The information below has been supplied by dairy marketers and other industry organizations. It has not been edited, verified or endorsed by Hoard’s Dairyman.

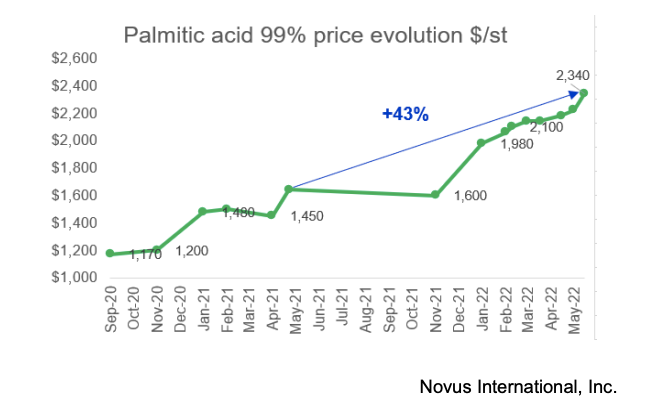

In the U.S., palmitic acid prices have risen 43% over the past 12 months. Simultaneously, the U.S. price of milk fat increased by 61%, creating a unique landscape for dairy farmers to try to balance increasing their income while battling increased costs for feed additives.

“The increase in milk fat premium represents a significant source of additional income for dairy farmers in the U.S.,” says Cecilia Lopez, U.S. ruminant solutions senior manager with Novus International. “But with the current price of palmitic acids and the possible scarcity of palmitic acid on the global market, dairy farmers may not be able to realize the additional income from the milk fat premium.”

“There are many factors driving palmitic acid prices,” says Lopez. “Indonesia, the world’s leading palmitic acid exporter, banned exports of palmitic acid for a time earlier this year; global supply chain issues, and the conflict between Russia and Ukraine are all escalating an already high-cost situation.”

Palmitic acid has been widely used for many years as a source of dietary fat to support milk fat production in dairy cows.

“Palmitic acid is mainly made up of the fatty acid C16:0, which is the largest amount of fatty acid found in milk fat,” says Hannah Tucker, Ph.D., and ruminant technical service manager with Novus. “By supplementing with palmitic acid there is a boost in milk fat production that happens quickly because it is able to go almost directly to the mammary gland to be packaged into milk fat.”

Alternative technologies can open possibilities to maintain milk fat at a lower cost than palmitic acid. To capitalize on the milk fat premiums, Lopez suggests dairy farmers take a second look at their ration formulation.

Depending upon what region of the world a dairy farm is in, different feed technologies may be available to achieve the farm’s goals.

“Feed supplements, such as a methionine hydroxy analogue (HMTBa), a source of methionine, can help optimize rumen fermentation, positively impacting one of the metabolic pathways to promote more milk fat production,” says Tucker. “MFP® feed supplement, MHA® feed supplement, and ALIMET® feed supplement are sources of HMTBa show to be positive solutions for dairy farmers as alternative technologies for milk fat production.”

Dairy farmers should talk with their nutritionists to determine the best possible strategy to maximize their return on milk fat.

For more information call +1 (800) 568-0088, email: info@novusint.com or visit www.novusint.com.