Definitely worth another look

Dairy producers are going to want to look carefully at the new program, now called Dairy Margin Coverage (DMC). For starters, it makes significant adjustments in both the level of margin support and premium costs. The DMC program should be studied and considered by producers, regardless of size. Many producers may find the new program provides safety net options that they will want to take advantage of in their farm’s total risk management strategy.

The calculated DMC margin remains unchanged relative to the previous MPP-Dairy margin and will continue to use the same milk and feed prices. It will be calculated monthly as passed in the Bipartisan Budget Act of 2018 (BBA18) instead of the bimonthly calculation used in the 2014 Farm Bill.

Cover between 5 and 95 percent. The percentage of production history that can be covered also is altered under the new DMC program. A producer can cover between 5 and 95 percent of production history in 5 percent increments. The smaller percentage of production history that can be covered allows larger producers to more easily qualify for the tier 1 level of premiums. Meanwhile, raising the maximum coverage option to 95 percent elevates the amount of production history that can be covered by smaller producers.

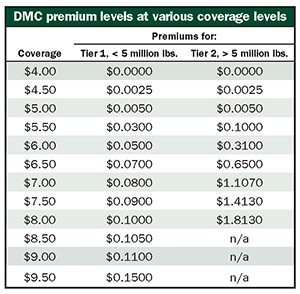

Reduced premium structure. DMC premium costs are shown in the table. Tier 1 premiums at the higher-coverage levels are much lower than the original 2014 Farm Bill MPP-Dairy premiums. For example, the original MPP-Dairy premium cost at $8 coverage was 47.5 cents per cwt. It was lowered to 14.2 cents per cwt. under the BBA18.

The 2018 Farm Bill tier 1 premium has been reduced even further to 10 cents per cwt. at the $8 level. Even the new $9 coverage option has a tier 1 premium that is less than the premium offered for $8 coverage under the BBA18.

Farms that produce over 5 million pounds. Larger producers that want to cover more than 5 million pounds of production history and have chosen $8.50 or higher coverage on their first 5 million pounds of production history can select $4 to $8 coverage for their remaining production history at the tier 2 premium levels. The 2018 Farm Bill has higher tier 2 premiums for $6 and higher coverage levels but lower premium costs for some of the lower coverage levels.

Receive a discount and a refund. Dairy producers that elect to commit to the same coverage level and percentage of production history covered for the five-year life of the 2018 Farm Bill will receive a 25 percent discount on their premium cost.

Dairy producers who paid MPP-Dairy premiums over the 2014 to 2017 period will be eligible to receive reimbursement of a portion of the premium cost in excess of the MPP-Dairy payments that they received. There are two options. They can elect to receive 75 percent of this calculated amount to use as an offset to their premium costs under the DMC program or receive 50 percent of the calculated amount in a cash reimbursement.

Potential payouts

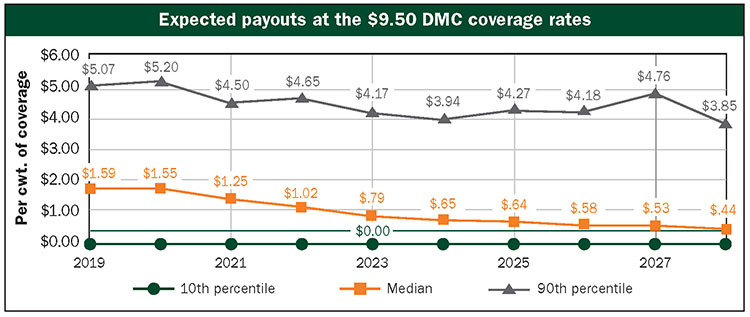

The graph shows DMC payments that could be received by dairy producers choosing the $9.50 coverage level. The range of DMC payments at this level is based on the stochastic baseline constructed in conjunction with the Food and Agricultural Policy Research Institute’s (FAPRI) long-term baseline process.

The $9.50 payment rate has a median outcome of more than $1.50 per cwt. for the next two years. The range of possible outcomes is large, however, with at least a 10 percent chance there would be no payment and a 10 percent chance these payments could exceed $5 per cwt. for the next two years.

Given the potential for large DMC payments at higher coverage levels, dairy producers are going to need to think carefully about their election relative to other producers. From current data available, it is estimated that roughly 30 percent of current milk supplies can opt for the $9.50 coverage level at the tier 1 premium level. This could mean DMC payments may slow the response of milk production cuts in periods of low-market returns.

Other changes in the dairy provisions contained in the 2018 Farm Bill include:

- Use of other dairy risk management tools while participating in DMC.

- A move in the calculation of the Class I skim price from the higher of Class III or Class IV prices to the average of the Class III and Class IV prices plus 74 cents.

- A new donation program aimed at beverage milk.

When to sign up

Yet to be released, USDA regulations will provide necessary details regarding sign-up timing as well as other needed parameters. Expect sign-ups for the new coverage options to begin sometime in early 2019.

It appears the DMC program will provide a needed boost to the dairy safety net and builds on the new policy direction laid out in the MPP-Dairy. The combination of lower premium costs, added flexibility in production history covered, and higher margin protection levels results in a much more effective safety program than the dairy industry has had for some time.