Over the past three years, the USDA has issued a number of direct payments to dairy farmers to offset some of the impact of both trade wars and the pandemic. In mid-August, the USDA announced another $350 million in funding for a new Pandemic Market Volatility Assistance Program (PMVAP), which looks like it is designed to partially compensate farmers for the negative Producer Price Differentials (PPDs) they experienced during the second half of 2020.

We don’t have all the details on how that payment will be calculated, but it will likely vary by Federal Order. Cooperatives and milk handlers will be responsible for getting the money to the actual farmers. These organizations also will be able to reimburse their administrative expenses out of the $350 million. Given that deployment strategy, I projected 90% of the $350 million will make it to the farm level, which is $315 million. That works out to about 28 cents per hundredweight (cwt.), if it is spread over all the milk produced in the country. The payment to individual farms is capped at an annual equivalent of 5 million pounds of milk production (about 210 cows based on U.S. production figures), so it will benefit smaller farms relatively more than larger farms.

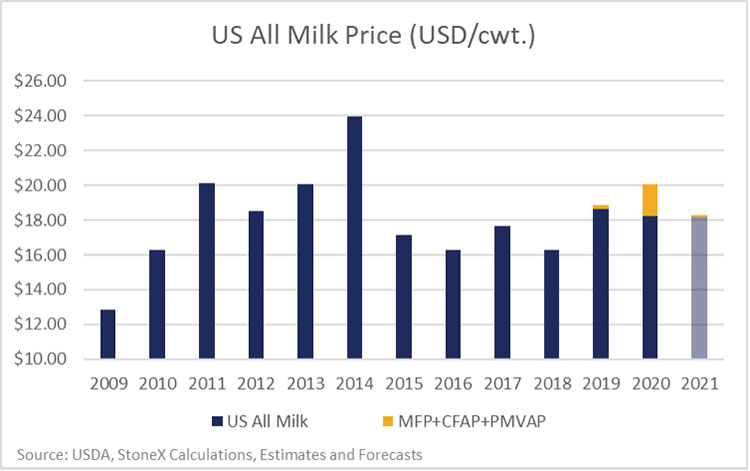

The 28-cent payment pales in comparison to the $1 to $2.50 payments that we saw during 2020. First there was the Market Facilitation Payments (MFP), which started in 2019 and was meant to help farmers that were being hurt by retaliatory tariffs that various countries (namely China and Mexico) had placed on some U.S. dairy products. In mid-2020, the Coronavirus Food Assistance Program (CFAP) was announced, which made direct payments to farmers to offset some of the negative impacts from reduced demand and market disruptions caused by the pandemic. Then, in late 2020, CFAP 2.0 was announced with payments covering the second half of the year.

There was a cap on payments at $250,000 per farm (unless there were multiple owners putting in their own labor). Large farms (500 cows or more) likely hit the payment cap, but smaller farms could have seen about $2.50 per cwt. in direct payments from the government in 2020. On a volume weighted basis (taking into account the large farms hitting caps), I think direct payments lifted milk revenue by $1.83 per cwt., which is a 10% boost on top of the market value of the milk.

Propelling more production?

I’ve been wondering how much of an impact the large direct payments in 2020 are having on 2021 milk production. One theoretical question is, how do farmers treat the checks from the government? Perhaps they saved the money instead of spending it on the farm.

Consumers tend to save a larger portion of one-off checks from the government than they save from their ongoing income. Are dairy farmers mentally accounting for this income from the government differently than other more consistent income streams?

My guess is business decisions are a little different than consumer decisions. Dairy farmers know they have to keep growing to stay competitive long-term, so they are probably always looking to expand if they can find the opportunity and the financing. The government payments help with the financing part.

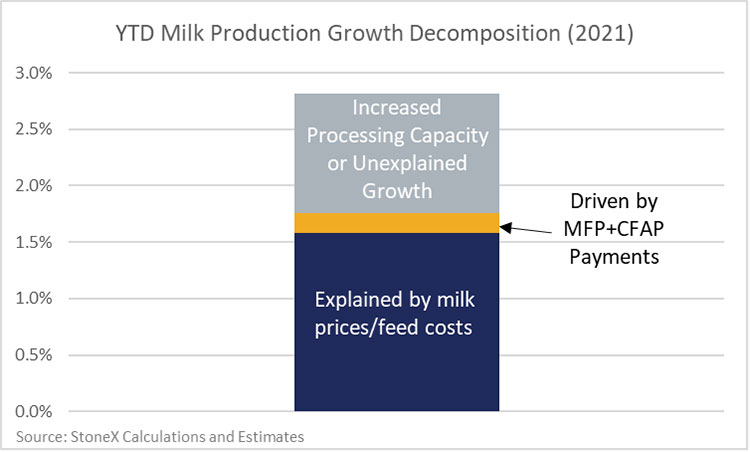

Year-to-date milk production is up 2.8%. Working through the models, 1.6 percentage points of the growth can be attributed to normal reaction to profitable margins in the second half of 2020. When I factor in the government payments, that only drives an additional 0.2 percentage point of the year-to-date production. The remaining 1% isn’t explained by margins or government payments.

The large direct payments from the government last year have helped to push milk production higher this year, but the estimated impact is relatively small at 0.2% compared to year-to-date production. Most of the growth in milk production is being driven by normal reactions to milk prices and feed costs, although there is a sizable part of the growth that we can’t statistically explain with market prices or government payments.

It’s possible my models are underestimating the impact of the government payments, but I think most of the unexplained growth is likely due to longer term planned farm expansions timed to coincide with new milk processing capacity coming online this year. The unexplained growth works out to about 7 million pounds of milk a day. The new cheese plant in St. Johns, Mich., will absorb about 8 million pounds per day once at capacity. Plus, there are various other plant expansions that came online this year as well.