Japan.

It’s one of the world’s highest-value markets, meaning that U.S. dairy farmers and processors can realize high returns when selling products there.

However, Japan is also one of the world’s most discriminating markets. Those high-value sales require quality product and a much deeper insight to the origin of that food. That means animal identification and product tracking all the way through the food chain are a must.

Meeting these demands can return good value to those marketing products in Japan. With 127 million people . . . equivalent to 40 percent of the U.S. population living in an area the size of California . . . the Southeast Asian nation must import a grand majority of its food. That makes farm land precious. So precious that Japan imports 60 percent of its calories.

Land scarcity can be detailed by its average farm size.

Japan farms, on average, have 3.7 acres, and its number one crop is rice. For perspective, the average-sized U.S. farm has 434 acres.

On Japan’s northern island of Hokkaido, farm size creeps up to 54.4 acres. That island is home to its largest share of dairy farmers who fulfill fluid milk, butter, and yogurt sales. That region also generates some cheese, but not nearly enough to meet its citizens’ demands, as Japan is the world’s largest cheese importing nation.

Its dairy sector is also in decline as some dairy farmers are using Wagyu semen and embryos in dairy cows to meet demand for the world’s highest-priced beef category. As that happens, its dairy herd continues to shrink.

This spells opportunity for U.S. dairy and beef

Next to the U.S. and China, Japan has the third-largest gross domestic product. That means its citizens have money. And they spend 25 percent of their income on food, but not just any food.

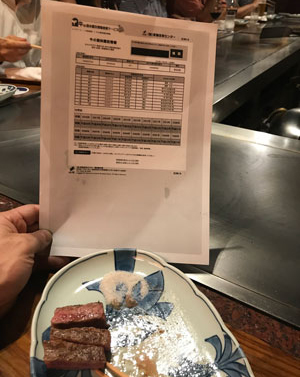

In stores and restaurants, consumers can ask for and even demand tracking information on meats. That’s right, national identification allows customers to receive printouts by scanning codes on food packages. Those codes follow product all the way to the grocery store or restaurant. That insight came as a result of an in-person visit during a recent U.S. Dairy Export Council (USDEC) Trade Mission to Japan.

When dining in Tokyo, we received one such tracking printout on a pair of Wagyu beef entrées. It included every stop that the animal made from birth to slaughter. Of course, Japanese diners translated the document for us since it was in their native language.

The same goes for dairy products.

Customers could scan products and learn more about each food at the Azabu store. The dairy case even included a map of the regions of Japan so discerning shoppers could learn more about each product. In watching activity at the dairy case, a number of Japanese shoppers were doing just that.

As consumers around the world learn more and have greater access to smart phone technology, these trends will only grow. Information is one click away.

The question is, “Will U.S. dairy farmers, and beef farmers for that matter, meet the consumer demand?”

If the dairy and beef groups do so, they will have continued and even greater access to the highest-margin food sales in the world. And that’s money in one’s pocket during these difficult times on U.S. farms. If the U.S. does not meet that challenge, they will cede sales to other export countries.