The monthly average CME Grade AA butter price eclipsed $3 per pound in August, with prices remaining above this mark during the early days of September. Higher butter prices have occurred even as cheese has dropped by 52 cents (22.3%) and nonfat dry milk fell 21 cents (11.6%) between May and August. While strong consumer demand, both in domestic and international markets, is certainly playing a role in historically high butter prices. Likewise, weak growth in butter production also has been a contributing factor.

Annual butter production for 2021 fell by 3.5% relative to 2020, and output for the first seven months of 2022 is 2.2% lower than the same period in 2021. While it is difficult to analyze precisely how the COVID-19 pandemic has altered normal dairy industry operation, USDA reported that the number of plants producing one or more dairy products declined 5.8% from 2019 to 2021, with butter plants falling by 4.9% from 2020 to 2021.

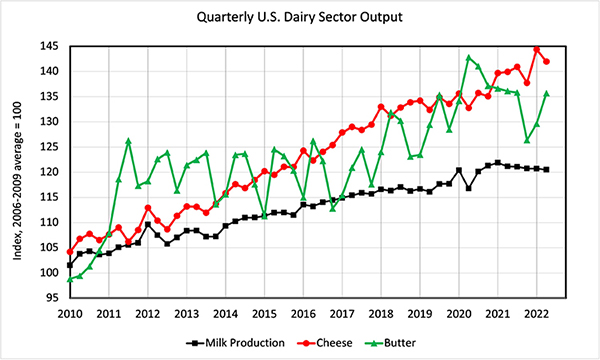

Dairy product output has managed a faster rate of gain than milk production over the past decade. This is taking place even as fluid milk demand continues its downtrend. When it comes to dairy product production, U.S. cheese output has continued to grow at a steady clip even as butter production has slowed. These supply dynamics within the U.S. dairy industry are contributing to wide spreads between Class III and Class IV milk prices.

The August Class IV milk price topped the Class III level by $4.71 per hundredweight (cwt.), the largest premium that Class IV milk has held since September 1998. For the first eight months of the year, Class IV prices have averaged $2.29 per cwt. above Class III. Compare this with 2015 to 2021, when Class III prices averaged $1.47 per cwt. above Class IV, and the largest Class IV premium in any month was $1.97.

With discussions for the next farm bill continuing to ramp up in the months to come, it is important to consider whether the industry still has the ability to quickly adjust butter supplies in response to changing market conditions. If the pandemic or other factors have compromised this ability, historical analysis of Class III and Class IV milk price spreads will have little relevance for the next farm bill period.