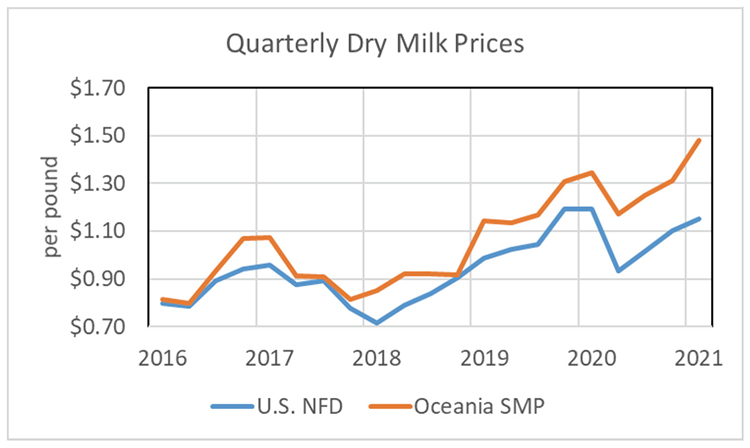

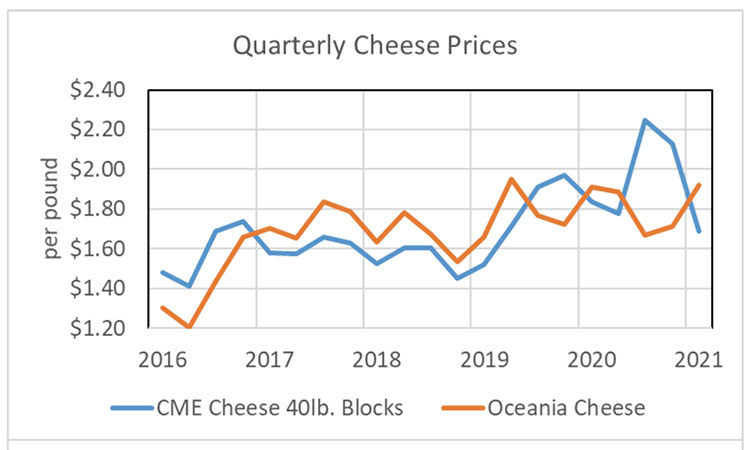

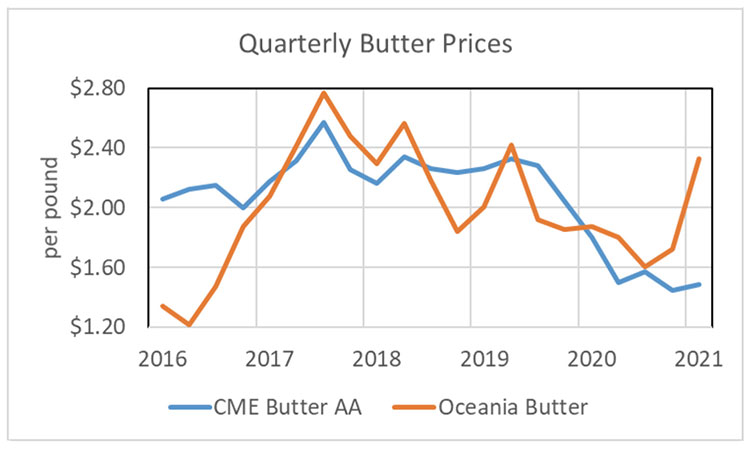

Although domestic milk supplies have been growing and keeping milk prices lower as we start 2021, international markets offer hope for higher prices as the year unfolds. The graphs of dairy product prices below show higher international dairy product prices relative to U.S. values for the first quarter of 2021.

Oceania skim milk powder prices have surged to $1.48 per pound in the first quarter of 2021, recovering from the $1.17 per pound level at the height of COVID-19 shutdowns around the world in the second quarter of 2020. Oceania butter prices, which had remained under pressure in part due to the food service shuttering that occurred around the world, expanded to $2.33 per pound in the first quarter of 2021. Oceania cheese prices have moved back above U.S. levels to begin 2021, following the second half of 2020 when domestic cheese prices were influenced by USDA food box purchases.

What is driving stronger international dairy prices in 2021? There are some obvious factors, like the rebuilding of the Chinese hog herd that has been important to growth in whey prices. However, it is imperative to highlight that economic recovery is expected to occur in many countries around the world as COVID-19 effects continue to lessen.

USDA’s Foreign Agricultural Service recently released the 2020 Agricultural Export Yearbook that shows the total value of U.S. dairy exports totaled $6.5 billion in 2020, up 9% from 2019. The effect of COVID-19 is best illustrated by Mexico, which reduced its value of U.S. dairy product trade by 8% in 2020. Canada grew by just 1% in 2020.

USDA’s February U.S. trade outlook highlights the recovery in gross domestic product (GDP) that is expected in 2021. World per capita GDP is projected to expand by 5.5% in fiscal year 2021 after declining by 4.4% in fiscal year 2020. Mexico, our largest dairy export market, is projected to expand by 4.3% in 2021 after contracting by 9% in 2020.

The growth in projected income around the world and a U.S. dollar that has weakened relative to many currencies over the past 12 months could lead to strong dairy exports in 2021. A substantial rise in the percentage of U.S. milk supplies that leave the country could be the necessary ingredient for higher milk prices in 2021.