Much has been written about milk supplies over the last year.

In the U.S., it is no secret that the industry is short on replacement heifers, as dairymen have continued to incorporate beef breeding into their practices. We are well aware of the negative impacts of highly pathogenic avian influenza (HPAI) on milk production in many states. Macroeconomic factors have also hindered expansion, given the cost of building, interest rates, and the availability of contractors. Add to that the various supply controls that have been in force since the arrival of COVID-19, and it has been difficult to grow our nation’s milk supply, one way or another.

And yet, in its most recent Milk Production report, USDA reported year-over-year growth in U.S. milk output. While all of the issues mentioned above may make a good case for resulting in lower milk supplies, those influences still aren’t nearly as great as the American dairy farmer’s ability to produce milk in a profitable environment.

And profitable it has been. When monitoring the Dairy Margin Coverage formula for U.S. dairy’s milk margin over the last year, we see that a new record was reached in September, at a margin of $13.81 per hundredweight.

Incentive to produce

When penciling on-farm margins, it’s important to keep a couple of things in mind. First, the milk-over-feed formula represents the All-Milk price, which can trend higher in certain parts of the country. Additionally, the feed portion of the formula is likely not representative of actual feed costs on any one dairy. Secondly, for the sake of pointing out the obvious, the costs of running a dairy have gone up drastically in the last handful of years, so today’s margins aren’t what they used to be.

With all of that said, the rise of milk prices, laid against a cascading feed price environment, has fostered a level of profitability not equaled by many other moments in history. If you allow that signal to exist in a market for any length of time, the result is predictable: more milk. And let’s not forget that the monthly milk production report only indicates pounds of fluid milk. Ever-rising component volume has USDA preparing to reconfigure milk components in federal order formulas. Together, it doesn’t take much imagination to see how we start to deliver more of that “white gold” into the hands of the processor.

Considering consumers

But supply is perhaps not the item we ought to focus on. Of greater interest this time of year is consumption.

As Americans, this time of year represents the marquee moment for dairy demand. We send kids back to school, which diverts more milk to bottlers. (Side note: Year-to-date fluid milk consumption is up on a yearly basis for the first time since 2009, with sales 1.4% higher.) College students return to school and their pizza-devouring habits. Football season brings even more pizza into homes. Holiday baking incorporates butter into our diets at a rate unequaled to any other time of the year. And let’s not forget gatherings and parties. You dare not show up at a holiday event in my family without a cheese tray!

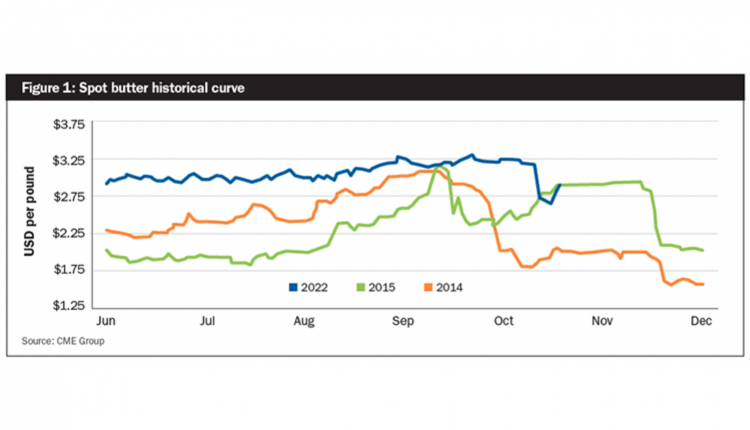

Given the preparation for this time of year, it is understandable why certain buyers are feeling the pressure — spot milk is less available, there’s less available fresh cheese in the wake of strong exports, and the low prices that everyone hoped for earlier in the year never showed up. Together with an active Mexico and an awakening China, demand appears perky for the moment. But what happens when the buyer has enough to supply this crucial period of dairy demand? What if the consumer changes their habits or pulls back in key areas?

These aren’t just hypothetical questions. We are witnessing such things already, even as we head into this most important season of consumption. In monitoring company performance, we have seen a shift in consumers of all income brackets toward less premium brands and offerings. To quote Dollar Tree Chief Operating Officer Mike Creedon in the company’s latest earnings report, “Beginning this quarter (Q3), we started to see inflation, interest rates, and other macro pressures have a more pronounced impact on the buying behavior of these (middle and upper income) customers.”

Placer.ai also reported that foot traffic among American consumers favored discounters and fitness centers. While the move toward gyms and workout facilities may hold with it the hope of greater dairy protein consumption, the move toward lower-priced goods suggests a consumer that is trading down.

Pizza consumption offers further evidence. While this time of year generally keeps the delivery boy busy, the top three publicly traded pizza chains are generally reporting flat sales. Meanwhile, frozen pizza sales are averaging year-over-year sales volume growth north of 10% in each of the last four months. When considering the volume of cheese applied in the two different categories, this has troublesome suggestions for future demand. Add to that the fastest-growing rate of credit card delinquency since the Great Recession, along with burgeoning consumer debt (+35% since 2021), and you have to question the tenacity of the consumer as we head into 2025.

We further have to examine foreign buyers. Our two top partners, Mexico and China, have woes of their own. The Mexican peso has fallen 14% in value since the summer elections, while China’s economy continues to struggle. Their collective buying power has shrunk tremendously. And while exports only account for 17% of U.S. milk, subtle changes in this category can have big implications domestically.

Our key takeaway: Demand is not nearly as strong as supply. So, how do the two come together? That is the grand mystery. However, with historically high prices defining the 2025 price curve, one should not be quick to dismiss managing profits.

The information contained herein has been obtained from sources to be reliable, however, no independent verification has been made. The information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag.