Domestic and international dairy product future prices offer a slight glimmer of hope as we march toward fall. The average monthly Class III futures price for the remainder of 2023 is slightly above $18 per hundredweight (cwt.).

With the painfully low milk prices producers have been experiencing and $1 per pound cull cow prices, it comes as no surprise that April, May, and June have shown a continued three-month trend of rising dairy cow slaughter numbers, with 255,700 head slaughtered in June.

Even with these additional animals leaving the national herd, total year-to-date U.S. milk production as of June is 0.51% higher than June of last year. The national herd has managed to stay north of 9.4 million head all year, which is approximately 13,000 head fewer than the same time last year. The incredibly unique set of market conditions and prices experienced by dairy producers this year has shown incredible resilience in our milk supply.

Waiting on demand

With milk production holding steady and few indicators on the horizon to indicate otherwise, signs of improved demand are needed to clear the market and bolster prices. On August 14, USDA Economic Research Service (ERS) published July dairy product data. The intel offered a mixed bag, with butter being the star of the day. Of the major dairy products reported, butter was the only product to see an increase in wholesale price, from $2.451 to $2.4825 per pound.

Total milk equivalents on a fat basis found a bright spot as domestic disappearance had slight growth over the previous month, led by a 21.1 million-pound increase in butter sales. Overall, this report offered little evidence of a mid-to-long-term market reversal.

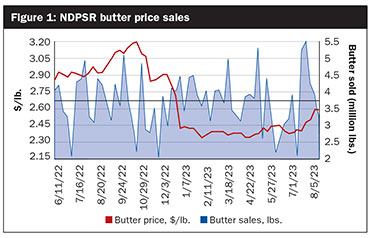

More immediate market information is available each week from the USDA Agricultural Marketing Service (AMS) via the National Dairy Products Sales Report (NDPSR). The NDPSR contains sales information for qualifying manufactured dairy products (Figure 1). High dairy product inventories in the first half of the year have left buyers with a lack of urgency when purchasing products. This, coupled with consistent production, has contributed to the drawn-out march to finding the bottom of the market.

When looking at block and barrel cheese prices over the past six months, we have been teased with “market bottoms” more than once. The economic law of demand states that there is an inverse relationship between price and quantity demanded. This logic had many on the lookout for signs of “bargain buying” as prices continued to drop, hoping it would be a definitive indicator that the worst was behind us.

So far, we have not seen that decisive spike in sales that would be expected if buyers were rushing to take advantage of these steep discounts like they are a Black Friday deal. Part of the reasoning for this is that buyers still have sufficient cold-storage stocks and domestic demand is having a lackluster performance.

It is for these reasons that declaring a definitive market bottom is a difficult task. We have seen prices come off their recent bottoms with 40-pound blocks posting a 44-cent per pound rise, 500-pound barrels climbing 37 cents per pound, and butter coming up 22 cents per pound.

A slow, steady crawl

Further price pressure continues to come from international markets. U.S. butter and whole milk powder prices are currently higher than world average prices. U.S. dairy products that have been competitively priced on the world market have not seen any significant uptick in export volumes.

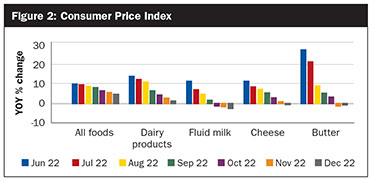

A tailwind that may carry milk price recovery forward is the recent Consumer Price Index (Figure 2). Fluid milk, cheese, and butter all posted negative year-over-year percent changes for the month of July. For the same period, all food products had almost a 5% year-over-year increase. With personal consumption expenditures now well above prepandemic levels and climbing, consumers are finding a bargain in the dairy case.

To say that we are out of the woods with only high prices on the horizon might still be a stretch. This demand-driven recovery looks like it is going to be more of a long, steady crawl than a sprint back to profitability. There is a possibility of light at the end of the tunnel, although it might be somewhat distant and faint.