The author is president of the producer division at Ever.Ag.

Love it or hate it, the U.S. dairy industry has grown to a size where exports are an important factor in the strength of domestic milk prices. U.S. dairy producers have grown output over the years — of both volume and components — largely through improved productivity. Consumers in the U.S., while partakers of cheesy pizzas and ice cream, have not kept pace. The surplus dairy needs to go somewhere, and the export market has often been a preferred outlet to keep sales from depressing the domestic market.

Two years ago, nonfat dry milk (NDM) powder and skim milk powder (SMP) reached a record share of exports, topping 9.5% of all U.S. milk solids (on a protein-equivalent basis). The next year, 2022, also came close to that all-time high. The good news for producers is that more cheese was exported last year, returning a higher blended milk price than in 2021. Looking at the data through August of this year, we can see why U.S. milk prices have struggled to rebound in 2023 and have largely stayed below prior-year levels. Exports of cheese are down 5.6% year-to-date on a total volume basis. While that might not seem like much, it doesn’t take a lot of surplus product to move U.S. prices.

Strong exports to Mexico

The brightest star in the export arena this year has been Mexico. The nation has benefited from post-pandemic reshoring trends and manufacturing work moving back to North America. U.S. companies that struggled to manage long supply chains overseas are finding an able and affordable workforce just over the southern border. The U.S. Federal Reserve of Dallas reported Mexican gross domestic product (GDP) at 3.4% in the second quarter of 2023, the seventh consecutive quarter of growth for the nation. Mexico’s industrial production was up 0.7% in July (compared to a gain of 0.2% for the same month-over-month change).

With Mexico’s economy humming, demand for food has risen, allowing the U.S. to take business with an already good customer to another level altogether. Year-to-date through August, U.S. cheese exports to Mexico were 13% higher than a year ago, while NDM and SMP climbed a whopping 31% on a total volume basis.

One advantage Mexico had earlier in the year was a strong currency relative to the U.S. dollar, which improved the purchasing power. Through the first six months of this year, CME spot block cheddar traded at an average of $1.76 per pound in U.S. dollar terms, down 18% compared to the first half of 2022. In terms of pesos, the same cheese would cost 3,144 pesos, down 28% versus January to June of 2022. Simply put, an 18% reduction in spot prices in U.S. dollars equated to a 28% decline for the same cheese in pesos. That’s a great deal for buyers. While the peso has pulled back since July, it’s still in relatively good health.

Other markets weakened

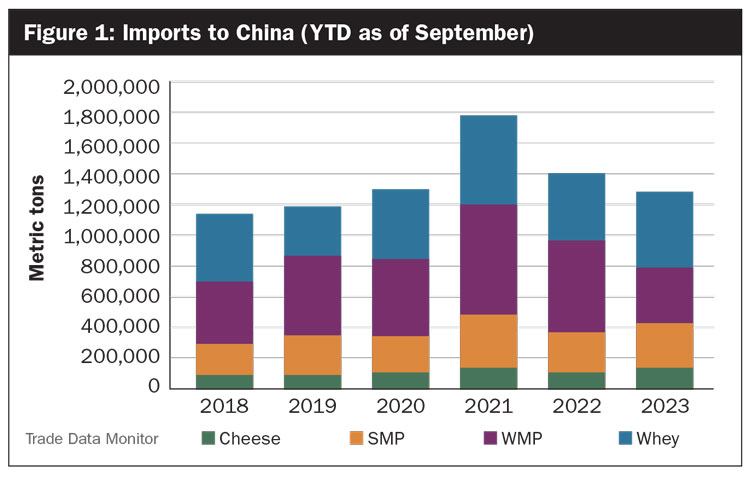

Export volume to China and Southeast Asia hasn’t been as solid. General economic health in the region could use a visit to the doctor – and maybe a prescription. For dairy specifically, the wheezing is caused by weaker domestic demand, more milk from modern Chinese dairies, and growing stocks. During 2021, Chinese buyers actively searched the globe for product to fill surging needs. But total dairy imports have declined since.

New Zealand is the largest source for most dairy products imported by China, being advantaged by low freight costs and the ability to meet Chinese specifications. But when China isn’t buying as much, New Zealand producers must find buyers elsewhere in the world, often battling head-to-head with U.S. and European manufacturers. Whole milk powder is suffering the biggest setbacks, with imports to China down 38% year-to-date through September. It’s not all bad news for U.S. dairy producers, though. China has imported over 13% more whey solids in 2023 through September, mostly from the U.S.

Economic malaise in China is spilling over into other nations in the region. Southeast Asia has experienced high inflation and an exodus of investment dollars due to rising interest rates in the U.S. Debt payments are soaring for businesses and consumers. The result for U.S. dairy is significant declines in export sales to the region.

Butter and cheese exports year-to-date through August to South Korea are down 70% and 45%, respectively. NDM and SMP volumes to Southeast Asia as a whole declined 26% through August. The one bright spot is whey, where year-to-date volume is up 415% over the same period, even if the revenue realized by U.S. exporters didn’t gain as much.

Keep exports in mind

The important point for U.S. dairy producers to recognize is how closely tied our markets are to the rest of the world. Slowdowns in demand on the other side of the globe can cause our prices to decline.

We’re too interconnected and have become too large to get the best return without international sales being a significant part of the mix. Given the risks posed when your revenue is tied to the world markets, producers are well advised to manage price risk accordingly.