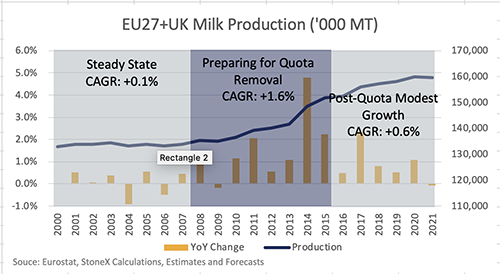

In the past three years, European Union (EU) milk production has generally been weaker than my models were expecting. If you look back at the last 20 years, I think there are three distinct periods of production growth.

• First, you have the steady state period from 2000 to 2007, when production quotas were in place and production was basically flat.

• Then, the EU started increasing quotas by 1% per year in the lead up to the eventual removal of quotas in April 2015. Along with the increased quotas, farm gate margins were very good in 2007 to 2008, which sparked some expansion.

• Last, you have the post-quota period. There was a fear that milk production would surge when quotas were lifted, but production growth has been modest at around +0.6% during this period.

When I dug into the estimated cow numbers, it looks like the herd has been in contraction the past three years and is probably declining again this year, too. The story varies country by country, but farmers who had a relatively low cost to add more cows likely expanded in the 2014-to-2017 period, and now the normal attrition of smaller farmers leaving the industry has reasserted itself. The situation is exacerbated by environmental restrictions in some places. With a herd that now seems to be dropping about 1% per year, it will be tough to get big gains in milk production from the region.

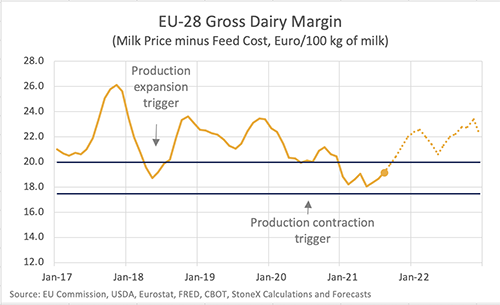

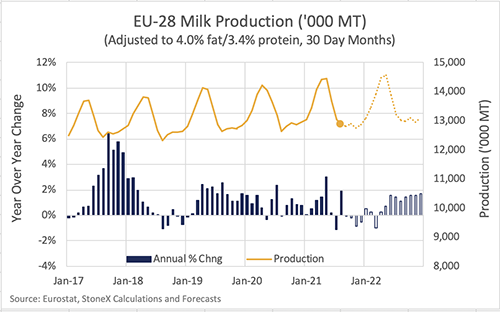

Farm gate margins in the EU were pinched this year by rising feed costs, which seems to be hitting production per cow on top of the declining herd. Production in August did pop back above year-ago levels, but the forecast has production running below year-ago September to December.

Farm gate milk prices in the EU should rise sharply for the remainder of the year and more than offset the higher feed costs. The models say the good margins should drive much better growth by the second quarter of next year, but I’m a little nervous that the declining herd will limit the growth in 2022 for the 27 countries within the European Union.

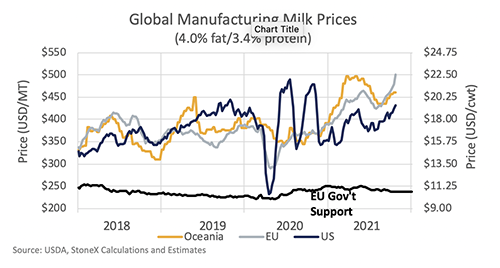

On a short-term basis, milk production has come in lower than expected in the U.S., New Zealand, and Australia during August and September. When you combine that situation with the weak production out of Europe, the supply side is facing a crunch, which is pushing dairy prices higher. This is good news for U.S. dairy farmers. U.S. prices are rising along with the world market, and the margin outlook for the remainder of this year and early next year is looking good.