Originally included in the Agriculture Improvement Act of 2018, known to many of us as the farm bill, it has finally reached the point where dairy farmers must decide their level of participation in the Dairy Margin Coverage (DMC) program. USDA has issued regulations relating to the DMC program and local FSA (Farm Service Agency) offices will allow producers to sign up for 2019 coverage beginning June 17, 2019.

DMC has strong associations to the Margin Protection Program for Dairy (MPP-Dairy) that was included in the 2014 Farm Bill . . . except that it provides stronger program features. Major differences between MPP-Dairy and DMC are that producers can:

- Protect between 5 and 95 percent of their FSA assigned production history.

- Cover up to 5 million pounds of production history at lower Tier 1 premiums.

- Choose higher coverage options up to $9.50 on Tier 1 production history.

- Pay lower Tier 1 premiums at given coverage levels.

These changes provide a stronger safety net under DMC compared to MPP-Dairy.

There is an abundance of information available about DMC, including sophisticated tools that are meant to help producers with the participation decision process. As producers traverse the options in DMC, it remains important for them to think through the downside risk protection provided by DMC and not to have a singular focus on maximizing payments from the DMC program. The maximizing payments strategy may provide a few more cents in their pocket in the near term but likely leaves them open to large downside risk longer term.

The 2019 decision is easy

Producers have two decisions to make during the 2019 sign-up period.

First, they must choose how to be reimbursed for the premiums they paid under MPP-Dairy from the 2014 to 2017 time period in excess of the MPP-Dairy indemnity payments they received over this same time horizon.

They can choose to get a cash payment equal to 50 percent of the calculated refund level less a 6.2 percent sequestration withhold. The second option is a credit to be used on future DMC premiums equal to 75 percent of the calculated refund less a 6.2 percent sequestration withhold.

Cash-strapped dairy producers may find the cash reimbursement appealing, while others will take the larger credit amount so it can be applied to future DMC premium costs.

Second, dairy producers will need to decide the level of coverage and percentage of their production history to cover. This decision is straightforward given the information producers already know regarding margin levels of the first three months of 2019. Picking the $9.50 margin coverage level on their Tier 1 eligible production history will provide the largest payment possible. With just the payments already calculated for the first three months of 2019, a producer will be ahead by 14 cents per hundredweight (cwt.) of production history covered even after allowing for the 15-cent premium cost.

The only decision that requires more in-depth analysis by dairy producers is the chance to go ahead and lock in their coverage decision for all five years to receive a 25 percent discount on their premiums.

Longer term participation

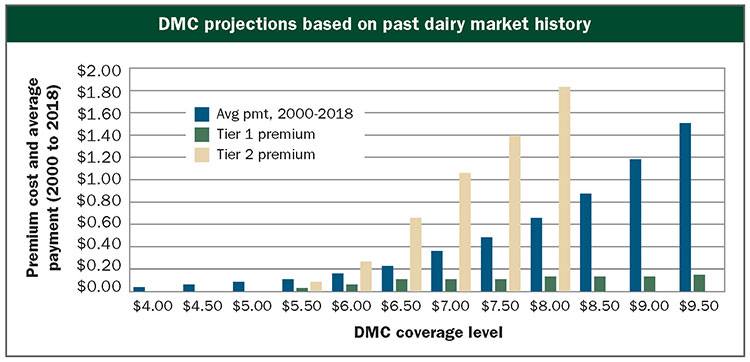

It remains important for dairy producers to think carefully about their DMC participation over the 2020 to 2023 period. The chart provides empirical evidence that can help determine an annual DMC election. Three bars are represented in the figure. The green and tan bars show the premium costs for Tier 1 and Tier 2 coverage while the blue bar represents the average annual indemnity payment over the 2000 to 2018 period.

The first focus needs to be on the decision for the first 5 million pounds of production history. If DMC had been in operation over the 2000 to 2018 period, the indemnity payment less the premium cost would have been maximized by choosing $9.50 coverage. That choice would have yielded a net effect of $1.36 per hundredweight on covered production history.

This example shows the average DMC effect for a given coverage-level choice over a long time period, but the program allows producers to annually choose their DMC coverage level. There have been some years under the operation of the MPP-Dairy program where producers were better off at the lowest coverage levels, while other years they were better off at the highest coverage levels.

The changed parameters of the DMC program, relative to the MPP-Dairy program, lower the incentive to switch in and out of coverage on a year-by-year basis due to the higher coverage levels and lower premiums offered under the DMC program for the first 5 million pounds of production history.

In fact, had DMC been in place over the 2000 to 2018 period, there was no two-year period where choosing $9.50 coverage did not result in a positive outcome. That is, even if in one year a producer would have been better off choosing a lower coverage level, over consecutive years there was always a positive net outcome by choosing the $9.50 coverage option.

Although hindsight would provide clear 20/20 vision with regards to the best choice a dairy producer should have made regarding their DMC program participation, the 15-cent per cwt. premium paid for $9.50 coverage is a small price to pay to protect the downside risk that has been prevalent in dairy markets recently.

This process could lead some to go ahead and lock in this choice for all five years to receive the 25 percent discount on premiums.

Larger producers who are looking at Tier 2 coverage options will find a different decision facing them due to the higher premium costs for Tier 2 coverage. The chart shows that, on average, over the 2000 to 2018 period payments exceed premium costs at $5.50 and lower coverage levels. Coverage options above $5.50 have higher premium costs relative to expected indemnity payments. Tier 2 coverage decisions will need more examination as payments occur less frequently at these lower coverage levels.

Offers inexpensive downside protection

Producers need to think about the downside risk protection provided by the new higher coverage levels under Tier 1 of the DMC program at the lower premium costs relative to the MPP-Dairy program. Producers who choose lower coverage levels under Tier 1 to minimize premium costs could find themselves missing out on critical downside risk protection. This is even more likely given that DMC could prolong lower margin periods as supply response on the milk production side of the equation could be muted by DMC payments.

It is time for dairy producers to think through how they want to use this new safety net program to address market risk. Don’t make your DMC participation decision based solely on your experience with the MPP-Dairy. DMC provides a much stronger safety net for all producers.