The coronavirus pandemic was an outlier event that dramatically shocked the supply and demand fundamentals of all commodity markets. Milk was no exception.

Let’s look back on the action and reaction of the 2020 dairy markets for the purpose of recognizing several basic commodity marketing principles and, more importantly, how these principles applied to the milk market. To fully engage in this discussion, a number of time-tested commodity market principles are listed below in no particular order.

The big seven

Nobody knows where the price is going. The 2020 milk price action fully confirmed the truth of this principle. An unexpected global event proved so unpredictable that no one could forecast either the time or effect of this event on milk prices. The milk market is, and always will be, void of a perfect fundamental or price forecast.

Commodity prices go up and commodity prices go down. The price volatility of the 2020 milk market confirmed the principle that price is dynamic and not stagnant. Price will continually be in an action and reaction mode. Therefore, one should never be surprised that low prices turn into high prices and vice versa. Case in point, during 2020, Class III futures traded between $11 and above $24 within a matter of months.

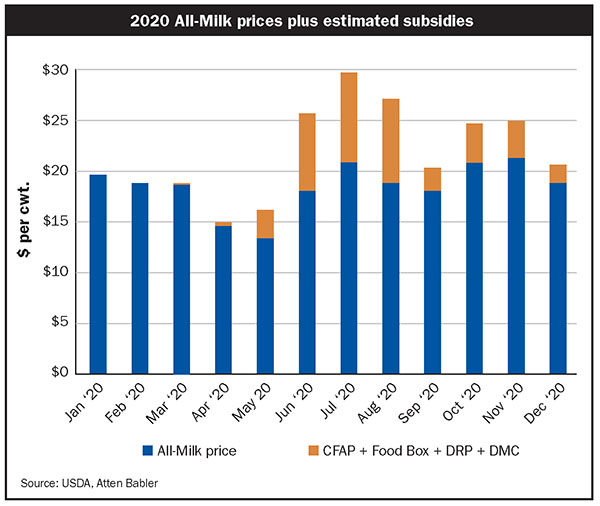

Demand is a real commodity price driver. The collapse of dairy product demand because of food service shutdowns caused a total free-fall in the market. Conversely, the injection of real demand provided by government dairy product purchasing confirmed that demand can drive the market aggressively in the opposite direction. Demand shocks can come from the natural world or the stroke of the policymaker’s pen . . . and both are equally unpredictable. The graphic illustrates the market movements by month.

Price is the focus of marketing. Milk price volatility in 2020 confirmed that a marketer must consciously separate his or her attention from the news, forecasts, and emotions surrounding a market. Instead, one must focus on what the current price provides in terms of opportunity.

Perishable commodity prices are in general more volatile. Fresh milk is a highly perishable commodity. The continuous production, processing, and consumption flow requires balance throughout the supply chain. Any disruption in any phase of the production and consumption system is a problem because the commodity can’t be stored long-term in the fresh state.

Storable commodities, in contrast, are in a position to accommodate disruption in the production, processing, and consumption flow. The bottom line is perishable commodities have more price risk.

Never doubt a commodity market. We are sometimes tempted to frame markets with what we believe are reasonable price parameters. Don’t do it. After over 40 years of studying, teaching, and trading commodity markets, I have found it is best to never doubt what a market can do.

Commodity prices, and especially perishable commodity prices, can do anything, at any time, for any reason. They can move to any price without our permission. Therefore, it is paramount that milk marketers never doubt what milk prices can do and apply risk management tools and strategies that recognize this principle.

Marketing requires a plan for decisive action forward in time. A producer who took marketing action in the fall of 2019 for the first and second quarter of 2020 was in a position to avoid a portion of the price and revenue loss brought on by the pandemic demand shock. Consistently applying price risk management to forward-marketing periods aligns with all of the principles discussed above.

To summarize, here are five main points dairy producers should consider:

1. Perishable commodities are more vulnerable to a demand shock.

2. Price often overreacts to a supply or demand shock.

3. Government buying, which was a new dairy demand driver, drove prices significantly.

4. Dairy producers who consistently apply risk management forward are well served for doing so.

5. Minimum price tools and strategies continue to be favored in the milk market.