my memory serves me right, they had the same issue from 2002 to 2005 as production in California was really ramping up. I think the conclusion we can draw from history is that when we have large new farms being built, USDA can often miss them and underestimate production in the region for a while.

What does this mean for the market and prices?

It is my belief that prices in the market reflect the actual supply and demand of dairy products whether USDA is under or overestimating milk production. Overall, the estimates do not change the actual amount of milk that is available in the market. However, it does influence perception . . . a buyer may decide to hold off purchases or try to drive a better bargain if the data is showing that production is growing strongly, and sellers may be more willing to sell a little cheaper, as well.

But the USDA errors are still relatively small. Over the past three years, the error has averaged just 0.15% with the largest being 0.40% in 2019’s fourth quarter.

I’m not trying to be an apologist for USDA. I wish they were more accurate. I bet they wish they were more accurate, too. But remember, we’re talking about billions of pounds of milk each month; being off by an average of 0.15% isn’t too bad.