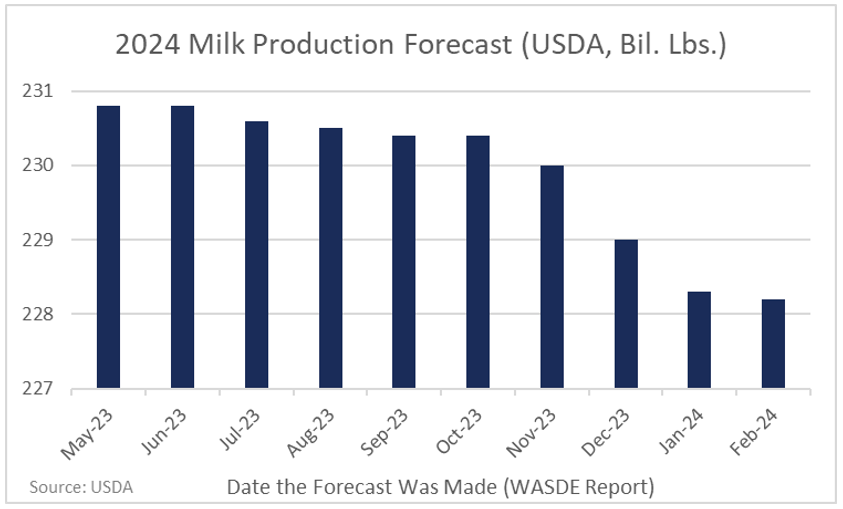

There is a lot of pessimism about U.S. milk production in 2024. Even USDA, in their monthly World Agricultural Supply and Demand Estimates (WASDE) report, has been continuously cutting the 2024 milk production forecast.

While there are some headwinds, I don’t think we should get too pessimistic about milk production. The negative argument seems to rest on three issues: heifers, margins, and interest rates.

Adapting to the heifer supply

Back in September 2023, I wrote about the tight heifer market, and it has stayed tighter than I expected. The January Cattle Inventory report from USDA estimates that dairy heifers expected to calve this year are down 1.1% from 2023 and at a multi-year low.

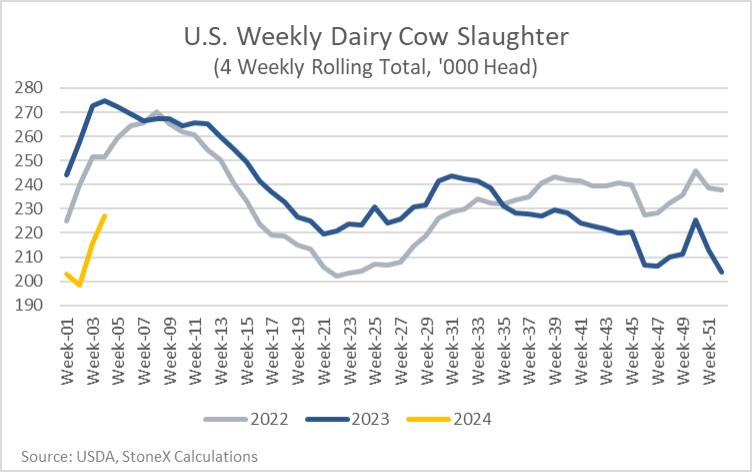

There’s no doubt that is easier for the industry to expand if there are cheap and plentiful replacements available, but farmers have already started to adapt to the current reality. If heifers aren’t available, then existing cows will need to be held for another lactation cycle, and we are seeing that show up in the slaughter data. During the last three months of 2023, the weekly dairy cow slaughter rate was running 5% to 15% below year-ago levels. During January, it fell even further and was running about 15% to 20% below a year ago.

Technically, you can’t just look at the percentage change in heifers (down 1.1%) and the change in slaughter (5% to 20% lower) and conclude that slaughter is down enough to offset the decline in heifers. To say that with absolute confidence, you would need to compare how many cows were slaughtered with the number of heifers calving that month. Unfortunately, USDA does not have data on the number of heifers that are expected to calve each month, only the total number for the year. So, we can’t say with absolute confidence that the herd is going to expand, but it sure looks like slaughter is down more than enough to offset the decline in heifers.

Feed is coming down

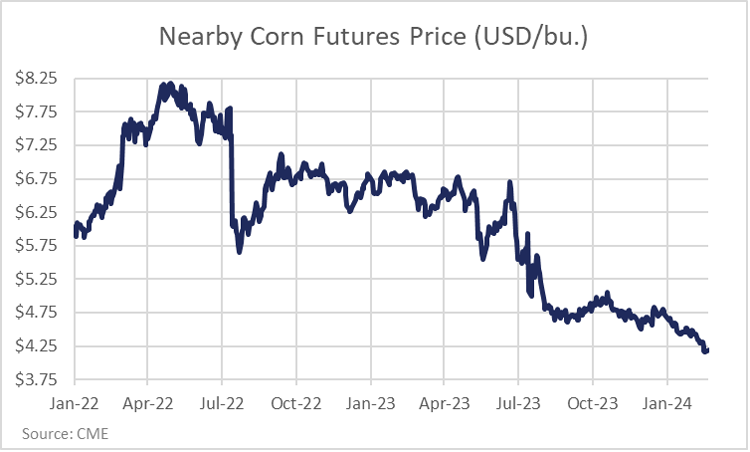

The second argument for being pessimistic about milk production is margins. High on-farm feed costs in 2023 (especially in product carried over from 2022) and weak milk prices during the middle of 2023 squeezed margins. While feed isn’t cheap now, it is much cheaper than it was a year ago, and some farmers we work with are starting to notice and comment on it.

On the revenue side of the margin, it is a mixed picture. In a recent Milk Check Outlook column, I talked about the expectations for Class III and Class IV milk. The Class III milk price is struggling due to weak demand for cheese and could face some headwinds in the fourth quarter of the year as new cheese plant capacity ramps up. However, the butter market is tight with weak production and very good domestic disappearance. This is keeping the butter price at very elevated levels, putting Class IV milk futures near $20 per hundredweight on the CME. So, for dairy farmers in regions with a lot of Class IV and Class II usage, margins are looking pretty good, and everyone is benefiting from lower feed costs.

Expansion may be stifled but needed

The last pessimistic argument is interest rates and lending standards. This is a tough one. We haven’t seen interest rates at these levels for a while, and that makes it hard to model how farmers will react to them. We certainly hear anecdotally that the current rates are limiting the interest and ability of farmers to expand.

With that said, there are multiple new processing plants and expansions planned to come online in late 2024 and the first half of 2025. Once they are running at full capacity, they will need something like an additional 23 million pounds of milk a day, which is equivalent to another 350,000 cows. There are a number of farms that are under construction to start to fill that new processing capacity despite the high interest rates, but I get the feeling the investments at the farm level are not keeping up with the investments at the plant level. Interest rates are probably a part of that.

To summarize, heifers are tight, but it looks like dairy cow slaughter is down more than enough to offset that. Margins in 2024 look better than in 2023, especially in markets driven by Class IV milk. Feed costs have shifted significantly lower, and dairy farmers are starting to notice. Interest rates are high, but there is also new capacity opening up, and some farmers are expanding to take advantage of that. I can certainly understand the pessimistic arguments, but there are also reasons to believe production won’t be so bad.