As the industry looks ahead to 2021, milk price outlook remains uncertain as factors weigh on markets that could lift or depress milk prices. A rise in COVID-19 cases that slows the opening of the U.S. or world economies could send milk prices lower in 2021 . . . yet, a recovery from COVID-19 through a new vaccine or even just a reduction in COVID-19 cases could send prices higher in 2021.

While future dairy product demand is impossible to know with any degree of certainty, dairy farmers need to develop plans for operations next year. What’s more, the unpredictable effects of COVID-19 must be replaced by focusing on the pieces of the puzzle that are clearer.

The negative effects of the novel coronavirus on the U.S. economy have become more apparent now that we are more than six months removed from the beginning of the pandemic. Many experts forecast the contraction in annual U.S. gross domestic product (GDP) around 5% in 2020. Although some recovery is projected in 2021, the U.S. general economy remains wounded by the pandemic, and it likely translates into a reduction in food demand, which includes dairy products, in 2021.

This general economic contraction has been masked at least in part by strong federal stimulus that has kept consumer spending higher. Negative economic effects have been felt outside America in key economies important to U.S. dairy trade as well. The industry must consider this economic headwind in any forecast of milk prices in 2021.

The cost of moving milk from the farm level to be processed and distributed to consumers through retail channels has climbed due to COVID-19. Bottlenecks and slowdowns in moving dairy products add costs that likely get pushed back into lower farm-level milk prices. The percentage of the consumer dollar finding its way back to the farm level will remain lower as long as the processing, transportation, distribution, and retailing sectors remain confined to protocols meant to protect workers in these functions.

Focus on the long-term view

It is easy to get lost in the COVID-19 discussion and forget that many of the traditional supply and demand factors will ultimately drive the direction of milk prices. For example, a drought as severe as the one experienced in 2012 would raise feed costs to the point that milk supplies stop growing, and that could provide a lift to milk prices.

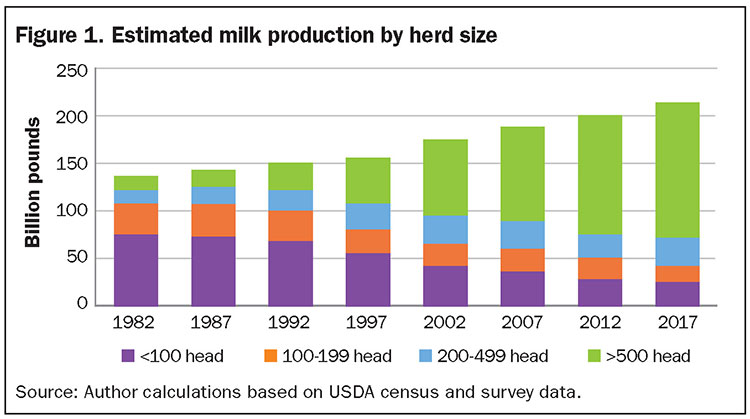

Perhaps even more fundamental is the point made well in Figure 1. When the industry was comprised of many smaller producers, milk supplies would contract more quickly in response to low returns, moving milk prices higher. Annual milk production contracted three times in the 1980s and twice each in the 1990s and 2000s. However, output did not contract even once during the 2010s.

In the 1980s and 1990s, the reduction in milk production that occurred as smaller operations left the industry helped to offset the growth in larger operations. As the number of smaller operations continued to shrink, the loss of production from these smaller producers has declined and no longer provides an offset to the growth of larger producers.

This supply side effect suggests that milk prices will generally stay lower as the aggregate milk supply expands easily in periods of profitability but remains stubbornly high in periods of low profitability. This year’s milk production growth in the face of COVID-19 may be due in part to the makeup of the supply-side of the industry today, although the effects of government payments were also important.

The long-term trend in the demand for milkfat and skim solids can also provide clues for future milk prices. These trends seem unlikely to reverse in the near term, so they can clarify the areas of demand that must be considered in the outlook for milk prices.

The skim solids story is more straightforward, as the total demand for skim solids has much to do with the weakness in skim solids used in fluid milk and the offset that export markets have provided. These two effects have nearly offset each other over the 1995 to 2019 period.

Although the dollar has weakened from the strength shown early in 2020, and some recovery in world economies is expected in 2021, export demand for U.S. skim solids may only show slow growth in 2021. It might be unable to offset what is likely another year of declining skim solids use in fluid milk.

Milkfat use has more moving pieces as the demand for milkfat in cheese and butter have been responsible in offsetting the loss of milkfat use in fluid milk. It is important to note that the loss of milkfat in fluid use has been less than the loss of skim solids in fluid use as consumers have switched to some higher fat fluid products. Cheese demand has stayed strong in 2020, but it remains uncertain how consumer purchasing habits may change in a post-COVID-19 market.

The bottom line is that cheese and butter domestic demand and exports of skim solids are the key positive demand drivers to pay attention to as 2021 approaches.

All things considered

Stubborn milk supplies and pessimism regarding the effects of economic weakness on demand for critical dairy products in the U.S. and around the world set the stage for more downside risk to 2021 milk prices. The use of strategies to mitigate downside risk are available to dairy producers and should be considered. However, maintaining some ability to take advantage of upside market potential in 2021 is vital as volatility in milk prices will continue.