The balance sheet is a portrait of the financial condition of the farm. After a period of low milk prices, the balance sheet now tells a story of how the farm weathered the storm.

Generally, this document is completed at year’s end to account for the total assets and liabilities. However, when milk checks start to show larger numbers, it is a good time to draw up a current balance sheet to assess the condition.

It is a real scramble to pay bills when the milk price is less than the cost to produce milk. Choices need to be made regarding what accounts to pay. Payments to lenders generally are made automatically from a milk assignment. There’s no real choice there; after all, lenders file liens on cattle and machinery. Mortgages are filed on land and buildings. These payments must be made before the rest of the milk check arrives. The loan balances should be less except for those loans that were added onto or created to pay the shortage of operating needs.

Access and prioritize

Now is the time to assess the farm’s financial condition and set priorities of what is to be paid or purchased.

- Start by hacking away at the payables. Suppliers of all kinds have extended credit beyond their typical policies. Run numbers to determine if every creditor can receive a larger payment than the monthly bill. Creditors with higher interest rates should be first on the list. Some creditors could negotiate interest if accounts are paid in full. Once the supplier is paid, keep the balance paid.

- Pay down the lines of credit (LOC). Most lenders make LOC available for operating needs. Repayment terms will vary from an annual payment in full to a percent of the balance to be paid monthly.

Pay LOC down in full to make these tools available for future needs. Make sure if they are paid down that the lender agrees to keep them open and available. - Only make the required structured loan payments with your lender. Resist paying more than what is agreed to on the loan document. As extra money flows into the farm account, it can be tempting to pay ahead on other term loans. There are plenty of other cash needs, such as replacement and updating of equipment, to be addressed before even considering extra payments.

- Replace daily-used equipment. Every morning there are certain pieces of machinery that must start or move. Make a list of priorities. New is a good choice. However, good used equipment should also be considered. TMR mixers, feed movers, and manure handlers should be at the top of the list. Tillage, planting, and harvesting machinery may need to be evaluated to be replaced or possibly custom hire may be a better financial choice. Do not forget cow comfort as well. If there is a need, consider some improvements.

- How about building some cash reserves next? Before one starts questioning this comment, having $100 to $250 per cow sitting in the checkbook makes a nice reserve for surprise needs. Maybe a better way to see this issue in a different light is to look at the next point, current ratio.

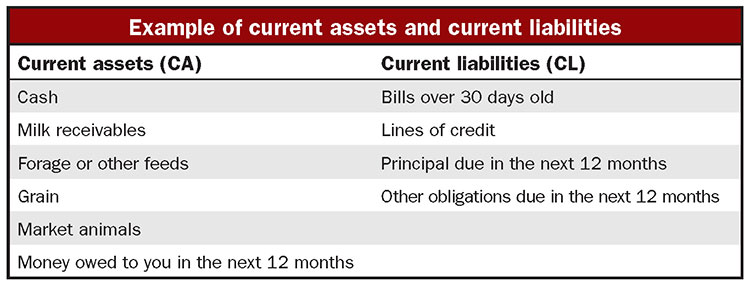

- Next to the importance of ownership equity on the balance sheet is the current ratio. This refers to the top portion of the balance sheet assets or current assets compared to current liabilities.

This is called an operating ratio, sometimes referred to as burn rate.

- A 2:1 ($2 CA to $1 CL) is ideal

- A 1.5:1 ratio will work

- A 1:1 or less is a concern

The message is if there is $1.50 to pay $1 worth of obligations, there should be a 50-cent cushion.

An example of CA:CL on a 1,000 cow dairy:

CA $1,500,000 ÷ CL $1,000,000

Ratio 1.5:1 or $500 per cow of working capital

In my earlier example, I recommend a $100 to $250 cushion per cow. Other financial advisers recommend $400 to $600 per cow.

Now is the time to set the priorities of how to build back the balance sheet. It is the statement of financial progress and a monitor for many benchmarks to watch.