CME spot cheese prices have been trending down since mid-March with both blocks and barrels trading as low as the $1.40 range by mid-May. If spot cheese prices stay this low, it would put Class III milk into the $14 range, which is a scary prospect for dairy farmers around the country. What has pushed cheese prices down to these levels?

We only have supply and demand data through March, and the fundamentals were still relatively balanced with cheese stocks still down 0.4% from last year. But there were some signs of stress that probably got worse in April and May.

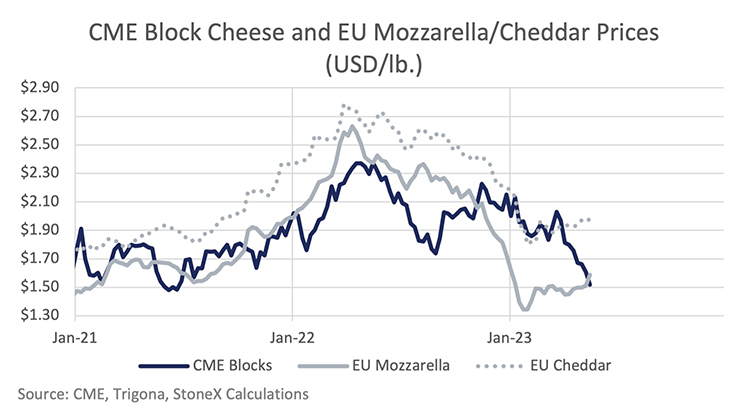

Total cheese production was weak, down 0.2% in March compared to last year, but Cheddar production was up 3.6% while Mozzarella production was down 1.4%. European Mozzarella prices collapsed in December and January, falling well below U.S. cheese prices. One important thing I should mention is that U.S. Mozzarella is typically priced off CME blocks, so for the sake of argument, assume U.S. Cheddar (CME blocks) and Mozzarella prices are effectively the same.

The price and purchase flip

The decline in EU Mozzarella prices was driven by strong milk production growth and a weakening domestic market. Export deals are often done on a quarterly basis, and despite U.S. prices being expensive relative to EU Mozzarella in the first quarter, U.S. cheese exports have held up well through March. That likely started to change in April, as second-quarter (Q2) contracts started and buyers switched over to sourcing from Europe. With U.S. Mozzarella makers losing those Q2 export sales, they likely started to reduce Mozzarella production and the milk was pushed into Cheddar plants. That, in turn, has now pushed CME spot prices lower.

What is next?

With the drop in CME prices, and a little firming for EU cheese prices, the U.S. prices are now at parity with Europe, which should make the U.S. competitive for spot export orders. However, most of the Mozzarella export deals are done on a forward basis. Despite the CME spot market being very weak, the third-quarter (Q3) cheese futures are still sitting near $1.86 per pound. Right now, EU Mozzarella for Q3 is on offer around $1.70, so the U.S. might be competitive for spot sales, but we aren’t very competitive for forward offers yet, and that could keep U.S. Mozzarella exports on the weak side in coming months and continue to push milk into Cheddar production.

While the U.S. is still facing some headwinds on Mozzarella exports, the U.S. is competitive on Cheddar. EU spot Cheddar is around $1.97 while Q3 is around $2.03. Prices in New Zealand fell a little this week, but the spot price on the Global Dairy Trade auction is around $2 per pound while Cheddar for delivery in Q3 is around $1.98. So, U.S. spot Cheddar prices around $1.50 and Q3 futures at $1.87 are somewhere between competitive and very competitive in the export market. Greater Cheddar exports probably won’t completely offset weaker Mozzarella exports, but they will help balance the market.

Anecdotally we’ve been hearing that there was a lot of U.S. cheese available for a while now, and prices are finally reflecting it. However, at these price levels, and at these spreads to the world market, we should see exports start to improve and a little more buying from domestic end users. It’s hard to say how long it will take for the surplus product to get absorbed and for CME spot prices to move sustainably higher. It will partly depend on if/when EU cheese prices move higher.

I think we are going to trade in a $1.50 to $1.70 range for one to three months. The blessing and the curse of long-term contracts is that when you have them, life is good (U.S. in the first quarter), but when you lose them, no matter how cheap your spot prices get, you might have to wait three months to get that demand back.