COVID-19 certainly has disrupted the markets. So much so that in mid-April the USDA announced that they would be partnering with “regional and local distributors, whose workforce has been significantly impacted by the closure of many restaurants, hotels, and other food service entities, to purchase $3 billion in fresh produce, dairy, and meat.”

The demand hit

The big problem in forecasting situations right now is we simply don’t know how much demand fell and how quickly it can bounce back. Current spot prices are suggesting domestic demand is down 10% to 15% for April. That’s about 150 million pounds of cheese. If we assume people start going back to work and eating out more, maybe we’re back to down 5% by June and flat against last year by this September.

Output at plants

Production assumptions are pretty important but no less a struggle. How many cheese plants are actually shutdown or running on reduced schedules due to little or no food service demand? Will any dairy processing facilities be shut down due to illnesses as we’ve seen happen to some meat packing plants? The point is that its possible cheese production is lower (and will remain lower) than what I’ve plugged in.

New demand

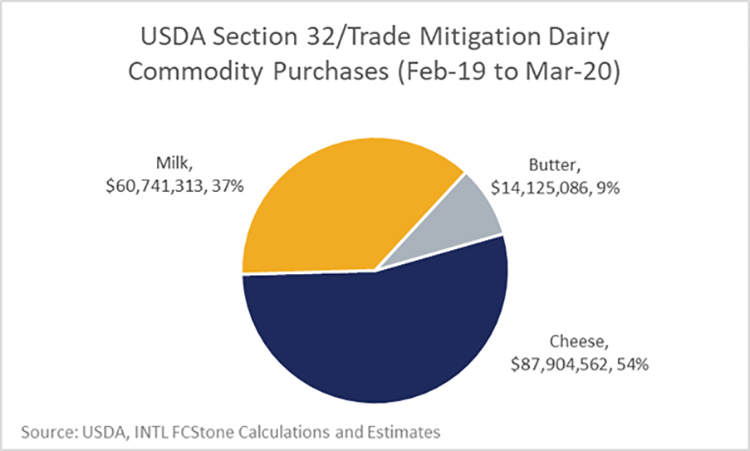

The U.S. government is going to start buying $100 million worth of dairy commodities a month starting in May. Over the past year, only 54% of the “Section 32/Trade mitigation expenditures” have been on cheese. If you assumed 50% of those dollars will be spent on cheese, they can buy about 35 million to 45 million pounds per month at current prices. And the amount they can buy will decline as prices begin to rebound.

The U.S. government indicates they have about $3 billion to spend on these purchases, and it will be spending $300 million a month (fruits/veggies + dairy + meats), so it could keep buying for 10 months max. Their plan is a “truck to trunk” use of food service distributors (Sysco, US Foods, and so forth) to collect all these commodities and pre-package them for distribution to the food shelves. We don’t know how much that will cost and whether that is included in the $3 billion or not, so the government might have less than 10 months of “purchasing ammo.”

Impact on prices

Based on these assumptions, without government purchases, you could make the argument that cheese could be trapped at or even below $1 per pound for the remainder of the year with cheese stocks running 20% to 25% above last year.

With the government purchases, cheese stocks only get up to 17% above last year in May and then tapper back to 5% above last year by October. That would still leave the price below $1 in May and June before hitting $1.30 in July and peaking at $1.70 in October.

What’s interesting to me is that it isn’t really the government buying that truly turns the market higher.

Government purchases of 35 million to 45 million pounds per month of cheese only offsets a 3.5% to 4.5% drop in domestic commercial cheese sales. If domestic sales really are down 15% in April, then the government buying doesn’t get us anywhere close to a balanced market.

None of this really takes into account how the different price levels would change milk/cheese production or domestic/export demand. We’re not even sure what to assume for cheese production levels given the amount of milk being dumped and the widespread milk handler 5% to 20% cutback requests.

The demand side is even more murky

It’s reported that 10 or 11 states plan to loosen stay-at-home restrictions between April 24 and May 1. Quite frankly, the natives are restless. And people need money. Protests are beginning to emerge. U.S. citizens want — and need — to get back to work.

At some point, especially as the weather improves, people will likely push the boundaries of the stay-at-home orders. There are already some signs that food service sales are improving during April, but they are still running more than 50% below year ago levels. Food service sales should continue to improve as the stay-at-home orders are lifted, but the evidence from Asia is that we won’t go back to pre-lockdown sales in the near future.