Year-to-date global milk production was up 0.8% in February — marking the sixth straight month of year-over-year growth. This comes after a full year of structurally short global milk supply. How long the growth cycle lasts is a critical industry question as economic headwinds and higher input costs cut into producer margins.

The global dairy complex now finds itself in what is not quite an overabundance but strong production growth that has occurred simultaneously with tough global economics that are pushing back on demand. While we’re seeing demand challenges that are lowering prices as production grows, input costs remain elevated. The combination of softening prices and high inputs has pressured margins globally — and that brings into question how long dairy production growth can continue.

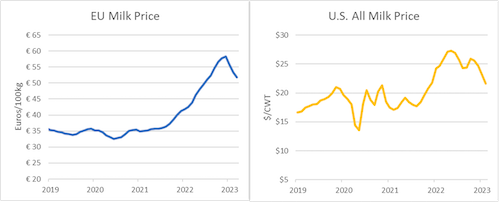

In the European Union (EU), milk production over the last six months is up 1.2%. A major contributor to that growth is the high prices European processors have been paying for milk, with the average EU price up 41% over last year.

However, pay prices have started to come down — and quickly, I might add. The overall EU milk price has dropped 11% this year, although pay prices vary across countries and companies. For example, Friesland Campina, a major processor in the EU, has cut its guaranteed pay price 28% so far this year. It dropped that price 11% last month alone.

These signals take time to reach the farm, making several more months of continued growth likely. However, with pay prices falling much faster than input costs, we can expect to see a supply reaction this year.

In the United States, similar forces suggest an American supply reaction also is likely to occur this year. The All-Milk price has fallen every month for the last four months and is down 17% over that time period. Continued high input costs are also pinching margins, with the DMC margin falling to $6.19 in February and not forecast to get above $9.50 until November. Those tighter margins will push back on expansion, especially when paired with current high beef prices that may incentivize some producers to pull out of the dairy business altogether.

USDA reports a slightly different picture

These statements may seem somewhat at odds with recent USDA data on dairy herd expansion, which shows strong growth this year. A major reason we are likely continuing to see growth is due to new processing plants and expansions that are coming online.

In contrast to what is taking place in the EU, the U.S. continues to invest heavily in processing capacity that supports the need for more milk production. While we will likely see milk production come under greater pressure in the middle part of this year, the continued capacity expansion will help keep milk production stronger than it may have otherwise been.

Rounding out the major exporters, New Zealand continues to be bolstered by strong pasture growth this year, with several months of robust milk production. While New Zealand is well past peak production for its 2022 to 2023 season, recent excellent pasture conditions have boosted milk production 1.3% over the last three months.

Despite that strong growth, production struggled in the fourth quarter last year, bringing milk production growth over the last six months to -0.67%. Growth in New Zealand production continues to live and die by weather conditions and pasture growth. With little incentive or opportunity to add cows to the herd, prolonged periods of sustained growth will continue to be out of reach in New Zealand.

With softer global demand stemming from tough economics occurring at the same time milk production has grown globally, it’s tough to see prices rallying enough to support prolonged production growth as we move through this year. High input costs pressuring margins also push back on expansion incentives.

As these signals make their way to the farm, we’re likely to see a few more months of milk production growth globally, but as pressures become more apparent and farm economics more dire, we can expect the back half of this year to be structurally tighter on milk than the front half of 2023. That will also lead to support for higher prices.