chief economist with the

American Farm Bureau Federation

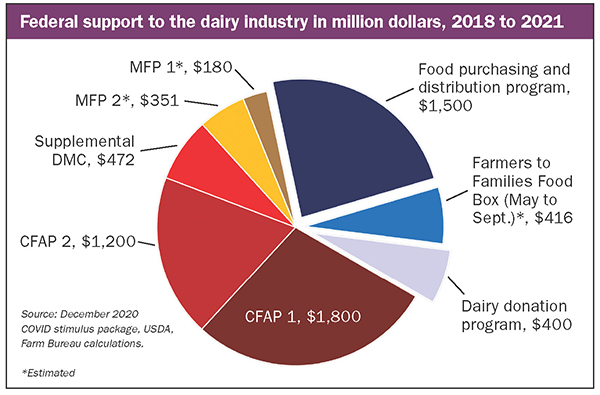

Then, to help offset the financial impact of COVID-19, USDA’s first Coronavirus Food Assistance Program (CFAP) provided dairy with $1.8 billion in first round payments and $1.2 in second round payments. As a percentage of the $23.5 billion in CFAP 1 and CFAP 2 payments distributed during 2020, dairy farmers received nearly 13%.

As a percentage of the total value of U.S. milk production, payments made by the feds were equivalent to 7 cents for every dollar. That’s assuming all farmers got the U.S. All-Milk price, which didn’t take place due to negative producer price differentials (PPDs).

Speaking of negative PPDs, from mid-May to mid-September, USDA’s Farmers to Families Food Box program purchased more than $300 million in dairy boxes, more than $100 million in fluid milk boxes, and another $640 million on combination boxes that also included some dairy. Government purchases of cheese and other dairy items, while for a good cause, contributed to record-large spreads between the Class III milk price and the prices for manufacturing and fluid milk. Enter depooling, negative PPDs, and a more than $2 billion shortfall in the FMMO pool value.

Oh, and then for the Class I dairy producers . . . the elimination of the higher-of resulted in a half-a-billion-dollar reduction in Class I revenue.

For those counting at home, that’s $3.5 billion in direct payments from MFP 1, MFP 2, CFAP 1, and CFAP 2, offset by what’s likely to be negative $3 billion represented by negative PPDs and lower Class I revenues.

There’s more ad hoc support coming, but it’s probably not in the form most have grown used to during the pandemic. The recently passed Coronavirus Response and Relief package should help dairy farmers who may have grown their herd size in recent years, the “CFAP 3” package includes a supplemental Dairy Margin Coverage (DMC) program for the 2021 to 2023 coverage years. The goal of the supplemental DMC is to raise a dairy farm’s production history to the maximum of 75% of 2019’s milk production or 5 million pounds of milk.

The Congressional Budget Office estimates that the supplemental DMC will provide more than $470 million in additional financial support to dairy farmers from 2021 to 2023. Early in 2021, USDA will open an enrollment window to allow dairy farmers to make coverage elections for the supplemental milk enrolled in DMC.

Second, the package includes an additional $1.5 billion for USDA to do another round of the Farmers to Families Food Box program, as announced on January 4, 2021. USDA is expected to purchase hundreds of millions of dollars’ worth of beverage milk, cheese, butter, yogurt, and other dairy products. To the extent that USDA purchases of cheese, butter, or dry milk powders help bolster demand and reduce supplies, milk prices should climb as a result — hopefully in more of a tandem fashion than what we saw in 2020. No more negative PPDs, please.

Next, the COVID relief package includes up to $400 million for a dairy-specific donation program. The standalone program is designed to facilitate the timely donation of dairy products and minimize food waste. Under the program, dairy processors will be reimbursed based on a variety of factors, including the cost of milk required for making the donated product at a value between the highest and lowest classified prices.

Importantly, the dairy donation program is retroactive, meaning dairy products previously donated could be eligible for reimbursement. This program, too, needs to be implemented carefully to prevent more price volatility . . . and more negative PPDs.

The bill does direct USDA to make additional payments to ensure that CFAP assistance more closely aligns with the revenue losses of farmers. Most read this to mean that any dairy farm that saw CFAP support reduced due to payment limitations could likely see additional supplemental payments up to 80% of the revenue loss.

Looking beyond dairy

While some dairy farmers could see additional payments, nothing in the bill requires USDA to make new direct payments to dairy farmers. The package does include additional inventory payments for cattle that could range from $7 to $63 per head. An additional $5 billion is included in the package to make $20 per acre payments to producers of corn, soybeans, wheat, and cotton, among other commodities. Many dairy farmers may be eligible for support in these categories.

Over the last few years, the federal government has provided, or will soon provide, billions of dollars in direct and indirect support to dairy. The latest COVID package provides nearly $1.5 billion for another Farmers to Families Food Box program, a $400 million dairy donation program, and a recourse loan program for dairy processors. For the dairy farmers, $470 million plus-up to the DMC program over a three-year period is included.

The next step for these programs is rulemaking and implementation. Some of the dairy-related provisions have been announced, such as the new Farmers to Families Food Box program, while others, such as direct payments for crops and livestock, will likely come later. However, one thing is certain — the milk check outlook for 2021 includes more ad hoc support.