Many value-added processes happen to farm commodities before they reach the ultimate consumer. Processing, packaging, and transportation tend to be some of the most identifiable links in the chain, but there are also labor costs to be factored in, whether at the wholesale, retail, or food service level.

USDA reports that as of 2018, the farm share of each consumer food dollar was just 14.6%. Food purchased for consumption at home yielded a 23.6% farm share, while that for food away from home was a meager 4.4%.

The share of the retail value that dairy producers receive for their production tends to fare better than the average. USDA reported that as of 2018, the farm value share for a “milk and dairy basket” was 27.9%, including components of 52.1% for a gallon of whole milk, 27.9% for a pound of cheddar cheese, and 18% for a half-gallon of ice cream.

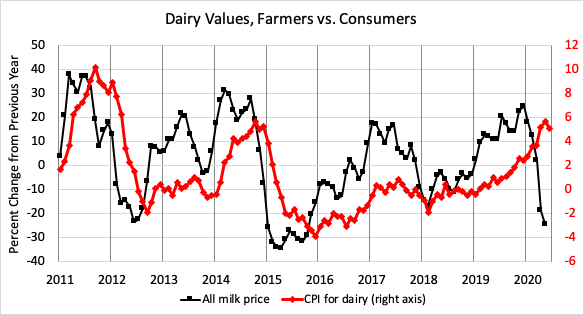

Even though dairy producers only receive a little more than one-fourth of dollars spent for dairy products consumed at home, fluctuations in prices at the farm and at retail still typically move together. Though retail movements tend to be much less volatile and often take more time to materialize, they typically represent to some extent the price changes at the farm level.

2020 has not exactly been a typical year. With the effects of COVID-19 showing up in just about every link of the supply chain, farm values and retail prices have come unhooked for many commodities in recent months. With additional costs for new COVID-19 measures hitting nearly all steps along that supply chain, farm shares have plunged.

The graph clearly illustrates the normal historical correlation that existed between producer milk prices and retail dairy product prices and the wedge that has been driven between them with the COVID-19 outbreak.

The duration and severity of the pandemic will dictate how long these abnormal relationships persist. How the new normal looks in terms of processing, transporting, and marketing food will determine whether these spreads permanently widen or eventually return to historical levels. One thing is for certain . . . higher costs to transform commodities into consumer-ready food cut into receipts at the farm and can have consumers facing higher prices as well.