Whether you are trying to fertilize fields, heat a home, or both, you know the bills for those products have gone through the roof this past year. During the virtual Thumb Ag Day hosted by Michigan State University Extension, assistant professor Matthew Gammans talked about the close link between anhydrous ammonia and natural gas.

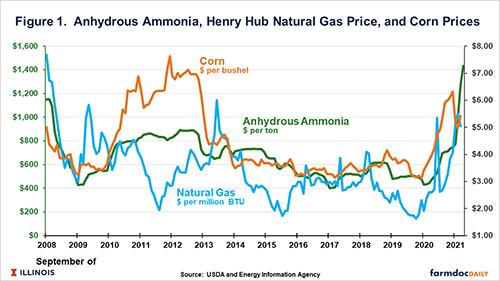

Pointing to historical trends, Gammans said in this past year, starting in January, the price for anhydrous ammonia “exploded.” He shared that the price tag went from $450 per ton in January to quotes as high as $1,350 per ton later in the year.

“What’s driving this?” he asked rhetorically. “There are obviously a lot of factors, but the big one is not a big mystery to us.”

A major driver is the price of natural gas, which nearly doubled from January to October. “Natural gas is a big input into anhydrous ammonia,” Gammans explained. “Those prices follow each other very closely.”

Thankfully, the price of natural gas has receded slightly as we near the end of 2021, and Gammans said that will hopefully trickle down through the market. “Still, we are seeing very, very high natural gas prices, and that is going to feed directly into the anhydrous ammonia market,” he noted.

Gammans also pointed out the relationship between natural gas, anhydrous ammonia, and corn. “Natural gas drives what happens with ammonia price, which drives decisions around corn spring, which ultimately affects the corn price,” he stated. “The three are very tightly linked, and it will be interesting to see how things unfold going forward.” These trends are shown in the table.

Fertilizer prices in general are much higher than historic averages. Gammans indicated that foreign factors play a role in where prices are and what they will do moving forward.

Another driver is the estimate for next year’s corn acreage. While some experts are predicting U.S. production to be at 91 million acres, others are estimating 96 million acres. “These are really different numbers,” he said. “There’s a lot of uncertainty.”