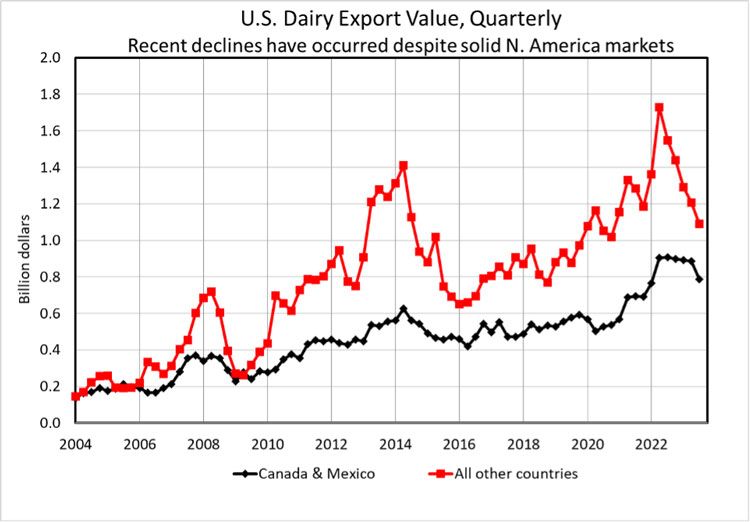

The previous two years marked a golden era for U.S. dairy exports. For seven consecutive quarters ending in the fourth quarter of last year, the export value of U.S. dairy products beat year-ago levels by 20% or more.

Some of those gains have been given back in recent months. While many factors have contributed to the difficult financial situation for dairy producers in 2023, the decline in export value has played a significant role. While markets in Canada and Mexico have held to near-record levels, shipments to other areas of the world have suffered steep dropoffs.

The top markets for U.S. dairy exports since 2020 have included Mexico (25% of total export value); Canada (12%); China (8%); Philippines (6%); and South Korea, Japan, and Indonesia (5% each). These seven markets have accounted for nearly two-thirds of our total export value.

What factors will determine whether 2023 is a temporary setback or the beginning of a long-lasting correction? First and foremost will be the level of dairy demand in our most important markets.

Recent projections from the International Monetary Fund (IMF) peg world real gross domestic product (GDP) growth in 2024 to be similar to this year’s gains, which are near the average growth rates from 2010 to 2019. The outlook is mixed for important U.S. dairy markets, with Canada, Philippines, and Korea seeing slightly better income growth next year. At the same time, Mexico, China, and Japan are expected to post slower gains.

Dairy reports from USDA’s Foreign Agricultural Service expect more butter, cheese, and nonfat dry milk imports for Mexico in 2024. However, powdered milk imports into China, the world’s largest importer of whole milk powder nonfat dry milk, are expected to fall again.

Also important will be the extent of milk production expansion in other important exporting regions such as Australia, New Zealand, and the European Union, and the strength of the U.S. dollar relative to the currencies of these other major exporters.

While the U.S. remains well-positioned to expand dairy exports long term, the outlook for the next year or two is clouded by demand uncertainty in key international markets, particularly Asia.