When looking at the Dairy Margin Coverage (DMC) program from USDA, we see that payments have been triggered for the first three months of 2023. Specifically, the margins have been $7.94 per hundredweight (cwt.) in January, $6.19 per cwt. in February, and $6.08 per cwt. in March. It is clear that the trend is downward and that the current scenario is not very optimistic.

To add some perspective, these margins are below those observed during the days of the former Margin Protection Program (MPP), which existed from 2014 to 2018. For example, a margin below $6.50 per cwt. occurred only twice under the MPP Program ($5.77 and $5.75 per cwt. for May and June 2016, respectively).

We can conclude at least two things from these observations. The first is that DMC is definitively more sensitive to adverse scenarios than the MPP. The second conclusion is that the current scenario might be as bad as that navigated during the 2015 to 2018 period.

Margins beyond milk prices

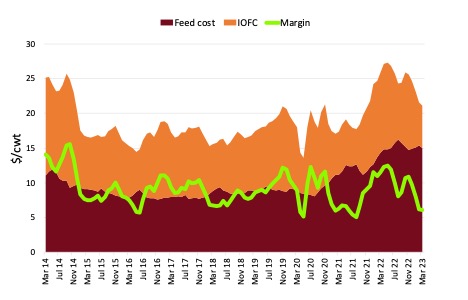

Let’s explore how that is possible. The figure below describes the feeding costs and the income over feed costs (IOFC) according to MPP and DMC. The sum of these two areas represents the milk price. The IOFC summits observed in 2014 and 2022 reflect the two high milk price occurrences that most dairy farmers will never forget.

On another note, feeding costs were relatively low during the 2015 to 2020 period. These low feeding costs helped sustain margins despite the low milk prices. Now, we see that current feeding costs are the highest of the last decade. Therefore, margins are currently at the lowest levels of the decade despite the relatively high milk prices. The margin is beyond milk price, although it seems like the industry is much more sensitive to low milk prices than to high feeding costs.

What is coming in the short term?

If we observe the futures market, we can see that Class III milk price is on a downward trajectory, which is not a good scenario. For example, the price of Class III for July 2023 dropped from $19.57 per cwt. in January 2023 to $16.65 per cwt. in mid-May 2023 (a 14.9% slide).

Fortunately, however, some commodities are also showing a downward trajectory. For example, the price of corn grain for July 2023 fell from $6.64 per bushel in January 2023 to $5.55 per bushel in mid-May 2023 (a 16.4% drop). The price of soybean meal for July 2023 came down from $449 per ton in January 2023 to $414 per ton in mid-May 2023 (a 7.8% reduction).

Even though it is good news that commodity prices are moving downward, the steady decline in milk prices is still worrisome. This all indicates that margins are not promising in the near future and that close attention to financial management is as critical now as it was during the 2015 to 2020 period.