The author is the director of dairy policy analysis at the University of Wisconsin.

we've had three years of farm bill debate and at least a couple of years prior to that when new dairy policy ideas were being developed by many concerned parties. Finally, we have the new Margin Protection Program for Dairy (MPP-Dairy) that is ready to be implemented by the Farm Service Agency (FSA).

The Milk Income Loss Contract (MILC) expired on August 31 of this year, but in its place our new safety net program protects the margin between milk and feed prices. MPP-Dairy differs from MILC in many significant ways. Although you will still have to register with your local FSA office, it isn't just a matter of signing up for the program. You will now have to make a choice about the level of protection you want and the amount of milk you want to cover.

The coverage level is available up to an $8 margin. Coverage is also available in 50-cent increments down to $4. The $4 coverage threshold is considered a catastrophic level and does not have any premium cost, just the onetime $100 sign-up fee. Above the catastrophic level, premium fees go up for additional coverage. Premiums are also more expensive if a farm is protecting more than 4 million pounds of milk on an annual basis.

Every farm will have a production history which is the highest amount of milk produced in calendar year 2011, 2012 or 2013. This production history will grow each year by the percentage that the U.S. milk production expanded the year before. So, you can continue to cover more milk production with this program, but no more than the national average growth.

The amount of eligible milk that you elect to cover annually (between 25 percent and 90 percent of your annual history) and the coverage level will determine your annual premium cost and any payments that you receive. The margin will be calculated as the average margin in two-month pairs like January to February, March to April and so forth. Anytime a two-month average margin falls below the level of coverage you have selected, you will be paid the difference on one-sixth of the amount of milk you chose to protect (one-sixth represents the proportion of your annual milk you produced in those two months).

If you go back over several years and sort of play "what-if-I-had-this-program-in-place," you would find that it would have been optimal to either buy all the way up to $8 coverage or spend as little as possible with the $4 catastrophic coverage depending on the year. The problem is that when you are actually making your choices for level and percentage, you won't know exactly what markets have in store for the year ahead - but we do know a few things.

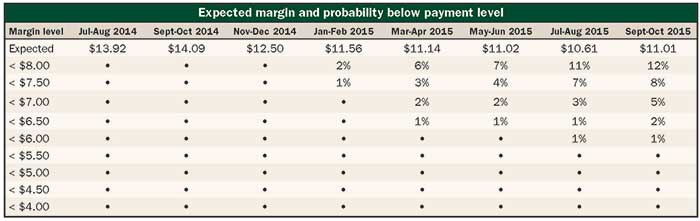

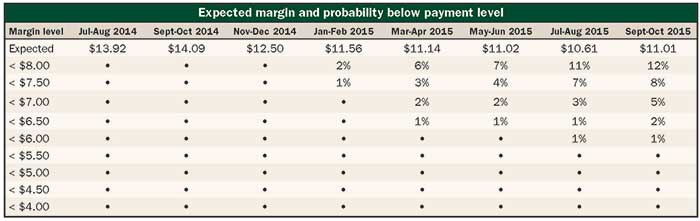

We have developed a web application at http://DairyMarkets.org/MPP to make your life easier. The decision tool will forecast the probability of payments in the coming calendar year using futures market data that is updated daily. The table shows two-month pairs with the expected average margin and the probability that the margin will fall below an $8 level, a $7.50 level and so forth.

The futures markets don't always get it right when looking ahead that many months, but they provide as good a glimpse as you are likely to get.

Click here to return to the Dairy Policy E-Sources

140910_566

we've had three years of farm bill debate and at least a couple of years prior to that when new dairy policy ideas were being developed by many concerned parties. Finally, we have the new Margin Protection Program for Dairy (MPP-Dairy) that is ready to be implemented by the Farm Service Agency (FSA).

The Milk Income Loss Contract (MILC) expired on August 31 of this year, but in its place our new safety net program protects the margin between milk and feed prices. MPP-Dairy differs from MILC in many significant ways. Although you will still have to register with your local FSA office, it isn't just a matter of signing up for the program. You will now have to make a choice about the level of protection you want and the amount of milk you want to cover.

The coverage level is available up to an $8 margin. Coverage is also available in 50-cent increments down to $4. The $4 coverage threshold is considered a catastrophic level and does not have any premium cost, just the onetime $100 sign-up fee. Above the catastrophic level, premium fees go up for additional coverage. Premiums are also more expensive if a farm is protecting more than 4 million pounds of milk on an annual basis.

Every farm will have a production history which is the highest amount of milk produced in calendar year 2011, 2012 or 2013. This production history will grow each year by the percentage that the U.S. milk production expanded the year before. So, you can continue to cover more milk production with this program, but no more than the national average growth.

The amount of eligible milk that you elect to cover annually (between 25 percent and 90 percent of your annual history) and the coverage level will determine your annual premium cost and any payments that you receive. The margin will be calculated as the average margin in two-month pairs like January to February, March to April and so forth. Anytime a two-month average margin falls below the level of coverage you have selected, you will be paid the difference on one-sixth of the amount of milk you chose to protect (one-sixth represents the proportion of your annual milk you produced in those two months).

If you go back over several years and sort of play "what-if-I-had-this-program-in-place," you would find that it would have been optimal to either buy all the way up to $8 coverage or spend as little as possible with the $4 catastrophic coverage depending on the year. The problem is that when you are actually making your choices for level and percentage, you won't know exactly what markets have in store for the year ahead - but we do know a few things.

We have developed a web application at http://DairyMarkets.org/MPP to make your life easier. The decision tool will forecast the probability of payments in the coming calendar year using futures market data that is updated daily. The table shows two-month pairs with the expected average margin and the probability that the margin will fall below an $8 level, a $7.50 level and so forth.

The futures markets don't always get it right when looking ahead that many months, but they provide as good a glimpse as you are likely to get.

140910_566