Dairy farmers across the U.S. have experienced remarkably positive financial returns. It will perhaps go down as one of the best years ever in our industry. This positive revenue stream has been a much needed boost to producers' bottom lines after a long period of financial stress dating back to 2008 and 2009. However, there are plenty of clouds on the horizon that indicate 2015 will not be a repeat of 2014's good fortunes.

Growing supplies apply pressure

Current market information shows that milk supply expansion is well underway. Cheaper and higher quality feedstuffs have resulted in milk yield growth our industry has not experienced for a period of time. Both the October and November 2014 milk production reports showed milk yields over 50 pounds higher than just one year earlier. This jump in milk output will likely remain well into 2015 given the plentiful supply of quality forages.

Dairy cow inventories have also climbed throughout 2014. By the time this year comes to a close, the industry will have added an additional 100,000 cows to the national herd in just one year. The industry has not seen that level of dairy cow growth since 2007. At the moment, it appears dairy cow inventory expansion is set to continue well into 2015.

The combination of more dairy cows and higher milk yields will likely push annual U.S. milk production near 213 billion pounds in 2015. We haven't seen this absolute gain in milk production since the mid-2000s. On the flip side, the California drought and high transportation costs for feedstuffs are two factors that could dampen milk supply growth in 2015.

Given the inelastic nature of dairy product demand, this level of milk production growth will surely put pressure on 2015 milk prices and provides a significant downside risk to the price forecast.

International prices add concern

As the growth in global demand for dairy products declined in 2014, international dairy product prices weakened, as well. However, U.S. butter and cheese prices stayed well above world prices for much of 2014 as domestic demand for these products remained strong. This U.S. to international price difference narrowed significantly late this year.

Dairy product demand from China remains an important piece of the 2015 milk price puzzle. Although it appears Chinese demand will strengthen in 2015, it may be late 2015 before significant global price builds momentum. If Chinese demand were to falter significantly, U.S. milk prices would come under even more downside pressure.

The level of milk supplies from Oceania and the European Union (EU) will also affect international dairy prices. EU quota elimination opens up the possibility of additional milk supplies in 2015.

Feed costs are a bright spot

With an almost ideal growing season, crop prices moved significantly lower in 2014. Corn prices have been cut in half from their drought-induced peak of just a few years ago. Other feedstuffs have seen similar reductions. The drop in feed costs is the primary reason that 2015 dairy returns will remain at a reasonable level.

Although discussion of higher crop prices seem difficult to imagine with the bumper crops produced this year, a drought in 2015 would push feedstuff prices higher later next year. If this would occur, it would become a key event that turns 2015 into a year dairy producers would want to forget. However, another great growing season in 2015 will ensure inexpensive feedstuffs throughout the entire year.

Dairy producers have found that record cattle prices have resulted in added returns to the financial statement. Cattle supplies remain extremely tight with inventories at levels not seen since the early 1950s. The accelerated use of beef semen in the dairy industry points to 2015 cattle prices providing another boost to dairy producer returns.

Factoring in Margin Protection

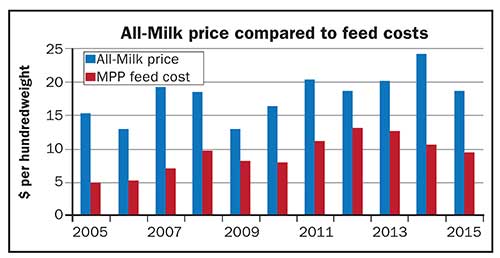

One new piece of information that has resulted from the passage of the Agricultural Act of 2014 (Farm Bill) that can be used to describe the financial health of the dairy industry is the margin in the MPP-Dairy (Margin Protection Program). This national income less feed costs margin can help illuminate the two most important factors in producer returns, milk price and feed costs. Although the MPP is calculated on a bi-monthly basis, an annual average of the bi-monthly margins can provide an estimate of the financial situation in the coming year.

The graph shows that the current 2015 estimate for milk prices (blue bar) has an annual decline that rivals the 2009 reduction of $5.52 per hundredweight when compared to the previous year. To provide additional perspective on milk price decline possibilities . . . in early December 2008, Class III futures prices for July 2009 were $14.44 per hundredweight. In reality, Class III prices in July 2009 fell to less than $10 per hundredweight. In December 2014, July 2015 Class III futures are projected in the mid $16.50 per hundredweight range. If Class III prices in July 2015 fall in a similar fashion to 2009, another $3 to $4 decline would be in store based on current futures estimates. That would put further pressure on the All-Milk price.

Feed costs, on the other hand, are expected to continue to moderate with a good growing season in 2015. Feed costs are projected to decline another $1.25 per hundredweight using the MPP feed cost formula. That is on top of the over $2 per hundredweight reduction from 2013 to 2014.

The 2015 MPP margin is expected to decline from the high level found in 2014, yet stay well above the tough financial years of 2009 and 2012. The risk for further tightening of the MPP margin largely rests in the downside risk in milk prices that could occur from expanding supplies and weaker international markets. Sign up for 2015 MPP coverage concludes on December 19.

Dairy producers need to look carefully at ways to reduce the downside risk to their 2015 returns. Although it appears next year will remain a reasonable one for producer returns, changes in international markets, domestic milk supplies and weather could turn 2015 into an extremely tough year.