Whether looking at your farm business or household accounts, it’s pretty obvious prices for just about everything are rising. News accounts are filled with nervous reports showing year-over-year price changes.

Dairy market analysts have been trying to figure out if the higher farm milk prices will compensate for the escalation in farm inputs. Others are pondering what these price runs will mean for future dairy product sales, including exports.

Cornell University

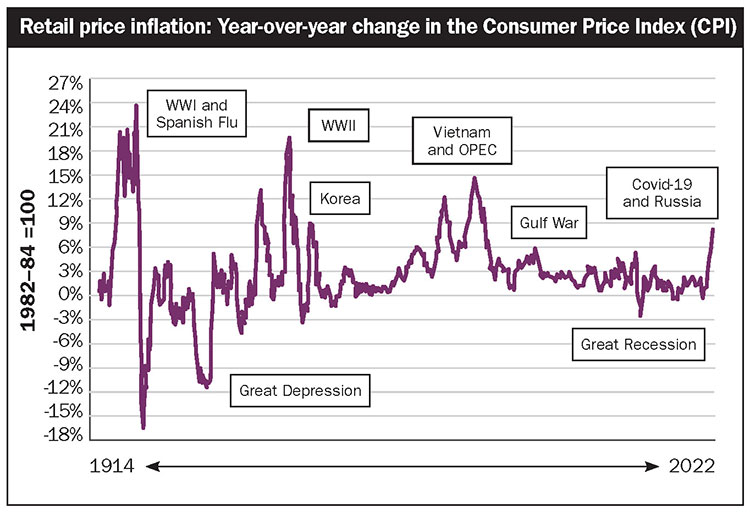

The Consumer Price Index (CPI) helps tell the story. This isn’t the only measure of price inflation, but it is a very commonly used one and data traces back to 1914. The CPI reminds us that prolonged and/or high periods of price inflation tend to occur following wars as shown in the figure. This is due to high government deficits during the war and often afterwards for a few years, but also to supply chain disruptions caused by wartime activity.

When looking at the CPI, we learn three things. First, the recent increases are as quick and large as any of the notable inflationary periods in the last 100 years. Second, the magnitude of the price run ups to date are far less than what we saw in connection with WWI, WWII, and the Vietnam era. Third, today’s rising prices follow a rather prolonged period of stable prices with little inflation. Hence, these higher prices tend to stand out a bit more.

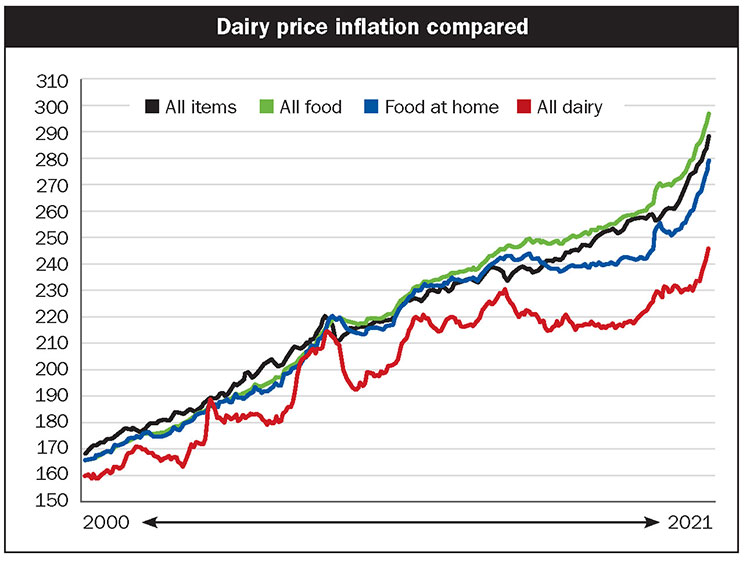

Let’s consider price inflation since 2000 and compare cheese and whole milk with all food items. The all food category includes food purchased for consumption at home as well as food purchased for consumption outside the home. In general, away from home food prices have been climbing a bit faster than at home food prices.

There are some additional observations. First, food prices tend to correlate with prices in general. Economists routinely refer to “core inflation” as the price changes for all items except food and energy. This is done because these categories have high weights in the index. Since food and energy feature prominently in our total household purchases and they tend to bounce around more than other items.

A second observation is that specific food items, in this case the two biggest dairy product categories, are more volatile than the broader categories. But, thirdly, these two dairy categories are behaving differently.

Whole milk prices were falling before the pandemic and rose as people raised at home consumption of fluid milk. At this moment, price inflation for whole milk is higher than for cheese, but remember whole milk comes off of a low base.

Cheese prices have been showing a sharp run up in early 2022, but the absolute inflation rate is well below that for milk or food in general. In contrast to fluid milk, cheese prices were more stable before the pandemic. They rebounded strongly early in the pandemic but then backed off a bit.

The last part of our story is to take a look at price changes across market levels . . . farm to wholesale to retail. The picture is similar insofar as retail prices have climbed the most since the early 1980s and farm prices the least. Also, the wholesale price for natural cheeses tends to move more in line with the manufacturer’s milk cost, as tracked by the Class III price. Retail prices for natural cheeses move up and down but have a stronger upward trend and a gentler sweep in both the increases and decreases.

These relationships are consistent with a long history of studies of intermarket milk price changes. We are currently in the part of the price point where retailers have been resisting matching wholesale and farm price increases, but that is likely to change.

The price forecast

So, what does it mean? Unfortunately, these data can’t tell us anything about how high prices will go or for how long. A few things we can see include the following.

First, the recent price gains look like the start of an inflationary period, but so far, we are well within historical highs for the magnitude of the increases. Whether the duration of the inflationary period will challenge the 1970s or the post-WWII period remains to be seen. I will simply say that I am cautiously optimistic that will not take place.

Second, the usual stimulants of large government deficits and high energy prices are at play now. Labor costs and supply chain disruptions are also coming into play, as they did during previous inflationary periods following wars. I think we are on the downside of the pandemic related problems, although we aren’t out of those woods yet. How long Russia will be a disruptive factor in energy and grain markets is anyone’s guess.

Third, on the plus side, interest rates have been trivial for several years, and the balance sheets are quite strong. Of course, that is not universally true, so one big question is whether government programs will help low-income families get through this period. Government support for farm businesses is certainly stronger than for most businesses.

Fourth, dairy product price inflation is notable if you focus on the first quarter of 2022, but this is tempered by the fact that dairy products have been a good consumer buy for the last seven years or so. Moreover, animal proteins, grains, fruits, and vegetables are showing higher rates of inflation; so, by comparison, dairy products are poised to continue to be a good buy.